- Topics

- Training

- Community

- Product Help

- Industry Discussions

- User Groups

- Discover

- Resources

- Intuit Accountants Community

- :

- ProConnect Tax

- :

- ProConnect Tax Discussions

- :

- Client moved from CT to GA on 11/15/22. All W2 income from CT was earned while resident of CT. All W2 from GA earned in GA. CT form includes all Fed income - why??

Client moved from CT to GA on 11/15/22. All W2 income from CT was earned while resident of CT. All W2 from GA earned in GA. CT form includes all Fed income - why??

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Printer Friendly Page

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Best Answer Click here

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

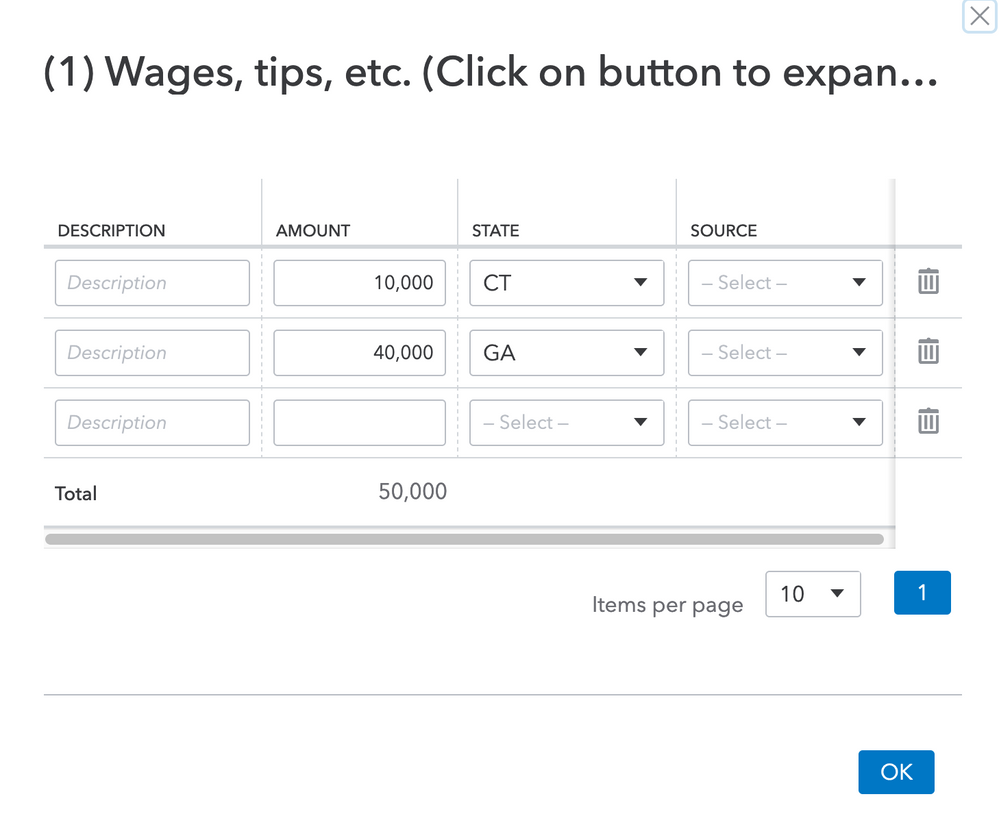

Gotcha, I was using the W-2 input screen to source the amounts like this:

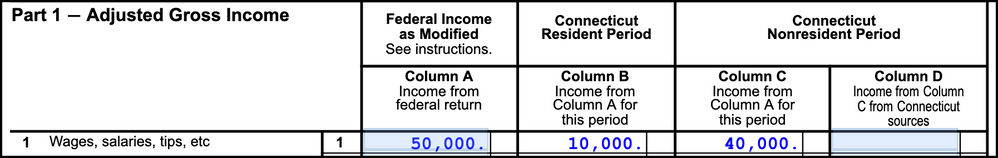

Which produces this result on my CT-1040AW:

Do you have similar selections for the state identifiers on Income > Wages, Salaries, Tips (W-2)? For box 1, in particular.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

These are the entries needed to generate the CT SI:

- on Client Information, make sure Resident State as of 12/31 is GA

- Full Year Resident un-checked

- Multi-State Return checked

- on CT Part-Year/Nonres Info, make sure Date moved out of Connecticut is entered, and State of new residence is selected.

- on GA Part-Year/Nonres Info, make sure both a Part-year resident from and Part-year resident to date are entered. In this case the "to" would be 12/31.

Getting the CT-SI generated should also trigger the CT-1040AW where you can see the PY income allocation.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Thank you. All information has been entered as you said. On the GA part year, it's very clear - you actually enter the income earned in GA. There is no such field on the CT part year form. I am getting the CT 1040-AW but it's wrong.

Column A - Fed AGI - this is correctly populated with the Fed AGI

Column B (CT Resident Period) - this should be the CT income but it is blank

Column C (CT NonResident)- this is blank - should not this be the GA income?

Column D - CT source income during non resident period - this is correctly blank

The CT 1040NR is still showing the full Fed AGI instead of the CT portion.

What now?

Thanks!

Mare

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Gotcha, I was using the W-2 input screen to source the amounts like this:

Which produces this result on my CT-1040AW:

Do you have similar selections for the state identifiers on Income > Wages, Salaries, Tips (W-2)? For box 1, in particular.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Thanks! That was it - all good now! Much appreciated!!

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Hello I have a return where client moved from SC to OH on 8/3/2023. All the W2 income is going to the OH return and not allocating it to the SC and OH return. I split out the amounts on the W2 input to include the proper totals for each state. I also broke out the amounts withheld for each state under the State withheld section. However the OH return continues to pull the entire Federal amount on the return. Help!