Welcome back! Ask questions, get answers, and join our large community of tax professionals.

- Topics

- Training

- Community

- Product Help

- Industry Discussions

- User Groups

- Discover

- Resources

Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

- Intuit Accountants Community

- :

- ProSeries Tax

- :

- ProSeries Tax Discussions

- :

- Re: Is the 8812 worksheet accessible?

Is the 8812 worksheet accessible?

Options

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Printer Friendly Page

avavs9

Level 1

02-07-2022

02:19 PM

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

I have a client that is getting a reduced child tax credit because of income, but I cannot access the calculation worksheet.

Labels

4 Comments 4

Level 15

02-07-2022

02:25 PM

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

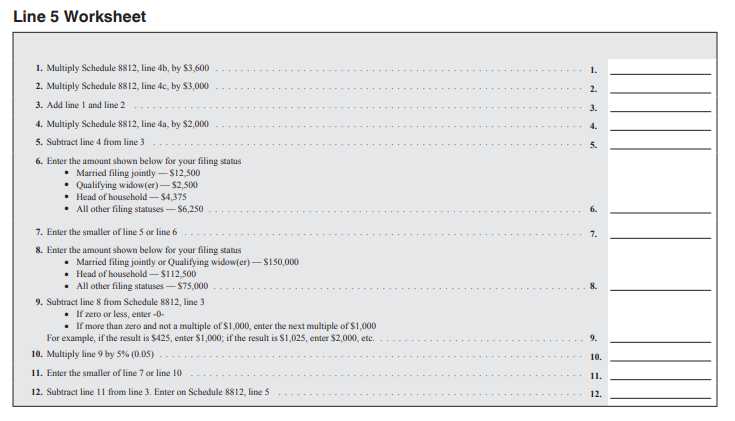

The 8812 pretty much does the calculations right on the form.

Doesnt the worksheet for Line 5 just show whether they're entitled to the 3000/3600 or the 2000 per kid?

♪♫•*¨*•.¸¸♥Lisa♥¸¸.•*¨*•♫♪

Doesnt the worksheet for Line 5 just show whether they're entitled to the 3000/3600 or the 2000 per kid?

♪♫•*¨*•.¸¸♥Lisa♥¸¸.•*¨*•♫♪

avavs9

Level 1

02-07-2022

02:50 PM

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

The worksheet calculated a reduced amount which I assume is based on income over 150k. But I cannot see the calculation.

RollTide68

Level 8

02-07-2022

03:12 PM

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

It is in the instructions for the form but embedded in the programming.

You won't be able to see the calculation.

rbynaker

Level 13

02-07-2022

04:11 PM

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

I would think the worksheet would be required for due diligence in "determining the amount of the credit" in IRC 6695(g)(2). Is this hiding on some other 8812 supplemental worksheet somewhere?

Rick