- Topics

- Training

- Community

- Product Help

- Industry Discussions

- User Groups

- Discover

- Resources

- Intuit Accountants Community

- :

- ProConnect Tax

- :

- ProConnect Tax Discussions

- :

- Re: Information transmitted to the IRS

Information transmitted to the IRS

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Printer Friendly Page

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

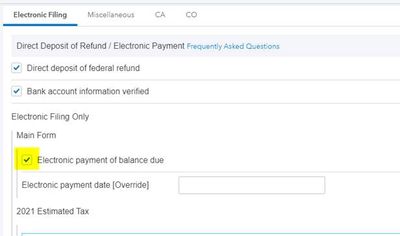

After client e-Signed the return, I caught the electronic payment option was not checked. As that is what client requested, I checked the box and e-filed the return, defaulting payment day is 5/17/21. I believe the electronic payment election was transmitted to the IRS, but how do I make sure of that?

Client told me they did not see a payment went out of their bank today. How many days does the payment clear the bank, and how do I verify whether this payment election was truly transmitted to the IRS?

Best Answer Click here

![]() This discussion has been locked.

No new contributions can be made. You may start a new discussion

here

This discussion has been locked.

No new contributions can be made. You may start a new discussion

here

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

With the return open in-program, you will want to go to the Check Return tab, from there clicking on Forms on the left-hand navigation bar, selecting US to get a view of your forms. It is in this list that you would see the E-file Payment Record.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Thanks for reaching out!

We'd suggest confirming that the E-file Payment Record was generated. You can check this in-program.

If so, the client's payment information was sent with the return to the federal agency. The IRS can take a few days to process payments.

Here's hoping that helps!

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Where should I go to check the e-File Payment Record was generated?

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

With the return open in-program, you will want to go to the Check Return tab, from there clicking on Forms on the left-hand navigation bar, selecting US to get a view of your forms. It is in this list that you would see the E-file Payment Record.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Ah I see it! Thank you so much for helping and I know I'll use this function a lot going forward! Much appreciated! \(^0^)/