- Topics

- Training

- Community

- Product Help

- Industry Discussions

- User Groups

- Discover

- Resources

- Intuit Accountants Community

- :

- ProSeries Tax

- :

- ProSeries Tax Discussions

- :

- Foreign earned income

Foreign earned income

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Printer Friendly Page

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

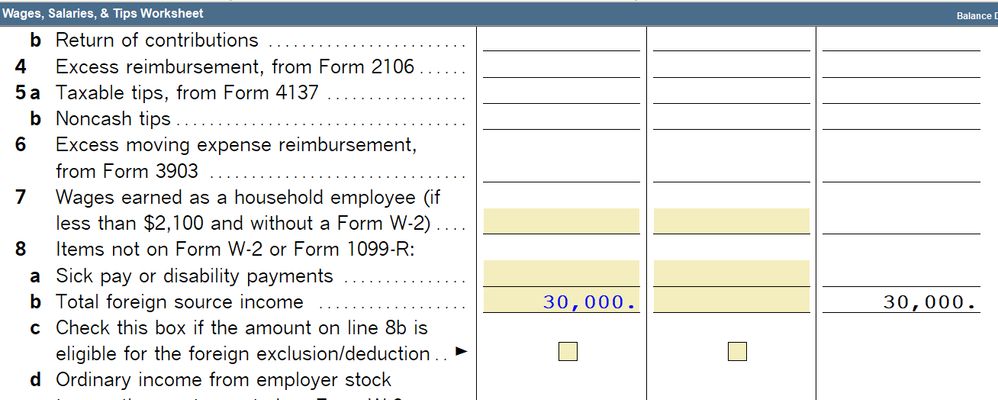

A kiddo worked in Canada for three months in 2021. She's not eligible for 2555 and 1116 doesn't apply. I've translated her paychecks into American money, but I don't know where to put them. Somebody said use the W2 worksheet, but there's no American EIN and ProSeries expects that. Just put it as "other income" on the 1040?

Solved! Go to Solution.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

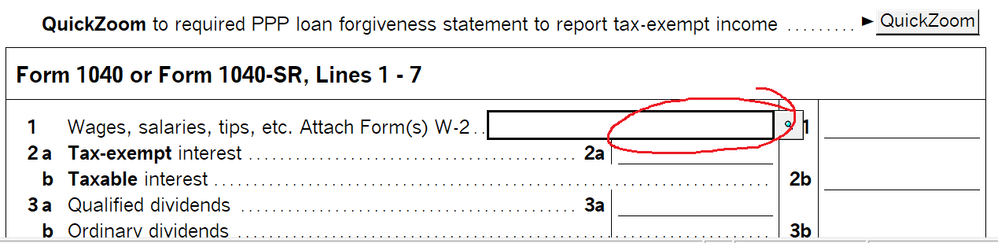

To the left of Line 1 on the front page of the 1040, click in the blank space and a hidden box appears, you can enter foreign income there and it will land on Line 1 Wages, rather than Other Income.

♪♫•*¨*•.¸¸♥Lisa♥¸¸.•*¨*•♫♪

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Isn't there a box to check for foreign employer?

Ex-AllStar

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

You put the foreign ADDRESS on the W2, but ProSeries continues to demand an American EIN.

There's a place to check that says "Eligible for deduction on form 2555" but this income isn't eligible for that.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

See if Bill's answer here helps:

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

To the left of Line 1 on the front page of the 1040, click in the blank space and a hidden box appears, you can enter foreign income there and it will land on Line 1 Wages, rather than Other Income.

♪♫•*¨*•.¸¸♥Lisa♥¸¸.•*¨*•♫♪