Trial information: The Lacerte trial includes either a Lacerte tax software download or access to hosted software for tax year 2023. The desktop trial software will not e-file or print. The hosted trial will not save. New customers only.

Product terms: Fast Path required to access functionality in Lacerte services (sold separately). Terms, conditions, pricing, subscriptions, tax forms, packages, features, service, and support options are subject to change at any time without notice. For more details, visit

https://accountants.intuit.com/tax-software/lacerte/

Hosting for Lacerte

Hosting for Intuit Lacerte is a monthly add-on subscription service. Purchase of Fast Path services for Intuit Lacerte is also required for concurrent user activity within Hosting for Intuit Lacerte. Additional terms, conditions, and limitations apply. Pricing, features, service and support options are subject to change at any time without

notice. For more information, please visit https://proconnect.intuit.com/desktop-hosting/.

Rightworks

Hosting for Lacerte and ProSeries is powered by Rightworks. Contact Rightworks to contract additional third-party software.

Rightworks performs backups of all hosted data on a nightly basis and retains the back-ups for a rolling 90-day period in a protected offsite facility as an additional level of protection. Rightworks maintains robust security enhancements, including enhanced firewall protection, encryption protocols, and security audits. There is

no limitation to the size of a customer's tax and business-related data back-up. Customers are responsible for verifying the integrity of hosted data at least every 90 days. Rightworks employs Snapshot technology to backup customer data. Snapshots are taken daily and then replicated to another physical Rightworks facility for Disaster Recovery.

Rightworks maintains compliance with international security standards and regulations, including IRS Security Six compliance.

Rightworks uses top-tier data centers and multiple layers of redundancy within its infrastructure to provide 24x7 availability. However, availability can vary, is subject to occasional downtime, and may change without notice. Rightworks encrypts all backup files and backup tapes. Virtual desktop connections are protected via TLS

with a minimum of 128-bit encryption and authentication. Each customer has a unique Rightworks virtual desktop. Access to each Intuit ProSeries or Intuit Lacerte company file is controlled at multiple layers including file access permissions. Access is locked out after multiple failed login attempts for the same user. Security features,

functionality, and access are subject to change without notice as deemed necessary by Rightworks. Availability can vary and are subject to occasional downtime and may change without notice. Click here for a list of compatible devices.

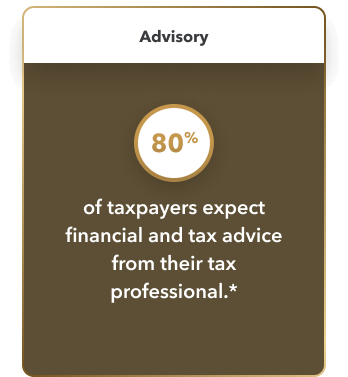

Intuit Tax Advisor: Intuit Tax Advisor is offered as an optional service through December 31, 2024. Additional terms, conditions and fees apply. Starting on or after January 1, 2025, access requires Fast Path for each Lacerte user or User Access for each ProConnect Tax Online user who is required to create and prepare Intuit Tax

Advisor plans. Any advisory impact is speculative and not guaranteed. Additional terms and conditions may apply.

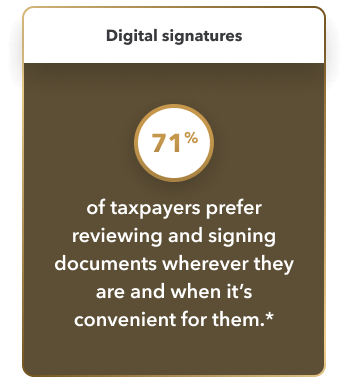

eSignature: The ability to add eSignature fields to all forms and documents, including business forms, has been enabled and is designed to be used at the preparer’s discretion. Per the current IRS Guidelines, electronic signatures are only accepted for the Individual Modules. Please review IRS Publication 4163 and PMTA- 2018-08

for more detail. It is your responsibility to keep updated and compliant on which forms can be used/recognized in connection with federal and state e-file tax returns and authorizations. Additional terms, conditions and fees apply.

Quick Employer Forms: License of Intuit Quick Employer Forms Accountant for tax year 2024 begins on November 21, 2024 and expires on October 31 31, 2025. Only customers with a current tax year license will be able to access their Intuit Quick Employer Forms Accountant client data from the prior year. Additional terms, conditions

and fees apply.

