Welcome back! Ask questions, get answers, and join our large community of tax professionals.

- Topics

- Training

- Community

- Product Help

- Industry Discussions

- User Groups

- Discover

- Resources

- Intuit Accountants Community

- :

- ProSeries Tax

- :

- ProSeries Tax Discussions

Options

- My Diagnostic Dashboard

- Mark all as New

- Mark all as Read

- Float this item to the top

- Subscribe

- Bookmark

- Sort by Topic Start Date

ProSeries Tax Discussions

Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Featured

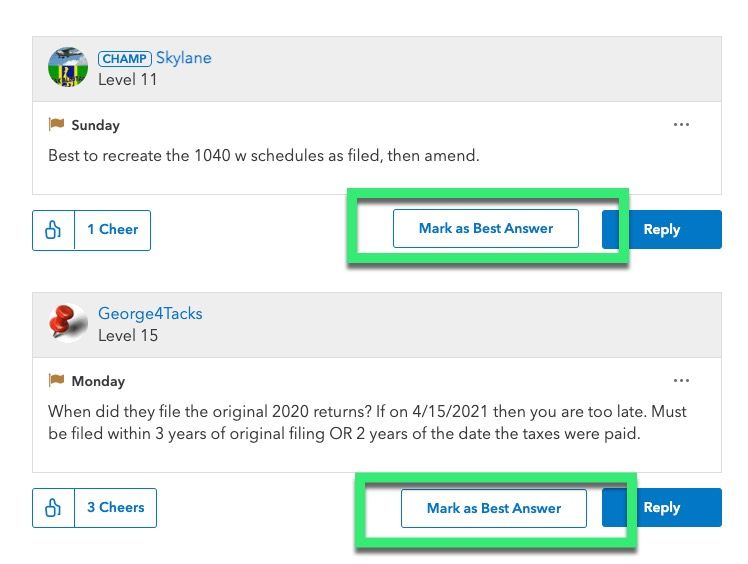

Updated 05/06/24 "Accept as solution" has been changed to "Mark as Best

Ans...

