- Topics

- Training

- Community

- Product Help

- Industry Discussions

- User Groups

- Discover

- Resources

- Intuit Accountants Community

- :

- ProSeries Tax

- :

- ProSeries Tax Discussions

- :

- After change of ownership. how to enter total income was calculated through the year for the old ownership k-1s? since the new ownership did not make any profit till the end of the tax year

After change of ownership. how to enter total income was calculated through the year for the old ownership k-1s? since the new ownership did not make any profit till the end of the tax year

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Printer Friendly Page

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

In 2021 Jan-Nov ownership was 50% for each (Partner 1 and Partner 2) total income calculated was 200K, in Dec 1st 2021, partner 2 sold 50% of his shares to a new partner so by the end of the year the ownership was (partner 1 (50%) + partner 2 (25%) + partner 3 (25%))

After entering the data in change of ownership smart worksheet and and the period of ownership in ProSeries, the profit in k-1s (partner 1 (100K) + partner 2 (50K) + partner 3 (50K))

In fact partner 3, after changing the ownership made Zero income since the 200K was made in Jan-Nov that year. and he does not need to pay income tax.

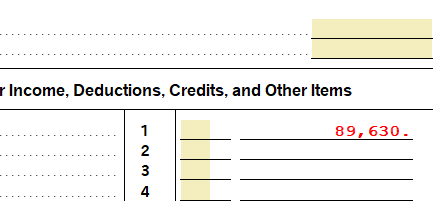

I override box 1 in each k-1 to (partner 1 (100K) + partner 2 (100K) + partner 3 (0K)) but it's showing me in read, is that the right way to do it?, or is there any other way to do the entry?

Solved! Go to Solution.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Yes it will get accepted. It will get accepted as long as all the k1's added up equals the totals on the 1065 ( on the main form ). I have done this for years with a couple of partnerships due to some having different guaranteed payments etc,,, Just double check that they do equal up 🙂 Have a great day and glad this could help.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

I had an issue somewhat like this...and what I had to do is alter all the figures. for example partner 1 would get the 50% of all income and expenses. Partner 2 would get the 50% of the first 11 months and then 25% of the 12th month 0, and Parner 3 would state 25% of 0 as I stated I had to alter the figures and it was efiled and accepted. So over ride the answers after you put in the percentages. As long as the total of all 3 k1's equal the total of all income and expenses it is fine.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

thank you for the answer

I was thinking of doing override, but it will always turn to red, so I was confused about if it will get accepted.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Yes it will get accepted. It will get accepted as long as all the k1's added up equals the totals on the 1065 ( on the main form ). I have done this for years with a couple of partnerships due to some having different guaranteed payments etc,,, Just double check that they do equal up 🙂 Have a great day and glad this could help.