- Topics

- Training

- Community

- Product Help

- Industry Discussions

- User Groups

- Discover

- Resources

- Intuit Accountants Community

- :

- ProSeries Tax

- :

- ProSeries Tax Discussions

- :

- Re: 1099-G taxable grant from NYS

1099-G taxable grant from NYS

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Printer Friendly Page

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

First time I've run into this and have two questions:

1. Is it self employment taxable [I believe it is] as it is received for providing energy audits and solutions for customers?

2. If it is self-employment taxable, how to I get the 1099-G, with the amount on line 6 to flow to the Schedule C?

Any help would be appreciated.

Best Answer Click here

![]() This discussion has been locked.

No new contributions can be made. You may start a new discussion

here

This discussion has been locked.

No new contributions can be made. You may start a new discussion

here

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Thank you - I try to enter all 1099s but if that solves my problem then I will do that.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

1. Yes

2. You can just enter a total in schedule C, you don't need to enter individual 1099s.

Slava Ukraini!

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Thank you - I try to enter all 1099s but if that solves my problem then I will do that.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

👍

Slava Ukraini!

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

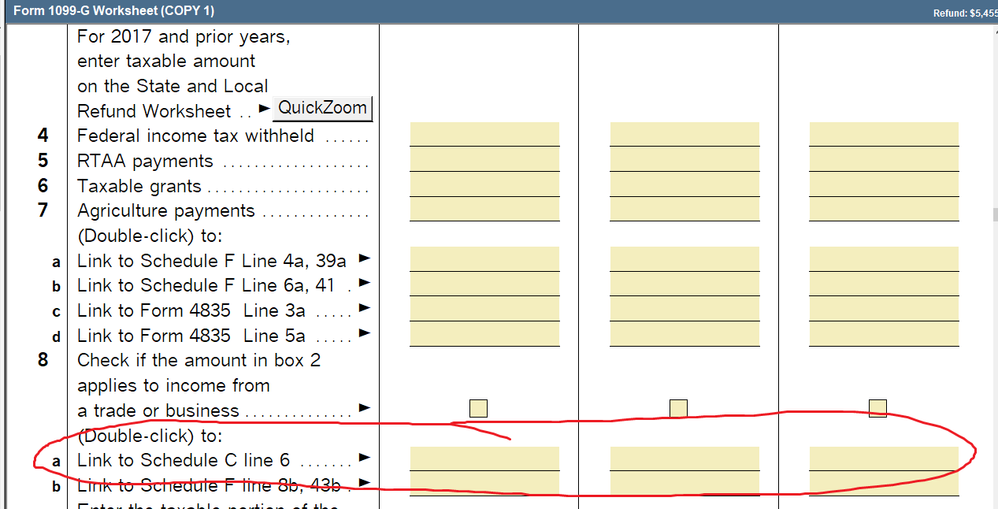

If you look at the 1099g worksheet, its got a way to double click to link to Sch C.

♪♫•*¨*•.¸¸♥Lisa♥¸¸.•*¨*•♫♪

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Tried that - it is only pertaining to box 2, doesn't apply to box 6