- Topics

- Training

- Community

- Product Help

- Industry Discussions

- User Groups

- Discover

- Resources

- Intuit Accountants Community

- :

- ProSeries Tax

- :

- ProSeries Tax Discussions

- :

- Re: S-CORP Effective date

S-CORP Effective date

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Printer Friendly Page

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

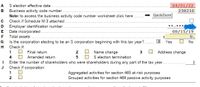

My client elected s-corp status and was approved with effective date 4/1/22. I put in the effective date in ProSeries and it is giving me an error message. Is there a way around this? Pictures attached.

Solved! Go to Solution.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

@eaf1213 wrote:

How do you mark the 1120S as a short year in ProSeries?

It's on the first information screen. Under the spot where you enter the name, address and EIN of the corporation.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Looks like you'll do a C Corp return from 1/1/22 - 3/31/22 (which might be late if not already filed) and you'll mark your 1120S with a short year 4/1/22 - 12/31/22.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

They were never a C-corp. They were a SMLLC and then filed for S-Corp status with effective date 4/1/23. January to March information is being filed on schedule C. How do you mark the 1120S as a short year in ProSeries?

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

@eaf1213 wrote:

How do you mark the 1120S as a short year in ProSeries?

It's on the first information screen. Under the spot where you enter the name, address and EIN of the corporation.