Run your practice your way

ProConnect Integrated Solutions

ProConnect’s integrated professional tax solutions give you the autonomy to run your business wherever, whenever, and however you want. It is yours, after all.

Call 844-591-8071 to talk with a specialist.

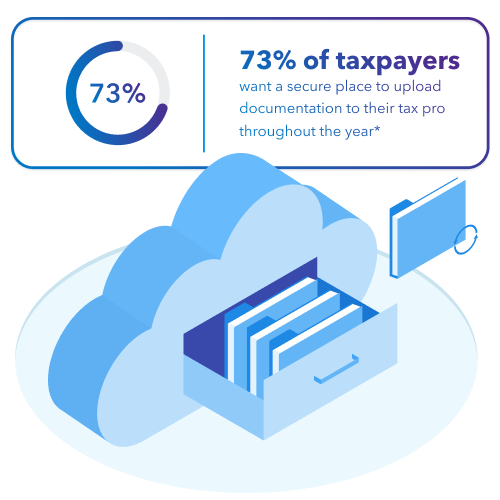

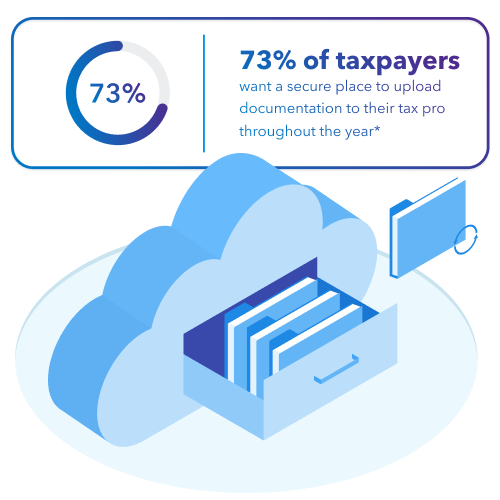

Our secure online portal simplifies data collection and organization to make fulfilling client data requests a breeze. Shared client data is automated and encrypted, so you can prepare accurate returns securely.

ProConnect integrates seamlessly with QuickBooks Online Accountant to streamline work and map tax data between your bookkeeping and tax clients in one sign-on experience.*

Request signatures and documents the modern, digital, and encrypted way from right inside ProConnect Tax. Then track client progress in real time—which is usually less than 24 hours.*

Quickly generate and e-file 1099 and W-2 forms. New for tax year 2023: Seamless search, sort, and filtering across payees, businesses, and forms. Plus, bulk e-file support within a business and across multiple businesses.

Give your clients the option to pay your tax prep fee through their refund with two reliable bank options and no upfront fees, so you can both get paid quickly.

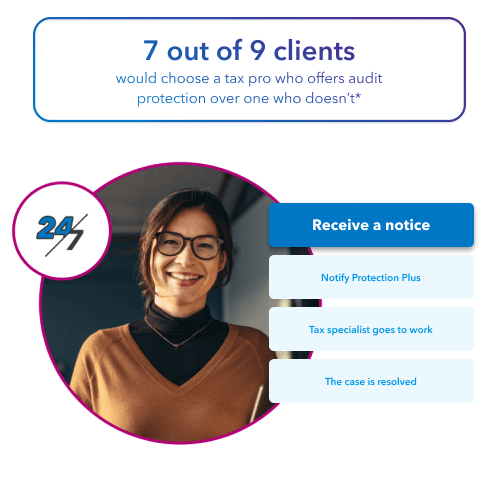

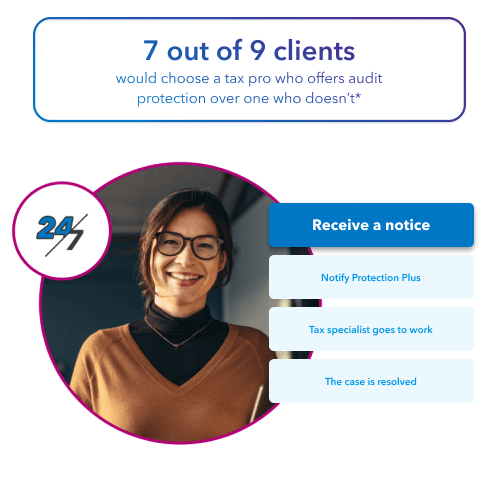

Our expert team of EAs and CPAs case resolution specialists provide personalized support to your clients if they receive an IRS or state notice, get audited, or experience identity theft.