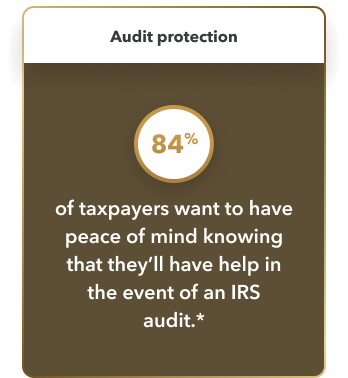

Protection Plus: Subject to the terms, conditions, limitations, and exclusions outlined in the Protection Plus Firm-Level Membership Agreement for 1040s. Business return coverage is subject to terms, conditions, limitations, and exclusions outlined in the Protection Plus Firm-Level Business Return Membership Agreement. Protection

Plus is a registered trademark of Tax Protection Plus, LLC.

EXCLUSIONS: The following types of tax returns and or Inquiries are specifically excluded. Company is under no obligation to provide Taxpayer with the Services in connection with such returns and or Inquiries: Returns other than individual 1040, 1040SR, and 1040NR, and state Returns including, but not limited to, corporate, partnership, trust,

estate, gift and employment returns. Returns in which the Taxpayer, Tax Preparer or ERO had knowledge of additional taxes owed as of the date Taxpayer enrolled in the Program. Returns prepared with Negligence, recklessness, intentional misrepresentation or fraud. Local, city and county tax. Returns that have become subject to IRS or state

criminal investigations. Inquiries and/or notices related to foreign income, flow-through entities (partnerships and S-corporations as reported on Schedule K), court awards and damages, bartering income, canceled debt, estate tax or gift tax. Inquiries and/or notices related to the following credits: Foreign tax credit, Plug-in electric vehicle

credit, Residential energy efficient property credit, Mortgage interest credit, Credit to holders of tax credit bonds, Health coverage tax credit, “Credit” for prior year minimum tax, “Credit” for excess railroad retirement tax withheld. When there is a lack of clarity from the IRS and/or state taxing authorities, we may not be able to provide

complete assistance. Any services performed by any individual or company other than the Services performed by Company or a Company appointed representative.

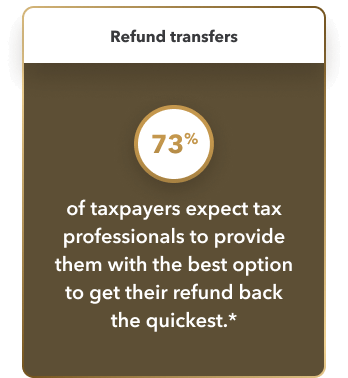

Pay-by-Refund or refund transfer program (“Program”) participation available to eligible ProSeries, Lacerte and ProConnect Tax customers. Program participants (will be designated to an incentive category as determined by Intuit and), depending on the software used, may earn a credit or other incentive for every qualified federal

funded Pay-by-Refund transaction as outlined in the table below (excluding Quick Collect transaction) that is filed from January 1st through the 1040 tax filing deadline of the then-current Tax Year through either of the following banks: Santa Barbara Tax Products Group or Refund Advantage through the 1040 tax filing deadline of 2023 (each a

“Participating Bank”). To be eligible participants must adopt industry refund transfer best practice principles by charging customary and reasonable processing fees, and federal returns must be transmitted to the IRS using a single account and EFIN. Federal returns that are rejected by the IRS, or deemed fraudulent, or a result of identity theft

are not eligible for credit under the Program. For Tax Year 2022 only, if software and a user are eligible for credits, aggregate credits payment will be delivered from Participating Bank by August 31st of the current year. For all other Tax Year filings, if software and a user are eligible for credits, aggregate credits payment will be delivered

from Participating Banks by May 31st of the year you are currently enrolled. For Refund Advantage, a $59.90 one-time bank set up fee applies to each federal Pay-by-Refund transaction. For Santa Barbara Tax Product Group, a $64.90 one-time bank set up fee applies to each federal Pay-by-Refund transaction. Additional fees apply to state

Pay-by-Refund filings. Offer may be terminated or modified at Intuit’s discretion and Program and software terms and conditions, including available features, credits, pricing, and support are subject to change without notice. You must meet certain minimum funded Pay-by-Refund transaction thresholds in order to be eligible to qualify for free or

discounted software.

Tax Planner and Tax Advisor: Additional terms, conditions, and fees may apply with these optional tools. Tax Planner and Tax Analyzer are included free in Lacerte Unlimited.

Practice Ignition is a registered trademark and is subject to additional terms, conditions, and fees.

SafeSend is a registered trademark. Subject to the terms, conditions, limitations, and exclusions outlined in the Terms of Use. Setup required for one-click action. Additional fees apply. Terms, conditions, pricing, subscriptions, packages, features,

service and support options are subject to change at any time without notice.