- Topics

- Training

- Community

- Product Help

- Industry Discussions

- User Groups

- Discover

- Resources

- Intuit Accountants Community

- :

- ProConnect Tax

- :

- ProConnect Tax Discussions

- :

- Re: Questions on explanation for amending 1040-Tax Year 2021 return and steps to take?

Questions on explanation for amending 1040-Tax Year 2021 return and steps to take?

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Printer Friendly Page

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

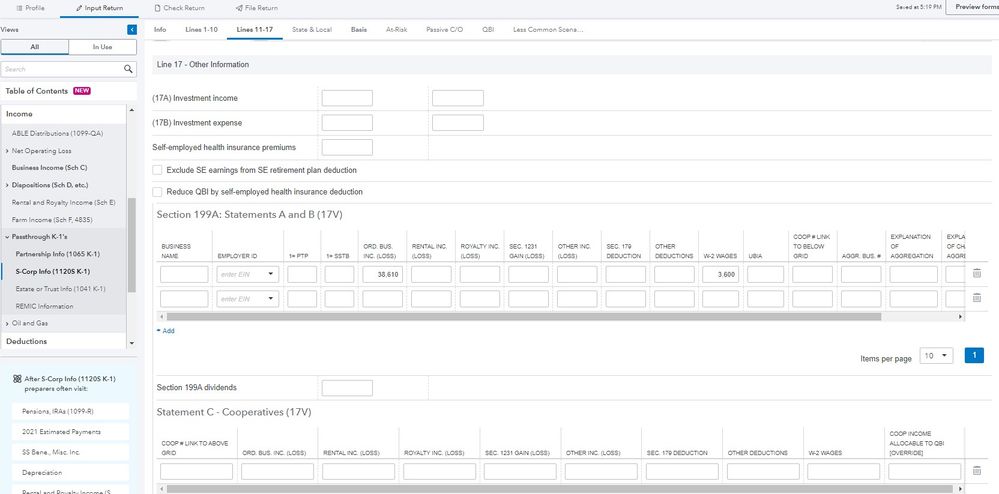

I made a mistake on a 2021 Federal Individual Income Tax return that was electronically filed with the Internal Revenue Service on April 12, 2022. The taxpayer has a 2021 Form 1120-S Schedule K-1 from his LLC with Schedule K-1, Box 17, Code V Shareholder’s Section 199A Information:

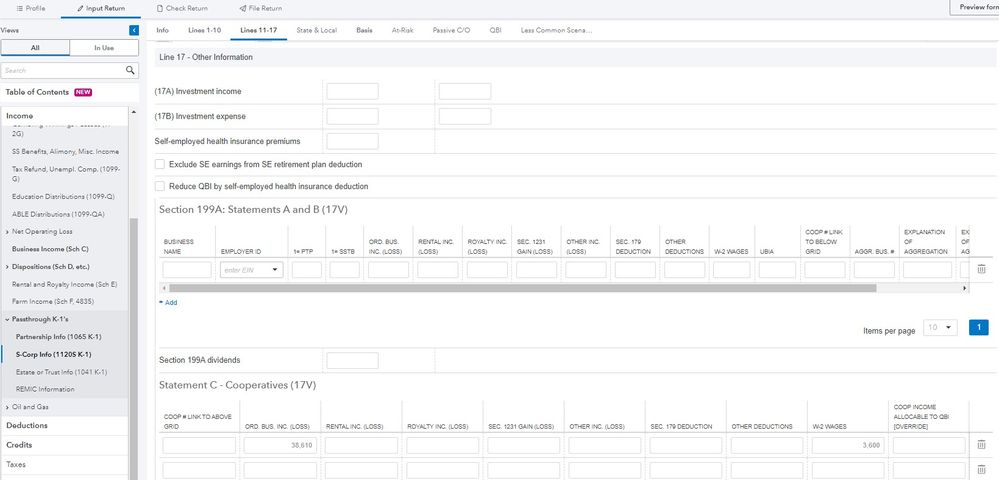

- Ordinary business income (loss) = 38,610

- W-2 wages = 3,600

I should have entered this under Income by selecting Passthrough K-1’s > S-Corp Info (1120S K-1) > Lines 11-17 and scrolling down to Line 17 - Other Information and filling in the Section 199A: Statements A and B (17V) grid with the information provided on the K-1. Had I input the information correctly, the Ordinary business income = 38,610 would have flowed to Form 8995 as Qualified business income or (loss) = 38,610 that combined with the taxpayer’s Qualified business or (loss) = -(1,800) from his Schedule C Business, and ProConnect would have calculated a Qualified business income deduction = 7,362 on Form 8995.

However, I scrolled down too far and filled in the Statement C - Cooperatives (17V) grid with the information provided on the K-1. The Ordinary business income (loss) = 38,610 did not flow to Form 8995. The taxpayer only had Qualified business or (loss) = -(1,800) from his Schedule C Business on Form 8995, and ProConnect calculated a Qualified business income deduction = 0 and a Qualified business (loss) carryforward = -(1,800) on Form 8995.

By making this unintentional mistake, the taxpayer had a balance due of $12,565 on his 2021 Federal Individual Income Tax return file electronically with the Internal Revenue Service on April 12, 2022. Had I input all of the information correctly, the taxpayer would have had a balance due of $10,919 on his 2021 Federal Individual Income Tax return. Also, the taxpayer would not have a Qualified business net (loss) carryforward from the prior year = -(1,800) that reduces his calculated Qualified business income deduction on his 2022 Form 8995.

I know I need to amend the taxpayer’s 2021 Federal Individual Income Tax return. I am pondering the proper explanation and steps to take.

- What should I put for reason for amending my tax return?

- incorrectly reported income?

- incorrectly claimed Qualified business income deduction?

- or something else?

- I have already created a 2022 1040-Individual tax return and transferred return data from year 2021 return that was electronically filed on April 12, 2022 and have input all the taxpayer’s income and expenses for the tax year 2022. Can I complete that 2022 Individual tax return first by manually overriding the Qualified business net (loss) carryforward from the prior year = -(1,800) under Income by selecting Net Operating Loss > Federal Net Operating Loss > Current Year NOL / Misc, and scrolling down to Qualified Business Loss Carryovers and deleting the 1,800 in the Qualified business loss carryover field?

- Do I first need to amend the 2021 1040-Individual tax return and electronically file it and then create a new 2022 1040-Individual tax return and transfer return data from the year 2021 Amended 1040-Individual tax return?

This is a screenshot of 2021 1120S K-1 Box 17 Code V information input correctly

This is a screenshot of 2021 1120S K-1 Box 17 Code V information not input correctly

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Can anyone answer my questions in this post?

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

"Keep it short and simple. Something like:

Qualified Business Income Deduction calculation omitted K-1 income. Form 8995 attached."

Should I attach the Schedule K-1, too?

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

"Keep it short and simple. Something like:

Qualified Business Income Deduction calculation omitted K-1 income. Form 8995 attached."

Should I attach the Schedule K-1, too?