- Topics

- Training

- Community

- Product Help

- Industry Discussions

- User Groups

- Discover

- Resources

- Intuit Accountants Community

- :

- Industry Discussions

- :

- Tax Talk

- :

- Re: IRA distribution (non taxable)

IRA distribution (non taxable)

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Printer Friendly Page

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

A client of mine brought me a 1099R instrument where he was distributed $14,000 as a taxable traditional IRA. The gross amount and taxable amount are both $14,000. Apparently, he was advised by his financial Advisor (who works for a reputable financial investment Co.) that if he donated $5,000.00 from this IRA to his church directly from the Financial Inst., that $5,000.00 would be tax free. I asked my client if he could provide me with the IRS publication or any 2018 tax reform that supports this, I would be look into it. I'm at a loss on this one???? Help!

Best Answer Click here

![]() This discussion has been locked.

New comments cannot be posted on this discussion anymore. Start a

new discussion

This discussion has been locked.

New comments cannot be posted on this discussion anymore. Start a

new discussion

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

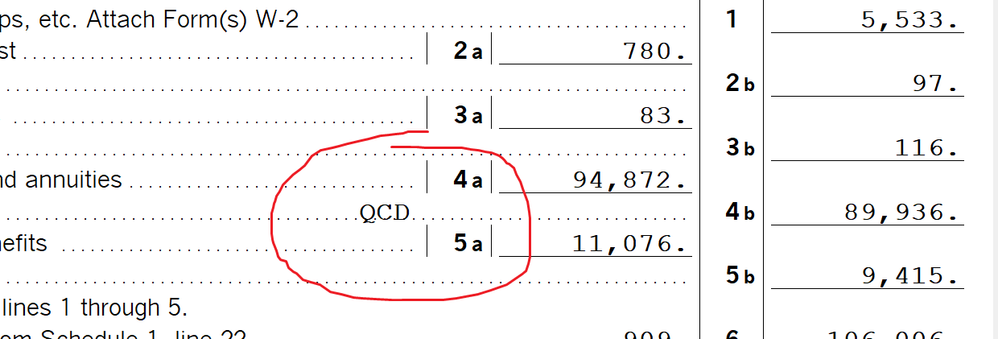

Only on the 1099R worksheet in the QCD box, then you should see "QCD" appear on the line by the retirement income on the 1040.

♪♫•*¨*•.¸¸♥Lisa♥¸¸.•*¨*•♫♪

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

If your client is older than 70 1/2 and the amount is not over $100,000 it is tax free and counts toward RMD. If you scroll down on the 1099R worksheet to " Qualified Charitable Distribution" you will see where to put the amounts. You cannot put it on schedule A also. here is the IRS site to read up on it.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

I have clients that do charitiable contributions directly through the investment form, they generally have something that shows the QCD occurred, who it was sent to and how much it was for.

Them just telling me it happened, isnt good enough for me.

♪♫•*¨*•.¸¸♥Lisa♥¸¸.•*¨*•♫♪

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

@Just-Lisa-Now- Clients who make the QCD (and bring you the proper form): nothing gets reported on 1040, right?

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Only on the 1099R worksheet in the QCD box, then you should see "QCD" appear on the line by the retirement income on the 1040.

♪♫•*¨*•.¸¸♥Lisa♥¸¸.•*¨*•♫♪

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Thank you so much, you saved a ton of research! Pat M.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Yes, it can be non-taxable, but should have been set up before taking the distribution since it has to be direct from the IRA to the charity. I use Schwab & fill out a form prior to the transfer, naming the charity, address where they are to send the check, and the amount.

In Lacerte, go to Pensions/IRA, etc. and at the site scroll down to "charitable IRA distribution" where you check a box & enter the amount. The amoun will be deducted from the IRA distribution with a a statement "QCD"