Welcome back! Ask questions, get answers, and join our large community of tax professionals.

- Topics

- Training

- Community

- Product Help

- Industry Discussions

- User Groups

- Discover

- Resources

Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

- Intuit Accountants Community

- :

- Lacerte Tax

- :

- Lacerte Tax Discussions

- :

- Re: Foreign sourced profit sharing income

Foreign sourced profit sharing income

Options

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Printer Friendly Page

rblok

Level 1

03-06-2024

06:02 PM

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

How do you enter Canada form T4PS line 35 (other income) into Lacerte? Itis for a US based company. Client believes that it's his employer's match.

Solved! Go to Solution.

1 Solution

Accepted Solutions

George4Tacks

Level 15

03-07-2024

10:13 AM

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

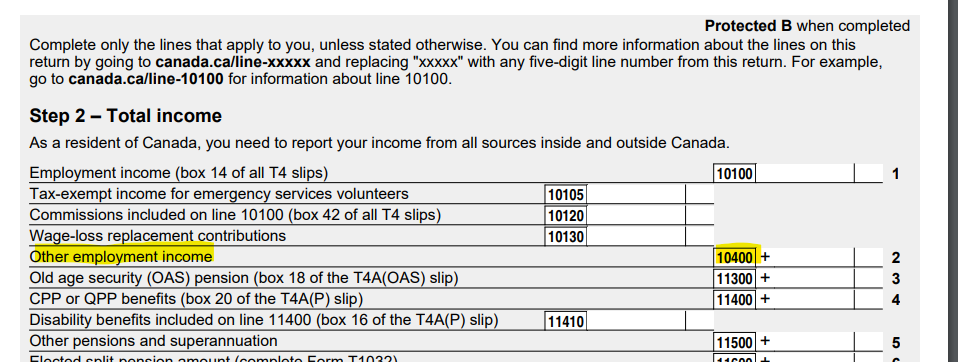

On the back of the T4PS it says to put in on line 10400 of the Canadian return. So, of course you look up what that line is.

I would add it as Other Income > "Other employment income"

Here's wishing you many Happy Returns

2 Comments 2

George4Tacks

Level 15

03-07-2024

10:13 AM

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

On the back of the T4PS it says to put in on line 10400 of the Canadian return. So, of course you look up what that line is.

I would add it as Other Income > "Other employment income"

Here's wishing you many Happy Returns