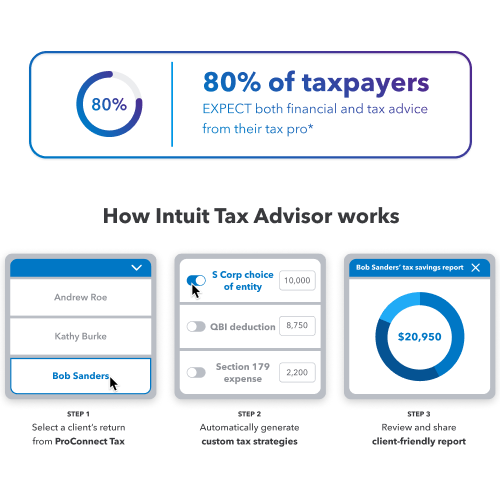

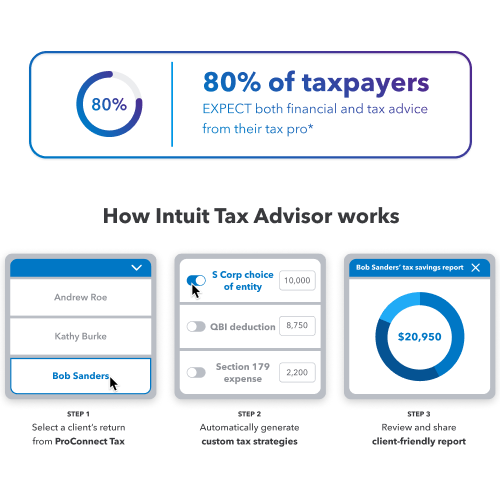

Experience tax prep and advisory tools working in tandem to build custom tax-savings plans in minutes with data generated automatically from your ProConnect software.*

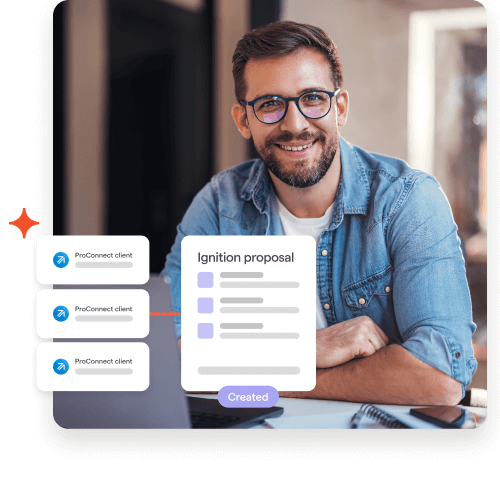

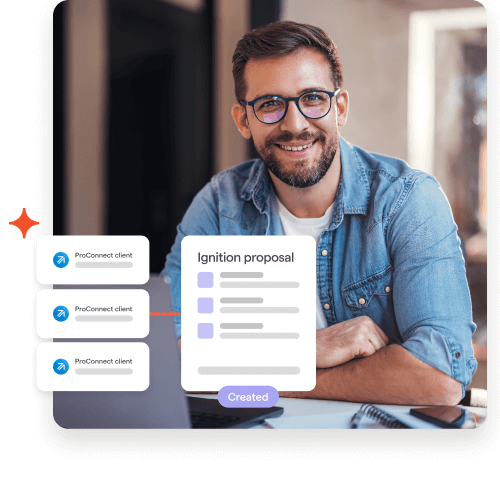

Streamline your proposals and automate the sales process from first contact to money in the bank.

Our secure online portal simplifies data collection and organization to make fulfilling client data requests a breeze. Shared client data is automated and encrypted, so you can prepare accurate returns securely.

ProConnect integrates seamlessly with QuickBooks Online Accountant to streamline work and map tax data between your bookkeeping and tax clients in one sign-on experience.*

Request signatures and documents the modern, digital, and encrypted way from right inside ProConnect Tax. Then track client progress in real time—which is usually less than 24 hours.*

Quickly generate and e-file 1099 and W-2 forms. New for tax year 2023: Seamless search, sort, and filtering across payees, businesses, and forms. Plus, bulk e-file support within a business and across multiple businesses.

Give your clients the option to pay your tax prep fee through their refund with two reliable bank options and no upfront fees, so you can both get paid quickly.

Our expert team of EAs and CPAs case resolution specialists provide personalized support to your clients if they receive an IRS or state notice, get audited, or experience identity theft.

Experience tax prep and advisory tools working in tandem to build custom tax-savings plans in minutes with data generated automatically from your ProConnect software.*

Streamline your proposals and automate the sales process from first contact to money in the bank.

Tax Pros talk ProConnect

Did you know?

Books and tax

of taxpayers are willing to pay more for a tax professional's service if it might result in improved financial outcomes.*

Refund transfers

of taxpayers expect tax professionals to provide them with the best option to get their refund back the quickest.*

Automatic reminders

of taxpayers would be delighted to get automatic reminders from their tax professional on documents or next steps needed.*

Tax documents

of taxpayers expect to send their sensitive data to a tax professional in a secure transfer.*

Digital signatures

of taxpayers prefer reviewing and signing documents wherever they are and when it’s convenient for them.*

Advisory

of taxpayers expect financial and tax advice from their tax professional.*

Audit protection

of taxpayers want to have peace of mind knowing that they’ll have help in the event of an IRS audit.*

Storage

of taxpayers expect their tax professional to store tax documents on encrypted servers with enterprise firewalls.

We innovate constantly based on customer feedback.

That’s why, ProConnect software is always up to date.

Or call us at 844-591-8071 to talk with a ProConnect Tax specialist.