- Topics

- Training

- Community

- Product Help

- Industry Discussions

- User Groups

- Discover

- Resources

- Intuit Accountants Community

- :

- Lacerte Tax

- :

- Lacerte Tax Discussions

- :

- Re: Clients registered as REP's for California but did not marry. Do they file as separate for Federal and REP for California?

Clients registered as REP's for California but did not marry. Do they file as separate for Federal and REP for California?

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Printer Friendly Page

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Best Answer Click here

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

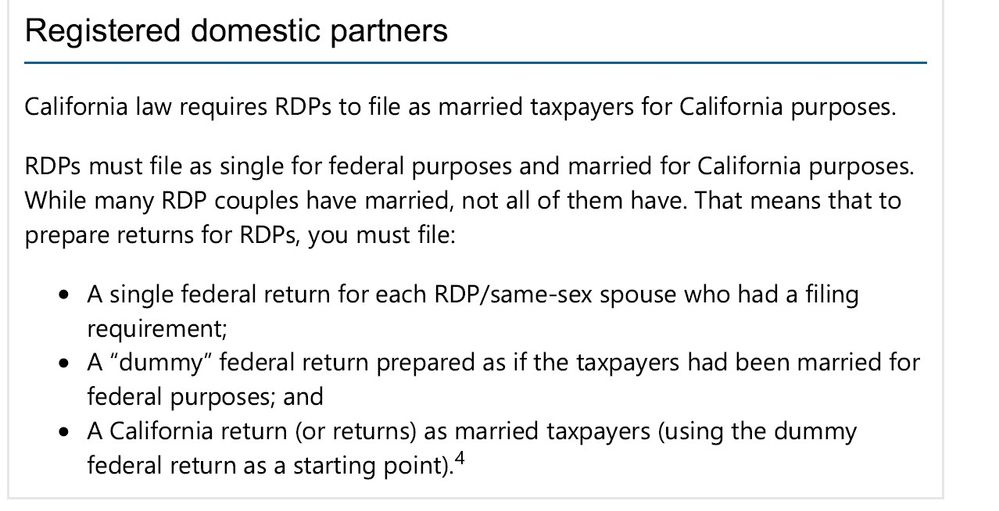

RDP is what you mean

Federal is Single

CA is RDP/MFJ

The first return you set up will be your CA return. MAKE SURE IT IS RIGHT. Before Splitting it, make sure everything is correct.

Then, split the return to prepare the Federal 1040s for each RDP.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Registered domestic partners. Pub 555. This publication is also for registered domestic partners who are domiciled in Nevada, Washington, or California. Registered domestic partners in Nevada, Washington, or California must generally follow state community property laws and report half the combined community income of the individual and his or her registered domestic partner. Registered domestic partners aren't married for federal tax purposes. They can use the single filing status or, if they qualify, the head of household filing status.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Clients only registered in CA as RDP's but did not marry. Does that still require them to file CA as RDP/MFS or can they just file separate? Does community property rules still apply even though they are not married?

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Spidell is an excellent learning resource. If you subscribe, you can get access to an excellent guide.

Community property rules apply to RDP in CA.