- Topics

- Training

- Community

- Product Help

- Industry Discussions

- User Groups

- Discover

- Resources

- Intuit Accountants Community

- :

- ProSeries Tax

- :

- ProSeries Tax Discussions

- :

- Program calculation error on Form W2 $5000 DCAP benefits

Program calculation error on Form W2 $5000 DCAP benefits

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Printer Friendly Page

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

I wanted to post what I believe is a calculation error in the software.

Prepare a MFS return with a w2 that has $5000 in Box 10 (DCAP).

This is a situation where the taxpayer is "not considered unmarried".

The software is only carrying $2500 to Line 12, part III. This is results in to

taxable benefits on the MFS return. There should be $2500. If anyone wants to

reach out to me from ProSeries, I can explain in detail. Thanks, Charles Markham

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

@charles wrote:

This is a situation where the taxpayer is "not considered unmarried".

Do you actually mean "not" considered unmarried? If so, $2500 seems to be correct. Can you clarify your problem?

But on my testing it, it seems like if you ARE "considered unmarried", the program may be doing it incorrectly.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

The terminology "not considered unmarried" is a double negative, but that is the terminology used. See the "Married Filing Separately worksheet" on the 2441 form.

In my case, my taxpayer is married. Both he and his spouse earn 6 figures. He has 2 kids that he is claiming and $5000 in box 10 DCAP on the W-2. If he was "considered unmarried" then he could claim the whole $5000 of DCAP. (He can't get the child tax credit, but he could use up the $5000). In other words, it's like he's single.

My client is definitely. The most EACH SPOUSE can get is $2500 on their individual tax returns.

Since he had $5000 in DCAP, he should wind up with $2500 added back into his wages if he files MFS. The software is NOT doing this.

I am happy to walk somebody through this and send them the sample return and they'll see the problem.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

yes

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

@charles wrote:

Since he had $5000 in DCAP, he should wind up with $2500 added back into his wages if he files MFS. The software is NOT doing this.

Yeah, for some reason line 12 of the 2441 is only importing $2500 from the W-2, rather than $5000. I would just override line 12 and enter $5000 there.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Agreed. I have overwritten and am good to go. however, my real point was to report the "bug" to Intuit. Is this the best way to do that?

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

@charles wrote:

however, my real point was to report the "bug" to Intuit. Is this the best way to do that?

In most cases, no. Occasionally we will see an Intuit employee stop by and say they will report an error, but that is rather hit-and-miss.

Unfortunately, there isn't a 'good' way. Calling support likely has the most effect, but then you would likely be on the phone for a long time trying to explain the problem and why it is wrong.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Hello,

We are unable to recreate the issue you described.

Please contact support. If you choose to provide your tax file through our support system, we can review and help you get this issue resolved.

Thank you!

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

@Intuit_SCarter6 wrote:

Hello,

We are unable to recreate the issue you described.

So you are saying you created a tax return that had $5000 in Box 10 of the W-2, and the MFS return shows $5000 on line 12 of Form 2441?

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

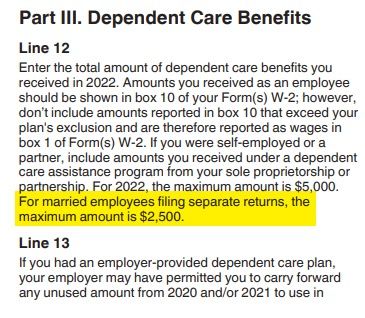

Hmm. Wondering if this makes difference. Based on 2441 line 12 instruction, it uses "married employees filing separate returns" term. Unlike other reference of instruction using "filing status is married filing separately"

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

But the taxpayer's W-2 has $5,000 in Box 10. I don't think the excess was included in Box 1.

Ex-AllStar

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

The software is doing this incorrectly. Any taxpayer married or single can have up to $5000 in box 10 of their W-2. I'll tell you a secret the guys programming the software don't really know taxes, they do no software and they are just trying to follow the rules. They get the rules from IRS publications. The change in the 2441 tax credit from 2021 to 2022, caused this to be re-programed.

The error is easily replicated create a MFS return, and put $5000 in Box 10 of a W-2. The $5,000 should carry to 2441 utlimately resulting in $2,500 being disallowed and added back into wages.

This is a software fix that Intuit needs to fix. I assume this is also occuring in TurboTax. There will be computational errors that will cause Intuit problems when the CP2000's start to fly.

Intuit needs to make this easier for someone to report an error to them. I don't have time to call and speak to someone. I will email you a sanitized return if you supply an email address.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Thank you for the IRS instructions. This actually proves what has happened. The IRS instructions are wrong--or they can be read incorrectly. They appear to say "if there is more than $2,500 in Box 10 and the taxpayer is MFS, only transfer $2500 to Form 2441." This is wrong and not how this works. If a person, had $5,000 in DCAP benefits and files separately, then $2500 should be added back into his/her wages. But this explains how the Intuit software people introduced the error. Someone at Intuit should run this by a CPA/EA on staff to confirm this. Once again, I realize the IRS instructions appear to be directing them to do this.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

I am pleased to note that ProSeries has fixed this bug in a release sent out on 4/13/2023.

Whew! I hope Intuit doesn't have a lot of claims from TurboTax users who get notices from the IRS in a year or two. (Since we use the same tax engine)

But, ProSeries is good to go.