Welcome back! Ask questions, get answers, and join our large community of tax professionals.

- Topics

- Training

- Community

- Product Help

- Industry Discussions

- User Groups

- Discover

- Resources

Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

- Intuit Accountants Community

- :

- ProConnect Tax

- :

- ProConnect Tax Discussions

- :

- How do I enter a 1099-R IRA distribution amount as a Part Year California resident and Part Year Arizona resident?

How do I enter a 1099-R IRA distribution amount as a Part Year California resident and Part Year Arizona resident?

Options

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Printer Friendly Page

tigerman99515

Level 1

04-06-2023

01:13 PM

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

There was some CA withholding in addition to Federal WH. No withholding from AZ. Just the one 1099-R with CA information only in the state portion of the 1099-R.

Labels

2 Comments 2

George4Tacks

Level 15

04-07-2023

10:18 AM

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

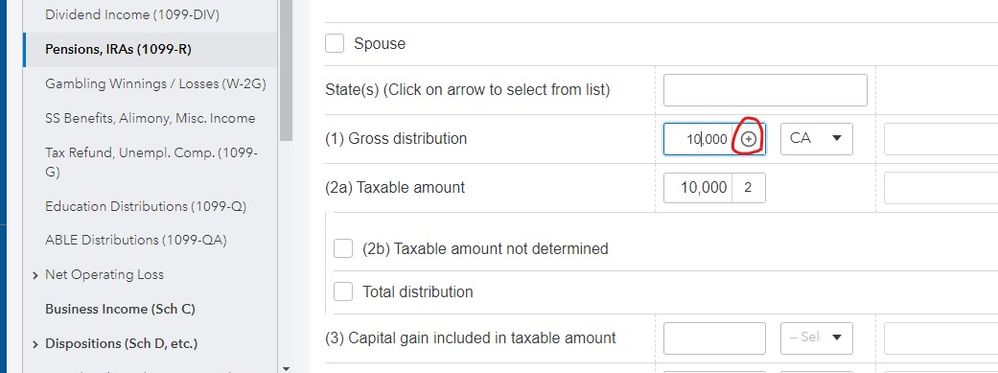

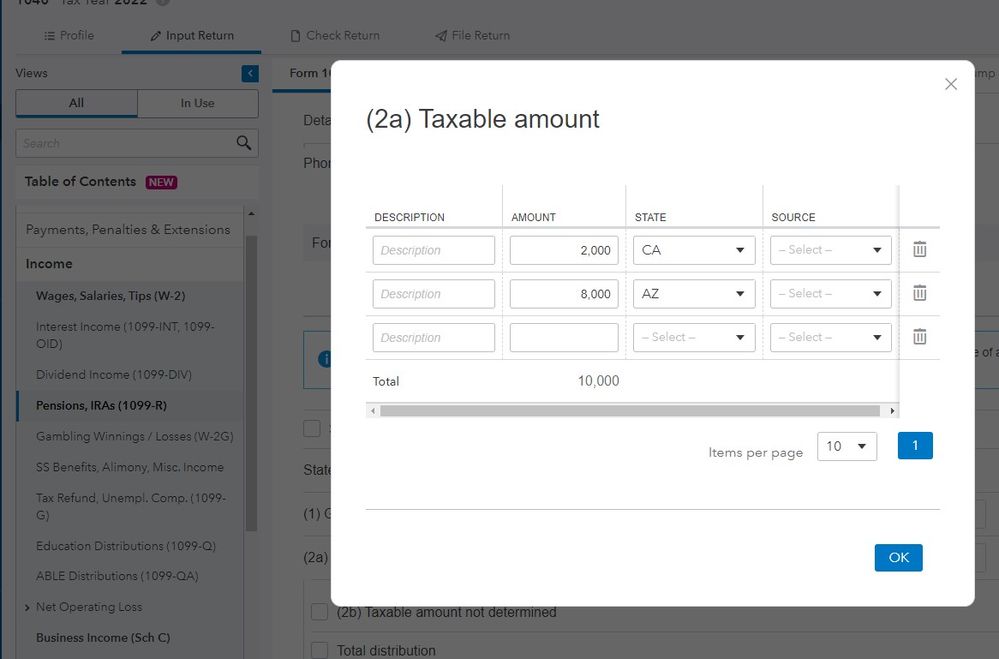

Do details and click the + or the 3 verticle dots at the taxable amount and the gross

Then you can get a grid like this to split between the states

This article may help

Here's wishing you many Happy Returns

itonewbie

Level 15

04-07-2023

09:07 PM

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Was the distribution made entirely during CA residency? If so, it shouldn't be taxable to AZ.

---------------------------------------------------------------------------------

Still an AllStar

Still an AllStar