- Topics

- Training

- Community

- Product Help

- Industry Discussions

- User Groups

- Discover

- Resources

- Intuit Accountants Community

- :

- ProConnect Tax

- :

- ProConnect Tax Discussions

- :

- Is anyone getting this Error Message: Form 2441, each "Identifying Number" provided must not be the same as the 'DependentSSN' in the return. Code: F2441-024 Any ideas?

Is anyone getting this Error Message: Form 2441, each "Identifying Number" provided must not be the same as the 'DependentSSN' in the return. Code: F2441-024 Any ideas?

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Printer Friendly Page

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Did you omit to tell us the line number that should be in the diagnostic?

My hunch is that you have created two separate entries on Line 2 for the same dependent with the same SSN, trying to match each line with a different provider on Line 1, when you only need to have one single line for the dependent by aggregating the qualified expenses.

FWIW, the Rule-Number you cited is not among those published by the IRS: https://www.irs.gov/pub/irs-utl/f2441_br.pdf

Hoping to get some extra credits from this answer for my Friday mind reading class so that I don't flunk the semester...

Still an AllStar

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

This is the error message and solution but identification number of provider is not the spouse or a dependent. Line 1 e has one entry and line 2 c has one entry. One provider and one dependent with child care expenses.

Error Message: Form 2441, each "Identifying Number" provided must not be the same as the 'DependentSSN' in the return.

Solution: Please review your Form 2441 input and ensure that the identifying number of the provider is not that of the spouse.

Code: F2441-024

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

The error description does not quite match the suggested solution.

The error clearly refers to the dependent's SSN. But the suggested solution refers to the provider's SSN being the same as the spouse's (which should trigger F2441-001 instead).

Haven't seen this happen.

In this case, I'd suggest deleting the provider from F.2441 and creating a new entry for the provider. If that still doesn't eliminate the error, I'd do the same with the qualified dependent.

@IntuitRebecca Would you be able to shed some light on this strange error as well as the apparent inconsistency between the error message and suggested solution? As mentioned in my earlier post, this is not among the rules that are published by the IRS. Thanks!

Still an AllStar

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

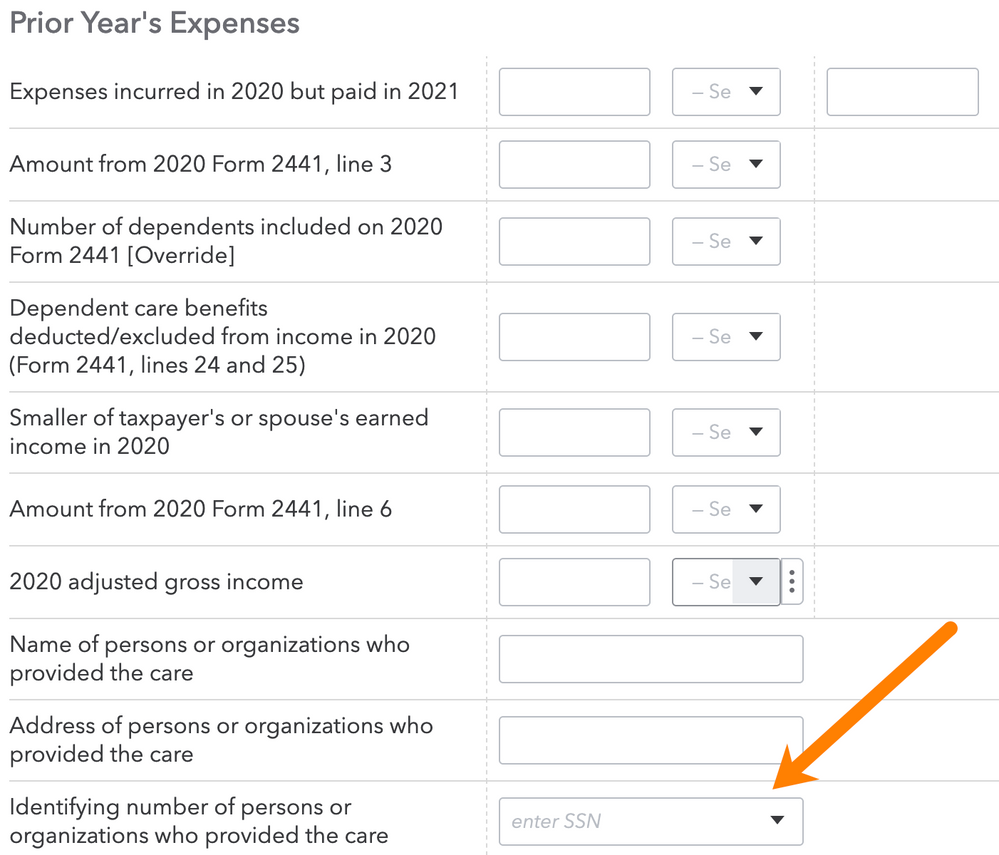

Hmm, I can't say that I've seen this rejection before. Other than what you've already reviewed, could you check if there's an entry for prior year expenses?

On the Dependent Care Credit (2441) > Children, Dependents screen, click the General Information link in blue at the top right.

Do you have an SSN entered here that matches any on the return (taxpayer, spouse, or dependent)?