- Topics

- Training

- Community

- Product Help

- Industry Discussions

- User Groups

- Discover

- Resources

- Intuit Accountants Community

- :

- ProSeries Tax

- :

- ProSeries Tax Discussions

- :

- Re: 2022 S Corp letter from IRS

2022 S Corp letter from IRS

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Printer Friendly Page

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

new one for me.. client just emailed IRS letter re: 2022 Form 1120S. letter says no valid 2553 filed though I know one was filed.. but anyways, is it best to file 2022 as a C Corp now or is there anything to be done to get 2022 S Corp status survive. letter talks about late relief but I never had this issue, not sure how to handle it. thank you.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

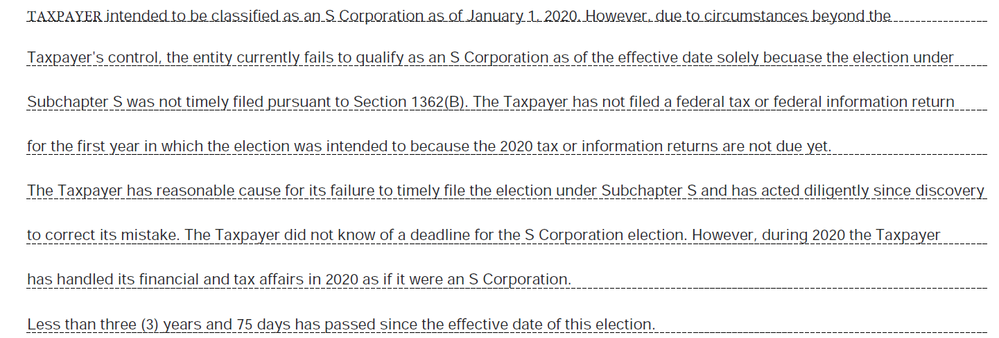

I advise filing another S election with late language. See the Snip. Also reference Rev. Proc 2018-58 and cite it at the top of Form 1120S, if it applies. I have had 3 late elections pass and one fail, which I am currently trying to resolve. I think the processing of these has been affected by the pandemic.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

I would do the same as Susan. I think I have a return like that lurking since my e-filed extension for an 1120S bounced even though the 2553 was filed with the return a couple of years ago. Believe it or not, the IRS does mess up every now and then.

Slava Ukraini!

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

I agree with Sue and Iron Man. A few years or so ago during the covid mess I had at least two 990 clients that they claimed the return was not received but it was. This was before the e-file mandate for 990 returns and the returns were mailed . They responded with a letter and the certified mail receipt and it was resolved okay. I think they are still having issues.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

New SCorp clients were required to provide me with a copy of the S Election Acceptance letter.

Didn't matter if they brought copies of previous 1120S returns. I wanted proof IRS said they were an SCorp.