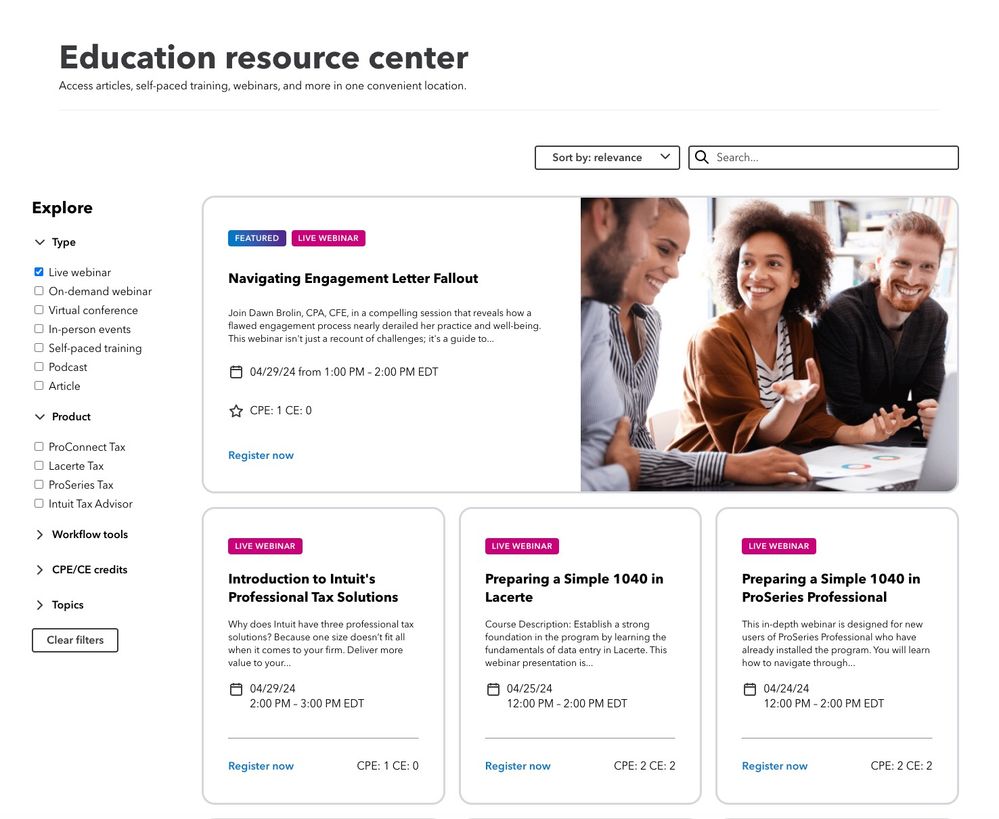

Updated: (05/01/24)Check out the Education Resource Center. See the full

li...

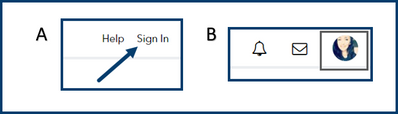

A custom profile photo is a great way to share a little bit of yourself

wit...

- Recent

- Popular

- Unanswered

- No Replies

- Hi to all,For tax year 2021, ProSeries does not support direct deposit. How can my client arrange for direct deposit with the IRS? Can I attach a letter written... read more0 0

- Hello,I e-filed 1099-NEC with 10 contractors for my clientOne contractor with 1099-NEC is $0 instead of $21000 that was issued and e-filedPlease tell me how to ... read more0 1

- I have a client who sold his business, LLC-tax class S Corp. I'm preparing his personal tax return now. I have entered in the amount that he sold the business f... read more

- Tennesse Repealed a major part of their Franchise Tax . See2024franchisetax (tn.gov). These are major refunds.Tax payer's will be allowed to amend 2020 and late... read more0 0

- the parents received a 1095A with their child on it but they did not claim her as a dependentthe IRS has rejected the childs return asking for a 1095A she doesn... read more470pitt Level 3ProSeries Professionalposted May 6, 2024Last activity May 6, 2024 by Just-Lisa-Now-3 2

- DependentTP Level 1ProSeries Professionalposted May 6, 2024Last activity May 6, 2024 by Just-Lisa-Now-4 3

- Hello,I am using Proseries and working on 1040NR. My client has income from rental. I remember seeing the check box for income not subject to withholding tax, w... read more0 0

- I entered a business vehicle on 2012 Schedule C (car and truck worksheet) with 5 year recovery period but system continues to depreciate after 11 years. Why?4 2

- The client filed head of household for 2023, her parent was a dependent. Only residents in the home are the client and her mom. Client is unmarried.Mom died Mar... read more

- Looking at deduction on Schdeule A for this repayment client made to employer. Is there a certain line on Schedule A that it goes on? Looking at program thinkin... read moreJim-from-Ohio Level 11ProSeries Professionalposted May 5, 2024Last activity May 6, 2024 by Just-Lisa-Now-14 9

- Does anyone know how to get ProSeries to include a Sect 754 asset in UBIA? I've had to manually override the Partners K-1 info, but ProSeries will not allow me ... read morePA CPA 900 Level 2ProSeries Professionalposted May 4, 2024Last activity May 6, 2024 by Taxes-by-Rocky0 5

- In ProSeries, where do I enter the CA real estate withholding for a sale of a rental property? The refund for the withholding to be kept in the trust.

- I have had problems all season with amounts being added back as additional income on Maryland returns that are just wrong. I resorted to overridding the system ... read more0 0

- Anyone still going fairly strong? I still have a lot of extensions to work through as well as my business accounts to take care of. Post tax season I schedule f... read moreJim-from-Ohio Level 11ProSeries Professionalposted May 4, 2024Last activity May 4, 2024 by MariaCrowley20 10

- How is it that the 2022 1040 Payments Line 25b shows 1099 withheld amount when none was entered for the 1099-misc/rents.. Identical 2023 return does not show a ... read more

Ask the community

Helpful Links

Top solvers

| User | Count |

|---|---|

| 13 | |

| 12 | |

| 5 | |

| 5 | |

| 4 |

Popular authors

Popular authors

| User | Count |

|---|---|

| 547 | |

| 251 | |

| 194 | |

| 158 | |

| 133 |