- Topics

- Training

- Community

- Product Help

- Industry Discussions

- User Groups

- Discover

- Resources

- Intuit Accountants Community

- :

- Lacerte Tax

- :

- Lacerte Tax Discussions

- :

- Re: 2021 trust/estate estimated tax

2021 trust/estate estimated tax

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Printer Friendly Page

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

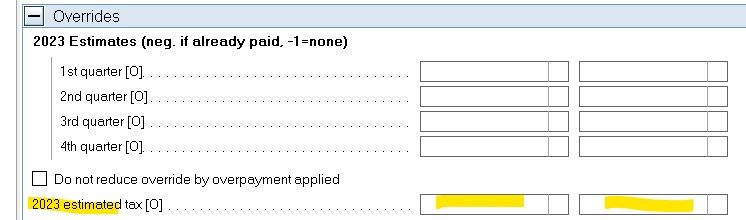

I can't get the trust/estate estimated tax vouchers to print after overriding all 4 quarter amounts. The calcs show 2022 tax due but no estimates are being generated. Please help!

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

This is never intuitive. Make sure the total tax due is input in the form, below the input for the 4 quarters.

I assume your estimate options are something other than Blank or Suppress.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Thank you for your response. I did what you suggested and added the total tax below the filled in quarterly amounts. However, it still didn't work. Do you think it matters that the first 3 quarters have -1 (none) entries? Any other suggestions?

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Have you chosen an option to calculate the estimates such as 100% of prior year, etc?

Those 3 -1 entries should not matter.

Does the Q4 voucher equal the total tax you have entered?

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

And is there a dollar threshold for when estimates are required?

Ex. State requires estimates when estimated tax is $1,000 or more. If you want to pay $800 that will be ignored unless you tell Lacerte in the options to ignore the threshold.

Ex-AllStar

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Thanks to everyone for your comments! I believe I had tried all the suggestions (option to calculate the estimates such as 100% of prior year, etc, the Q4 voucher equals the total tax, tell Lacerte in the options to ignore the threshold) but to no avail. Not sure what else to try, so I will print blank vouchers and use Adobe to fill in the amounts.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

1. You are welcome

2. I tried to produce estimates and couldn't.

3. When the software doesn't help...aaargghhh.

4. I wonder if the software didn't allow a Q4 estimate because you were trying to do it on January 16. And although it was still one day prior to the due date, the software programmers didn't account for MLK day.

5. It isn't worth calling because they won't know.