- Topics

- Training

- Community

- Product Help

- Industry Discussions

- User Groups

- Discover

- Resources

- Intuit Accountants Community

- :

- Lacerte Tax

- :

- Lacerte Tax Discussions

- :

- Re: Specially Allocate Pass-Through Excess Business Interest from Lower Tier Partnership

Specially Allocate Pass-Through Excess Business Interest from Lower Tier Partnership

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Printer Friendly Page

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Facts:

LLC with investments in lower tier partnerships that has passed-through excess business interest (line 13k, Schedule K-1). My Parent LLC fails the "substantial economic effect" tests for partner allocations of tax losses requiring a special allocation of losses to partners. As such, I need to allocate the pass-through excess business interest expense from these lower-tier partnerships in accordance with a ratio that does not match the partners interest in profits.

From my research, this item is allocated to partners using profit ratios, but that is not consistent with the "substantial economic effect" under IRC 704(b). I need to specially allocate this lower-tier pass-through amount, but I do not see an input area for this item in the Special Allocations screen 29.2

I can allocate Total Partnership Excess Business Interest Expense in Screen 29.2, "Deductions (Sch K-1, Boxes 12-13), but that does not address the allocation of the lower-tier pass-through. I have used the special allocation for excess business interest expense, however the lower-tier partnerships' amounts continue to show up on the Partner's Share of Investment in Passthrough Entities.

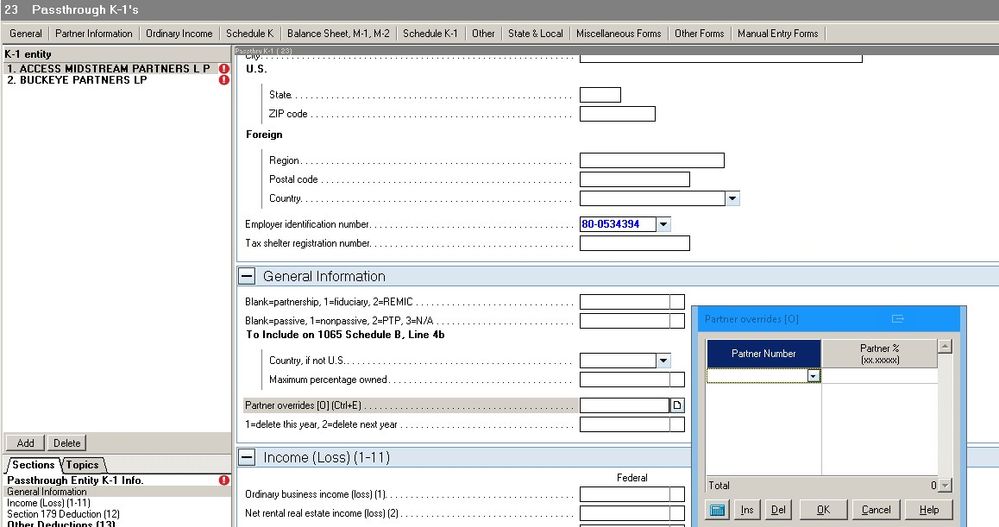

Looking for a workaround to clean this off the Partner's Share of Investment in Passthrough Entities form. Finding nothing on Screen 23 for the lower-tier partnerships K-1 input and nothing on Screen 29.2 that addresses this issue beyond total excess business interest.

Extremely complicated issue-any feedback would be appreciated.

Best Answer Click here

![]() This discussion has been locked.

No new contributions can be made. You may start a new discussion

here

This discussion has been locked.

No new contributions can be made. You may start a new discussion

here

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Have you tried using the Partner Override entry box on each Screen 23 K-1 input? That gives me what appears to be appropriate output, but things that work in a relatively straightforward dummy client don't always come out right on a very complex return. Note also that your existing special allocations of other items might need to be re-adjusted; special allocations are the worst.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Have you tried using the Partner Override entry box on each Screen 23 K-1 input? That gives me what appears to be appropriate output, but things that work in a relatively straightforward dummy client don't always come out right on a very complex return. Note also that your existing special allocations of other items might need to be re-adjusted; special allocations are the worst.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Works in my case, thank you.

However if this lower tiered partnership had separate items of income versus losses, such as interest income versus RE Losses it would fail. For instance, when applying allocations of interest income, one would apply the profit sharing ratios, but items of losses would be specially allocated in my situation due to the need to specially allocate from the failed "substantial economic testing".

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Yes, you'd probably need to use Excel if you wanted accurate pass-through entity schedules in that scenario. Lacerte is pretty middle-of-the-road software and doesn't handle edge cases particularly gracefully.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Thank you.

The Partner Override box would be useful attached to each pass-through item or some additional box within it to assign the override to targeted pass-through items on these lower tiered partnerships. Too expensive from a programming standpoint I would assume.

Worked with UltraTax in the early 2000s and while it was versatile, I found the moment the standard partners profit/loss ratio allocations fail due to tax law issues, it got cumbersome and required underlying excel schedules, of course that is always the case when dealing with PIP, 704 and substantial economic effect.

Thank you again.