- Topics

- Training

- Community

- Product Help

- Industry Discussions

- User Groups

- Discover

- Resources

- Intuit Accountants Community

- :

- ProSeries Tax

- :

- ProSeries Tax Discussions

- :

- Re: Form 8606 not added in filed copy of tax return when client has non deductible IRA contribution

Form 8606 not added in filed copy of tax return when client has non deductible IRA contribution

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Printer Friendly Page

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

My client contributed to 401K and traditional IRA both which makes his traditional IRA contribution non deductible. After adding IRA contribution in IRA contribution worksheet, Proseries is not adding form 8606 to e-filing copy of forms. How do we force Proseries to add form 8606 in filed copy of the tax return.

Best Answer Click here

![]() This discussion has been locked.

No new contributions can be made. You may start a new discussion

here

This discussion has been locked.

No new contributions can be made. You may start a new discussion

here

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

The latest update (released today) for Proseries Basic has corrected this problem. Form 8606 is now correctly being pulled in filed copy of tax return.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Its adding it in mine, use Print Preview, its not in your list? or do you see it on the list on the screen, but nothing comes out of the printer?

♪♫•*¨*•.¸¸♥Lisa♥¸¸.•*¨*•♫♪

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Lisa,

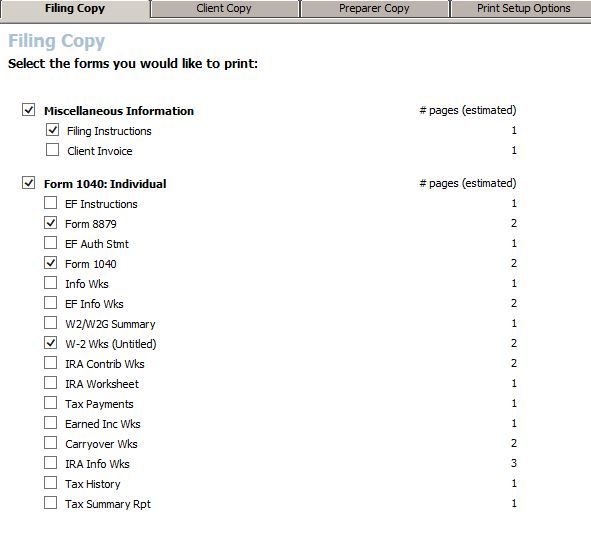

Form 8606 is NOT showing up in list of forms added under "Filing Copy" tab. Its also missing in Print Preview. Are you using "Proseries Basic"?

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Is the 8606 showing up on one of the bottom 'tabs'?

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

If I manually select Form 8606 then I can see the form and content in it. However Form 8606 is not automatically added to Filing Copy or Customer copy. Its not even added in printed copy of the tax return. I am using Proseries Basic,

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

That is normal as form 8606 is not required to be sent if you don't make any non-deductible IRA's in the current year. But you can always force print in print options.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

In my case the client HAS non deductible IRA since he contributed to both 401K and Traditional IRA. It appears that Proseries Professional automatically adds this form to filed copy but Proseries Basic is not adding it.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Change your prints options for Control Which Forms Print. Mark it to print if Any Data....see if that forces it to be included.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

From reading other posts on this forum, there seem to be quite a number of problems right now with 8606 and how the program taxes IRAs. So you may need to wait for some updates.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

The weird part is Form 8606 is correctly added to Filing Copy if you use Proseries Professional software. But in Proseries Basic software the form is not included at all.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

I am on Proseries technical now and they are saying the same thing. I am in Proseries Basic and earlier versions on 2 computer did print for nondeductible IRA and basis information. When updated recently, Form 8606 is no longer in the print screen. This needs to be fixed in Basic.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

The latest update (released today) for Proseries Basic has corrected this problem. Form 8606 is now correctly being pulled in filed copy of tax return.