- Topics

- Training

- Community

- Product Help

- Industry Discussions

- User Groups

- Discover

- Resources

- Intuit Accountants Community

- :

- ProSeries Tax

- :

- ProSeries Tax Discussions

- :

- Foreign earned income

Foreign earned income

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Printer Friendly Page

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Where do I enter foreign earned income that comes on a statement (not a W-2) that doesn't qualify for either exclusion on Form 2555? It is subject to FICA and Medicare tax that needs to be paid on the tax return.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

@Kath87 wrote:

Where do I enter foreign earned income that comes on a statement (not a W-2) that doesn't qualify for either exclusion on Form 2555?

It is subject to FICA and Medicare tax that needs to be paid on the tax return.

Is this wages (and employee), or is it self employment income? If it is wages, Social Security and Medicare taxes are not due.

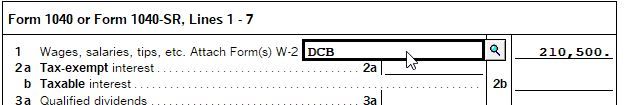

Assuming it was wage, there is a wages worksheet. The easiest way to get it is to go to the 1040Wks, then click the blank space to the left "1" (line 1). That will open the worksheet, then enter it on Line 8b of the worksheet.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

There is no blank to the left of Line 1 in the 1040Wks that I see. There's Schedule 1 part 1 worksheet, Additional Income. That's where I put it, and it is on line 8, so it's may be what you mean, but it's 8z, not 8b.

Thanks, everybody. It's in the return.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

But it should be enter on Line 1 of the 1040, as "earned" income, not on Schedule 1.

See the picture below for the area to click on the 1040Wks.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

OK, thanks. I moved it. There's no difference in the bottom line, but I appreciate the clarification. And now I see the "box"!

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Depending on the employer and type of taxpayer SS and Medicare may be due.

Ex: US citizen employed by a foreign embassy in the US.

In that case, you need to find a way to add/adjust SE income. I don't use ProSeries so can't help there.

Ex-AllStar

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Thank you for adding information, but that doesn't apply in this case.