- Topics

- Training

- Community

- Product Help

- Industry Discussions

- User Groups

- Discover

- Resources

- Intuit Accountants Community

- :

- ProSeries Tax

- :

- ProSeries Tax Discussions

- :

- Re: e-filing 2020 amended return prepared by someone else - 8/6/21 alert

e-filing 2020 amended return prepared by someone else - 8/6/21 alert

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Printer Friendly Page

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

As of 8/6, we are supposed to be able to e-file 2020 amended returns when the original was prepared and e-filed by someone else. The reject error says if amended return is checked, then Form 1040X must be present in the return. The instructions in the Intuit article only refer to a return you originally filed, except to say use the forms for input rather than override the 1040. We completed the client status worksheet and entered the date the original was accepted by the IRS. Has anyone been able to file an amended return that you did not originally prepare and e-file?

![]() This discussion has been locked.

No new contributions can be made. You may start a new discussion

here

This discussion has been locked.

No new contributions can be made. You may start a new discussion

here

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

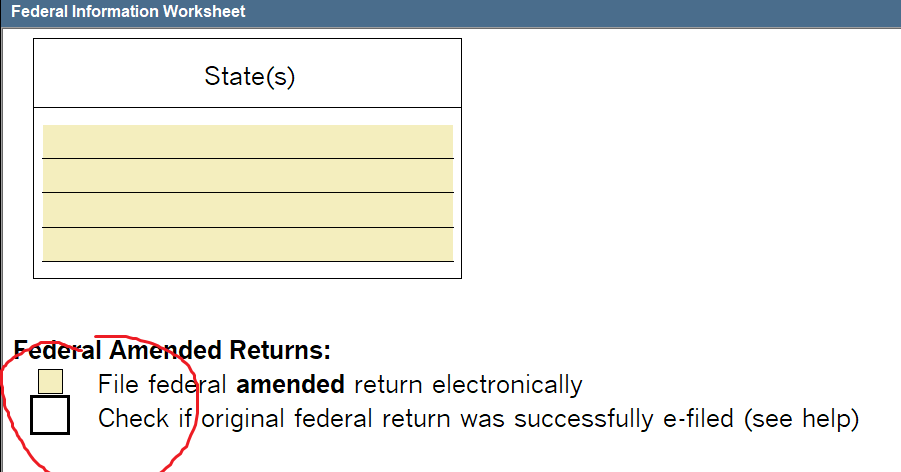

So you prepared the return exactly the same as the original, then activated the 1040x, then made the changes youre amending for and you marked the Efiles boxes for the amended return including both of these boxes?

♪♫•*¨*•.¸¸♥Lisa♥¸¸.•*¨*•♫♪

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

♪♫•*¨*•.¸¸♥Lisa♥¸¸.•*¨*•♫♪

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Yep. And we used all of the forms (W2, 1099R, etc.); we didn't just type amounts into the 1040 or the 1040X (sorry for not being clear on that).

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Youre sure your program is completely up to date?

You may want to run Refresh Updates just in case an update didnt install properly at some point, by using Refresh it dumps the old and downloads all new files.

♪♫•*¨*•.¸¸♥Lisa♥¸¸.•*¨*•♫♪

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

I run Updates and Refresh Updates every morning.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Try checking off the original EF box for the federal, the amended EF box and the box that says original return was EFiled. That actually worked for me once with no errors and it filed.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

All of those boxes were checked and the client status worksheet was updated to show the original return was e-filed and accepted by the IRS.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Melissa,

Did you ever find a solution for this? I am getting the exact same rejection error on a 2020 amendment. I didn’t prepare the original return.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

I am having the same exact problem. The reject message doesn't even give me a code. It just says the amended return is rejected. I followed the instructions that proseries provided but no luck on sending it electronically.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Skip this first section if you dont want backstory

Ive been having this issue for 2 weeks. I recreated a 2020 return, efiled by another preparer. i saved it. I made the changes for 1040X/500X and "Saved As" a new file. I clicked the 'efile federal return', clicked 'efile federal amended return', and clicked 'marked original return as efiled'. but i forgot that the IRS doesnt accept 9465's for previous years for the current efile system. I sent it, they received it, and I got a rejection code, of course for the ridiculous 9465 issue. When I tried to efile the amended return, 4 rows showed up, and the box next to "federal amended return" was greyed out; it said in the status area, "not ready", and in the reason area, "federal return not completed". It drove me nuts. So i backed up the original and the amended file, to try a few things.

Solution:

Once you receive a 'Rejected' status from the IRS, go back to the amended file, and UNCHECK the FIRST "efile federal return", just under Part VI, ABOVE the box of states that can be efiled. Do the final reviews, click "File Electronically" on the left sidebar as if you were normally efiling. 3 rows will show up, and The box next to "Federal amended return" will now be open. Click it, and efile it. Because you still have the error of unchecking the "efile federal return", it won't actually efile. It's an automatic failure bc of not passing the review portion. Once you get that failure status, open the same amended return, RECLICK "efile federal return", and go through the reviews, and efile like normal. THIS time, all 4 rows will appear, and the box next to "federal amended return" will be open. Click to choose it, and efile as normal. You should receive an efile successful status, and in my case, i got an "Accepted" status after about 10 mins. Until Proseries fixes this, I think this might be the only fix.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

I tried the first step of unchecking the efile federal return and the error checks and then tried to efile. Got a weird box that popped up about ProSeries requiring a Sender ID for id purposes and that it will create it automatically, and to enter our customer number in the box and hit ok. Our customer number is already in the box, but the ok button is disabled, so I am stuck.