- Topics

- Training

- Community

- Product Help

- Industry Discussions

- User Groups

- Discover

- Resources

- Intuit Accountants Community

- :

- ProConnect Tax

- :

- ProConnect Tax Discussions

- :

- S-corporation shareholder stock basis at beginning of year

S-corporation shareholder stock basis at beginning of year

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Printer Friendly Page

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

For a taxpayer with a Schedule K-1 (Form 1120-S), how do I determine the shareholder's stock basis at the beginning of the year when it is not given on the Schedule K-1?

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Ask the preparer of the S-Corp return.

Ask your client.

Recreate the info from looking at all years that the K-1 has been provided (that ownership has existed.

Bonus - determine if there's any 'outside' basis.

( Generic Comment )"

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

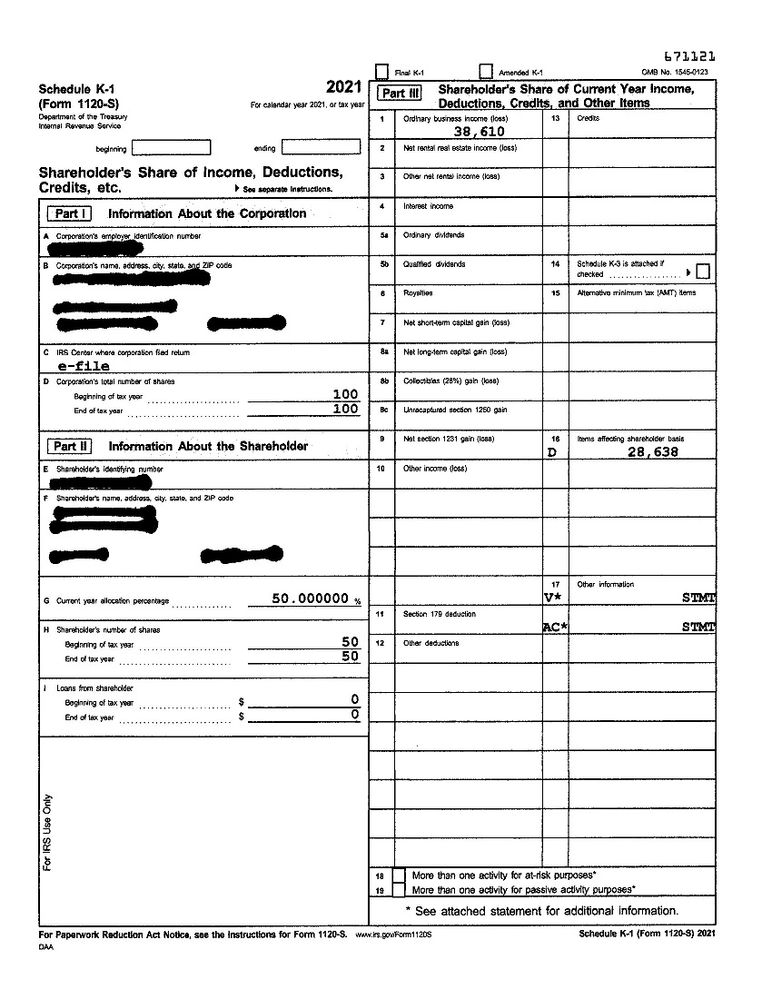

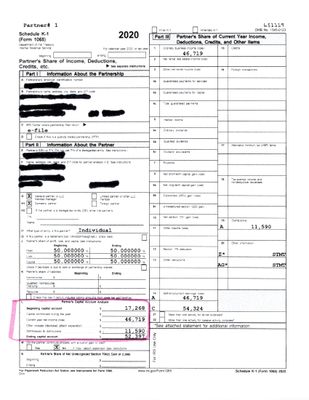

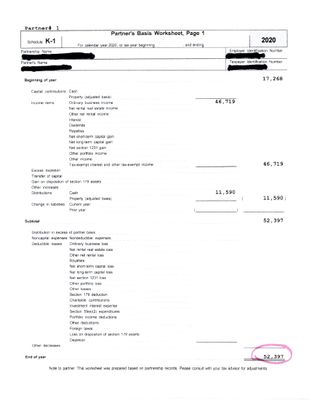

Tax year 2021 is the first year the company is an S-Corporation. It was a Partnership from tax years 2018 through 2020. The Schedule K-1 (Form 1065) provided a Basis Worksheet that was not included with the Schedule K-1 (Form 1120-S).

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Then you have a starting basis for the S Corp .

Neither an S Corp or a partnership is required to provide basis schedules to the shareholders/partners although many do.

It is the responsibility of the shareholder/partner to keep track of their basis. Usually that means the tax return preparer does it.

EDIT: Remember that the shareholder won't get basis for liabilities so remove those to the extent included in the ending partnership basis schedule.

Ex-AllStar

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

sjrcpa or abctax55

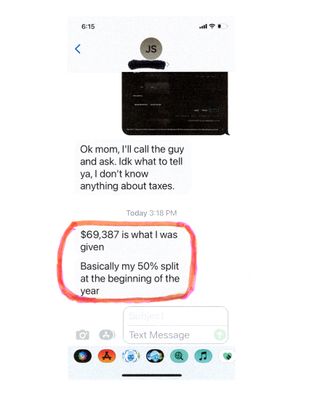

The first photo below is the amount ($69,387) the preparer of the S-Corporation return gave the shareholder for the shareholder stock basis at the beginning of the year 2021. The second photo is the2020 Schedule K-1 (Form 1065) and the third photo is the 2020 Schedule K-1 Partner's Basis Worksheet.

Do you know why the shareholder's stock basis at the beginning of the year 2021 would be $16,990 more than the partner's basis at the end of the year 2020?