- Topics

- Training

- Community

- Product Help

- Industry Discussions

- User Groups

- Discover

- Resources

- Intuit Accountants Community

- :

- ProSeries Tax

- :

- ProSeries Tax Discussions

- :

- CA relief grant $5000

CA relief grant $5000

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Printer Friendly Page

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Hi everyone and I really appreciate it.

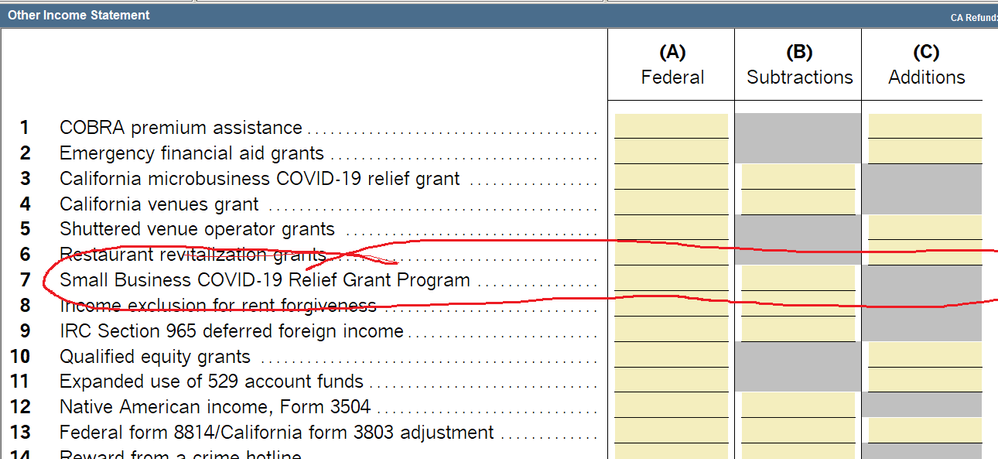

CA relief grant as we know is not taxable for California and clients received 1099-G which goes to schedule C as income so my question is for CA 540 adjustment. Am I right if enter it on line 8Z column B with a explanation? Or it can be adjusted automatically by ProSeries?

Hope someone can help me.

Solved! Go to Solution.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Yes, CA has a special line for it, the program will not do this for you automatically. In the list of Forms in the CA program, look for Other Income, it goes in the subtractions column.

♪♫•*¨*•.¸¸♥Lisa♥¸¸.•*¨*•♫♪

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Yes, CA has a special line for it, the program will not do this for you automatically. In the list of Forms in the CA program, look for Other Income, it goes in the subtractions column.

♪♫•*¨*•.¸¸♥Lisa♥¸¸.•*¨*•♫♪

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Lisa, do you know how to properly adjust for the S Corp on 100S?

I found an article explaining how to adjust it in Proconnect, but for in Proseries.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

This is for PPP and EIDL in ProSeries, might get you to the right spot? I dont regularly prepare SCorp returns, so I dont know my way around the 1120S module very well, sorry.

♪♫•*¨*•.¸¸♥Lisa♥¸¸.•*¨*•♫♪

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Thank you, Lisa. I reviewed the information. This is a Covid grant taxable on federal, not taxable by CA.

The link says:

S-Corporate:

- Open the California return.

- Open Form 100S p4-6.

- Scroll down to the Schedule K on Side 6.

- Enter the amount of the grant and description on the Other deductions line 12e in the CA Adjustment line.

- This amount will be reported on the CA Schedule K, line 10b, column c.

The problem is 5, after I enter it as other deduction as explained under step 4, it does not flow to the K-1 at all as it says it would under step 5. It says: "This amount will be reported on the CA Schedule K, line 10b, column c." No, it does not flow to the K-1 at all.

Any idea?

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

♪♫•*¨*•.¸¸♥Lisa♥¸¸.•*¨*•♫♪

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

No, it does not. Line 1 Column C of the K-1 does not show the grant adjustment.

Seems, based on the Proseries instruction, it does not even want you to have that adjustment under line 1 Column C of the K-1. Maybe, because the line 1 of Column C is "ordinary income/loss." Seems, it wants you to have it as a deduction on a separate line. Proseries says to enter the amount on the other deductions line 12e in the CA adjustment line which is Column C, I am assuming. Now, when I do only that, it does not flow to the K-1 anywhere at all, but when I also enter the same amount on the other deductions line 12e under Column D as well ( total amount using CA law column), it flows to the K-1 but not to the line 1 Column C of the K-1, but it flows to the other deductions 11e of the K-1. The line 1 Column C of the K-1 does not reflect that. But maybe, that is the right way since this is a S Corp and maybe that is Ok to report it that way and makes sense ? However, Proseries is saying " the amount will be reported on the CA Schedule K, line 10b, column C". No, it does not show up there at all.

Do you think calling Proseries would help or nah? 🙂