- Topics

- Training

- Community

- Product Help

- Industry Discussions

- User Groups

- Discover

- Resources

- Intuit Accountants Community

- :

- Industry Discussions

- :

- Tax Talk

- :

- Schedule K-1 Partner Information

Schedule K-1 Partner Information

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Printer Friendly Page

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Where can I enter partner information from J,K, and L of the K-1 into ProSeries Professional for an individual return?

Best Answer Click here

![]() This discussion has been locked.

New comments cannot be posted on this discussion anymore. Start a

new discussion

This discussion has been locked.

New comments cannot be posted on this discussion anymore. Start a

new discussion

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

The Schedule K-1 Worksheet in the 1040 return does not have data entry fields for those lines. That informaiton would be for your records.

**Mark the post that answers your question by clicking on "Accept as solution"

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

In the ProSeries program, using the Schedule K-1 worksheet, you will find all the necessary line items to be able to "input" the information from Schedule K-1 received, which will then "flow" to the appropriate lines on the tax return, Sch E and the like. You mention J, K and L of the K-1, are you looking at supporting statements or the actual K-1 provided by the client?

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

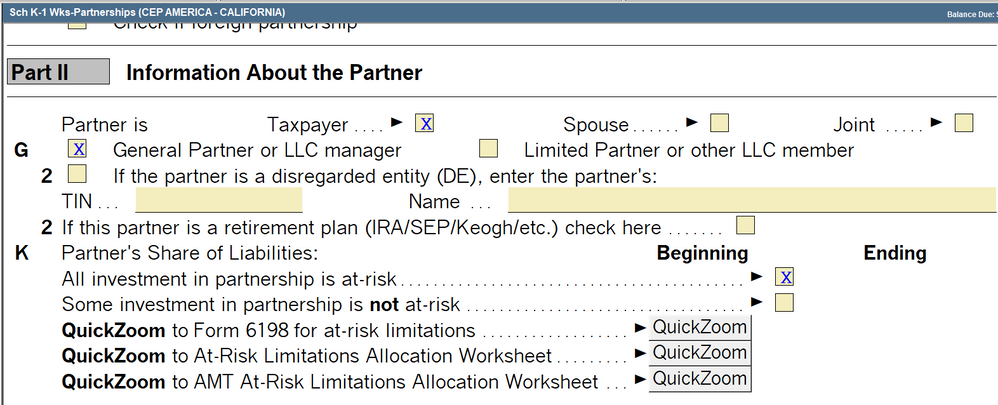

Looking at the actual K-1, Partner information section--these include the partner's share of profit, loss, and capital, partner's share of liabilities, and partner's capital account analysis. This is in Part II of the K-1. In ProSeries there is a small section for Part II the entry worksheet but nowhere to enter these details. See below:

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

The Schedule K-1 Worksheet in the 1040 return does not have data entry fields for those lines. That informaiton would be for your records.

**Mark the post that answers your question by clicking on "Accept as solution"

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

What about Box L, capital contributed, current year net income or loss, and ending capital account?

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Those may come into play if there are any sort of basis limitations on losses that need to be accounted for. ProSeries does not have a worksheet for Basis Limitations but this article shows you how you can track that if the taxpayer does have basis limitations.

**Mark the post that answers your question by clicking on "Accept as solution"

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Did you ever figure it out? I'm running into the same issue.