- Topics

- Training

- Community

- Product Help

- Industry Discussions

- User Groups

- Discover

- Resources

- Intuit Accountants Community

- :

- ProSeries Tax

- :

- ProSeries Tax Discussions

- :

- AZ Form 1099-G

AZ Form 1099-G

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Printer Friendly Page

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

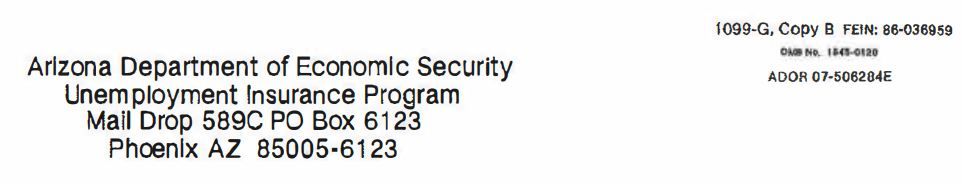

Information from Arizona form 1099-G needed: Payer's Federal TIN and street address, thanks.

Solved! Go to Solution.

![]() This discussion has been locked.

No new contributions can be made. You may start a new discussion

here

This discussion has been locked.

No new contributions can be made. You may start a new discussion

here

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Arizona #86-6004791 Arizona Dept of Revenue 1600 W Monroe Phoenix Az 85007

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Arizona #86-6004791 Arizona Dept of Revenue 1600 W Monroe Phoenix Az 85007

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Thank you very much - stay safe!

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Anytime! You as well!

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

I'm using the # you provided for AZ 1099G refund and an error message pops up saying

it doesn't match the one at the top of the page for 1099G worksheet. It is the refund from

prior year and there is no 1099G provided

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

I get that same error message. I entered the correct tin, and there is no tin at the top of the page for the 1099G worksheet.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

When I go to tax help It lists the States which require the 1099-G electronic filing information worksheet be filled out, and AZ isn't one of them. Yet the diagnostic remains even though I entered the correct tin: 86-6004791.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Try this 86-036959

From https://des.az.gov/sites/default/files/media/1099g_sample_0.pdf

Here's wishing you many Happy Returns

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Thanks. Actually I just noticed that the tin was not entered near the top of the 1099-g worksheet though there was no diagnostic so I entered the original tin and the other diagnostic went away, so problem solved.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Thank you so much. I was at an impasse!

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

I'm having the same problem today, trying to e-file a Fed & AZ return. AZ says they were not required to issue the 1099 because taxpayer used standard deduction. I have used the 86-6004791 number twice, and I still get an error message that the numbers don't match. Does anyone have a fix?

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Were you able to get a fix?

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

I got the same problem

Anyone know how to fix?

last year Federal TIN: 86-6004791

Try this year not active show error

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

for state of Arizona

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

roll back on the top entry at Payer's TIN 86-6004791 and problem solve.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Has anyone found a true solution to this issue?

error message and the box is field is highlighted in red

86-0369595

86-6004791

I’ve tried these two with no luck

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

How about 99-9999999

I really bothers me that it is even needed if there is no withholding.

Here's wishing you many Happy Returns

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Are you having similar issues and have you found a solution?

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

No. The few 1099G I have dealt with actually have an EIN. If it is for state tax refund and it is not even taxable, why are you even trying to enter it?

Here's wishing you many Happy Returns

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

because it’s a 7202 and it’s self employment

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Call AZ and they will likely get you what you need. https://azdor.gov/contact-us

Here's wishing you many Happy Returns