This article will help you report Paycheck Protection Program (PPP) loan forgiveness and Economic Injury Disaster Loan (EIDL) grants in ProSeries. Forgiven PPP loans and EIDL advances or grants are considered nontaxable for federal purposes.

- Adjustments may be needed to expenses that are no longer deductible. See the Treasury and IRS Issued Guidelines for details.

- See IRS Notice 2020-32 for additional details on the tax treatment of PPP Loan Forgiveness.

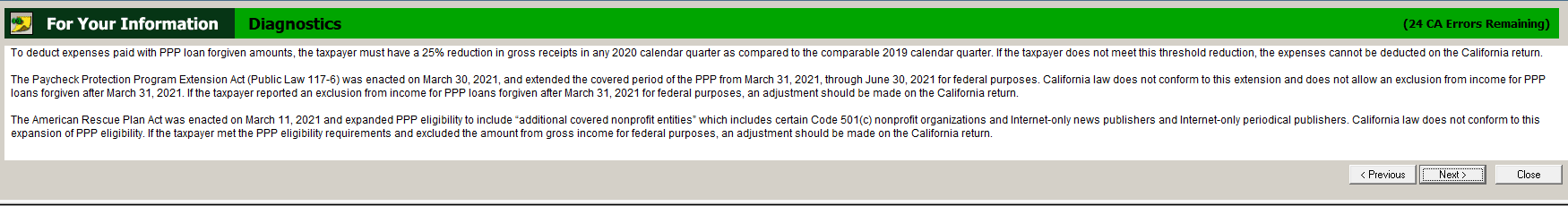

- State adjustments may be needed if the return includes a state that doesn't conform to federal guidelines.

Follow the steps below for your return type to report the forgiven PPP or EIDL as tax-exempt income.

To enter a PPP loan statement on a 1040:

- Press F6 to bring up Open Forms.

- Type in PPP to find the PPP loan forgiveness statement, then press OK.

- Scroll down to the Smart worksheet and enter the information for any PPP loans forgiven for 2020 or 2021.

ProSeries will include this statement with the e-filed return. If you want to attach multiple PPP loan statements, you must create your own statement in Preparer Notes or a PDF attachment.

For partnership returns:

- Go to Schedule M-1 Items Worksheet.

- Under Income Items in Other Permanent Items (income), enter a description and the amount of forgiven loan or EIDL advance received.

The loan amounts will be reported on Schedule K, line 18b, as other tax-exempt income. An adjustment for the loan will generate on Schedule M-1, line 6.

For S-corporate returns:

- Go to Schedule M-1 Items Worksheet.

- Under Income Items in Other Permanent Items (income), enter a description and the amount of forgiven loan or EIDL advance received.

The loan amounts will be reported on Schedule K, line 16b, as other tax-exempt income. An adjustment for the loan will generate on Schedule M-1, line 5.

For corporate returns:

- Go to the Form 1120 p3-6.

- Scroll down to the Schedule M-1.

- On Line 7 below the Tax-exempt interest field enter a description and the amount of forgiven loan or EIDL advance received.

This will generate an adjustment for the loans Schedule M-1, line 7.

For exempt organization returns (Form 990):

Per Form 990 instructions for Part VIII, line 1e,

The Coronavirus Aid, Relief, and Economic Security Act (CARES Act) established the Paycheck Protection Program (PPP) to provide loans to small businesses as a direct incentive to keep their workers on the payroll. The loans are forgiven if all employee retention criteria are met and the funds are used for eligible expenses. Amounts of PPP loans that are forgiven may be reported on line 1e as contributions from a governmental unit in the tax year that the amounts are forgiven.