Welcome back! Ask questions, get answers, and join our large community of tax professionals.

- Topics

- Training

- Community

- Product Help

- Industry Discussions

- User Groups

- Discover

- Resources

Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

- Intuit Accountants Community

- :

- ProConnect Tax

- :

- ProConnect Tax Discussions

- :

- How do you E-File without paying the taxes due? (without form 9465). Client applied for payment plan online, and website says to not file form 9465 if you applied online.

How do you E-File without paying the taxes due? (without form 9465). Client applied for payment plan online, and website says to not file form 9465 if you applied online.

Options

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Printer Friendly Page

waynefinancials

Level 1

03-29-2023

10:38 PM

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Like the title says, looking for a way that I can E-file without paying the clients tax liability. Client applied for payment plan online, and IRS website states to not file form 9465 if you are applying online. Is there another way to E-file without paying the amount that is owed?

Thank you in advance

Thank you in advance

Labels

5 Comments 5

Level 11

03-30-2023

08:57 AM

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

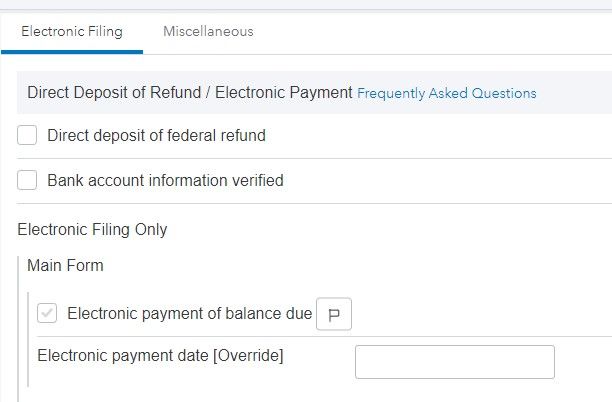

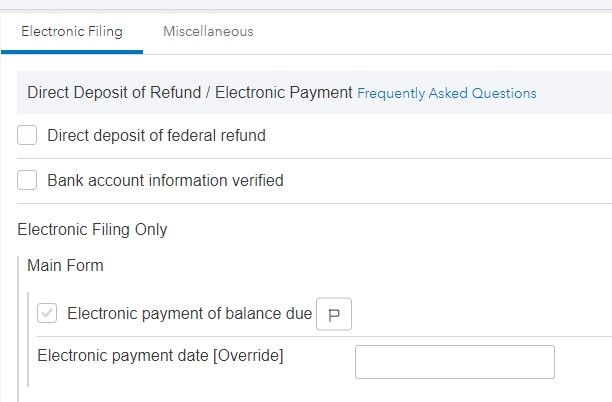

Either uncheck the box for direct debit or enter a -1 in the 1040-V field.

George4Tacks

Level 15

03-30-2023

09:08 AM

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

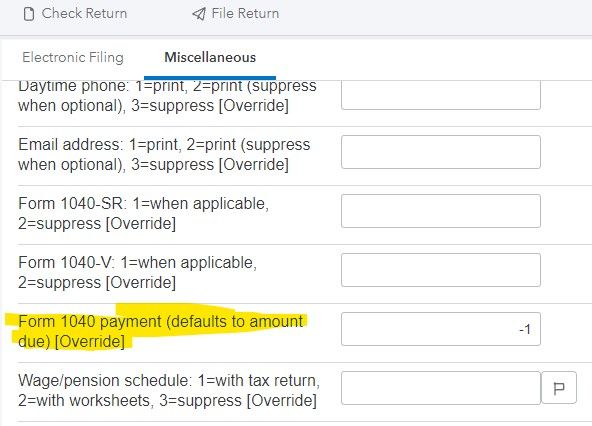

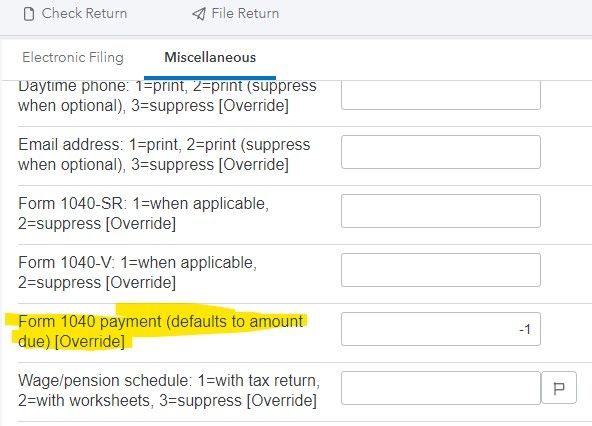

Misc. Info./Direct Deposit > Scroll down to Form 1040-V and then one more to Form 1040 payment AND ENTER -1 (-1 means zero)

Here's wishing you many Happy Returns

waynefinancials

Level 1

03-30-2023

09:04 PM

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Thank you for your response. Are these the locations that you are talking about? I have tried looking for the areas that you described but I am still unable to figure it out.

waynefinancials

Level 1

03-30-2023

09:06 PM

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Thank you for the response. I am unable to find these locations. Are these the areas that you are talking about? I have deselected the electronic payment, and I also entered the -1 for 1040 payments

George4Tacks

Level 15

03-31-2023

09:03 AM

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

That looks right. Check out the client letter. "no tax is payable with the filing of this return"

Here's wishing you many Happy Returns