- Topics

- Training

- Community

- Product Help

- Industry Discussions

- User Groups

- Discover

- Resources

- Intuit Accountants Community

- :

- ProSeries Tax

- :

- ProSeries Tax Discussions

- :

- Amended 2020 1040-original filed by another firm

Amended 2020 1040-original filed by another firm

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Printer Friendly Page

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

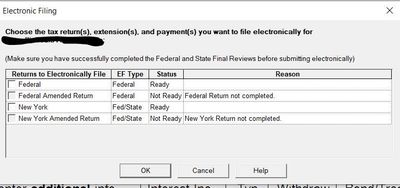

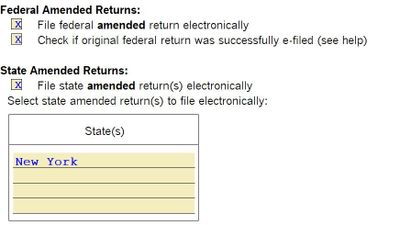

I prepared an amended 1040 for tax year 2020. The original was filed by another accounting firm electronically. Proseries allows me to check two boxes. One, File the federal amended return electronically. Two, Check if the original federal return was successfully electronically filed. When I try to electronically file, the box to file an amended electronic return is grey. How can I electronically file?

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

I have had the same issue and no idea what I am doing wrong. So you are not alone. NOthing I have tried works. I have a message in to an Admin so will see if that produces any thing.

Here is my post from earlier this month:

Just tried and it did send to the IRS, then came back as rejected. Same message. Says the 1040-x is not in the return.

If I hit "EF Now" from within the client instead of from EF Center, the amended return boxes are blanked out and it is looking for me to check the original return boxes.

I wonder if I need to somehow purge the Efile records for this client. I have now tried to file it 4 times. I did copy the file over to a new name yesterday and rechecked all the boxes. I just cannot get this to go. I know for a fact the first one was efiled, as I had the acknowledgement from the irs and "wheres my refund" shows refund on original return was issued.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

I have an issue and not sure how to proceed.

A wrong file was sent by Proseries to the IRS and was accepted. I know for a fact that I e-filed through the client file but Proseries picked up a file from a different directory with a same SSN. The wrong file was accepted by the IRS but the right file is still saying transmitted for federal and received by Intuit for CA for three days.

Since the file with the same SSN was accepted by the IRS, I was thinking of doing an amended return but not sure how to proceed. Does anyone has any experience on this?

Thanks.