Welcome back! Ask questions, get answers, and join our large community of tax professionals.

- Topics

- Training

- Community

- Product Help

- Industry Discussions

- User Groups

- Discover

- Resources

Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

- Intuit Accountants Community

- :

- ProConnect Tax

- :

- ProConnect Tax Discussions

- :

- Re: Refund overpayment rather than credit to next year

Refund overpayment rather than credit to next year

Options

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Printer Friendly Page

jdeleo1743

Level 2

03-21-2023

01:17 PM

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

I am trying to get Proconnect refund an overpayment on a Form 1040 and it keeps crediting to next year. How to fix?

Labels

5 Comments 5

Moderator

03-21-2023

02:19 PM

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Hi there,

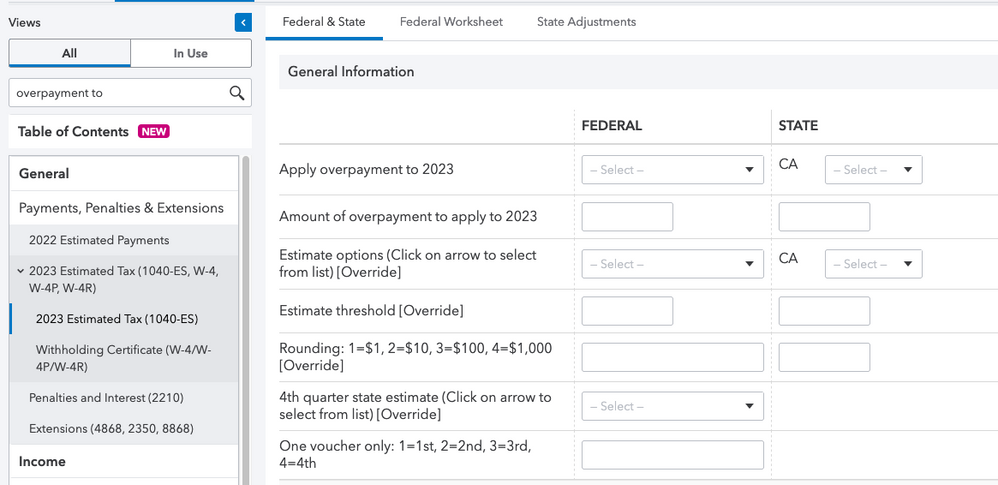

The entries you want are on Payments, Penalties, Extensions > 2023 Estimated > 2023 Estimated Tax:

Make sure "Apply overpayment to 2023" is blank (set to "Select"), and there's no amount entered in Amount to apply.

- Rebecca

jdeleo1743

Level 2

03-21-2023

06:05 PM

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Yep That works!

jfoley

Level 1

10-16-2023

10:56 AM

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

I am trying to do the opposite, credit to 2023 instead of refund. I have the boxes checked to apply, what am I doing wrong?

George4Tacks

Level 15

10-16-2023

11:06 AM

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

@jfoley Are you amending a return? If so, you can not apply the refund. Look at the Profile and see if Amend boxes are checked

Here's wishing you many Happy Returns

jfoley

Level 1

10-16-2023

12:58 PM

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

That was it!!! Thank you very much for the help!!