- Topics

- Training

- Community

- Product Help

- Industry Discussions

- User Groups

- Discover

- Resources

- Intuit Accountants Community

- :

- ProSeries Tax

- :

- ProSeries Tax Discussions

- :

- Re: Can someone help me understand this depreciation?

Can someone help me understand this depreciation?

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Printer Friendly Page

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

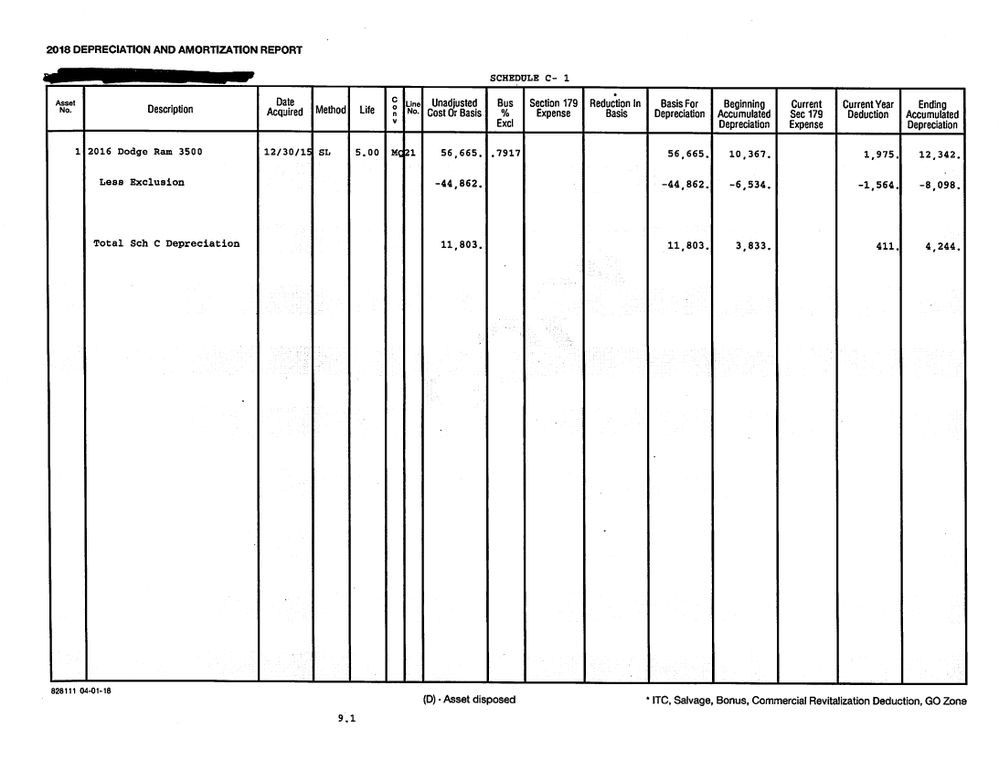

New client, came in with a 2018 printout, he's a sole prop Sch C and Im trying to set up his company truck on the car and truck worksheet...this is what the report shows, but I dont understand what this Exclusion is...

♪♫•*¨*•.¸¸♥Lisa♥¸¸.•*¨*•♫♪

Best Answer Click here

![]() This discussion has been locked.

No new contributions can be made. You may start a new discussion

here

This discussion has been locked.

No new contributions can be made. You may start a new discussion

here

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Sorry for the late response ...

It seems like that 79.17% is the PERSONAL percentage. And the "exclusion" is the personal percentage of use (79.17%). So the report is just showing the total Basis on the first line, then subtracting the personal percentage on the second line, resulting in the Business Basis on the third line. Does that make a little more sense?

So for ProSeries, all you need to do is enter the Total Basis ($56,665) and the "Prior Depreciation" of $4266. Then let the program do its stuff.

Straight Line is usually part of MACRS, so yes, ProSeries will list it as MACRS. Just makes sure it says SL (the program should automatically do that because the business percentage is under 50%)

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

I think I found it! His printout was all scrambled up from a re-fi, all the pages printed front to back (making me crazy!)...I finally found the 4562 and it looks like his percentage of business use was only 20.83% as business.

It also shows SL, ProSeries automatically assigns MACRS, Im not seeing away to change it.

♪♫•*¨*•.¸¸♥Lisa♥¸¸.•*¨*•♫♪

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

That sounds right (at least the math works). @TaxGuyBill is great with this stuff, I almost always just use standard mileage. With <50% business use aren't you stuck with straight-line? I'd get the full tax history to make sure the client didn't step on a recapture land-mine somewhere along the way.

Rick

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

@rbynaker wrote:

That sounds right (at least the math works). @TaxGuyBill is great with this stuff, I almost always just use standard mileage. With <50% business use aren't you stuck with straight-line? I'd get the full tax history to make sure the client didn't step on a recapture land-mine somewhere along the way.

Rick

I just edited my post, I didnt see any responses and couldnt tell anyone was typing, sorry.

So hes got lots more business use this year, closer to 80% so how does that work? Can I switch it to MACRS?

♪♫•*¨*•.¸¸♥Lisa♥¸¸.•*¨*•♫♪

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

I think the preparer last year got his business and personal miles flip flopped.

♪♫•*¨*•.¸¸♥Lisa♥¸¸.•*¨*•♫♪

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Sorry for the late response ...

It seems like that 79.17% is the PERSONAL percentage. And the "exclusion" is the personal percentage of use (79.17%). So the report is just showing the total Basis on the first line, then subtracting the personal percentage on the second line, resulting in the Business Basis on the third line. Does that make a little more sense?

So for ProSeries, all you need to do is enter the Total Basis ($56,665) and the "Prior Depreciation" of $4266. Then let the program do its stuff.

Straight Line is usually part of MACRS, so yes, ProSeries will list it as MACRS. Just makes sure it says SL (the program should automatically do that because the business percentage is under 50%)