- Topics

- Training

- Community

- Product Help

- Industry Discussions

- User Groups

- Discover

- Resources

- Intuit Accountants Community

- :

- Lacerte Tax

- :

- Lacerte Tax Discussions

- :

- Massachusetts Child and Family Tax Credit for Disabled Spouses (Form 1, Line 46)

Massachusetts Child and Family Tax Credit for Disabled Spouses (Form 1, Line 46)

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Printer Friendly Page

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Massachusetts allows a tax credit ($310) for disabled spouses as part of the Child and Family Tax Credit. To claim the credit, the disabled spouse (though not actually a dependent for tax purposes), should first be listed on Schedule D1 which then flows to line 46 of the Massachusetts Form 1 where the credit is claimed. Presently, there is no way to claim this credit in Lacerte without listing the disabled spouse as a dependent on the return. Since the disabled spouse is already listed on the return as one of the taxpayers, they cannot also be listed as a dependent. So Lacerte needs to develop a workaround to enable this credit to be claimed for disabled spouses without listing them as a dependent on the return. I have a number of taxpayers who qualify for this credit and I imagine there are many other MA based tax professionals with this same issue. I am hopeful for a fix sooner than later since the returns cannot be filed until it is.

Note: The above was originally posted 3 weeks ago. Since then I have called Lacerte twice to try to resolve.

I am very disappointed in the process that Lacerte has for addressing programming omissions. I have called Lacerte 3 times to make head way in getting this issue resolved or to check in on whether it is being addressed and each time was left hanging with the suggestion to post the issue to this suggestion board. I have asked to speak to a supervisor or a person who can find out if this issue is being addressed but am told that they cannot do that without some sort of permission which doesn't come. The first two times I called the call the agent did not leave any call notes so I have had to repeatedly explain the issue which until it gets fixed does not allow me to file a MA return and claim this credit for a disabled spouse. Pro Series, also owned by Intuit, has the programming to allow the proper computation of this credit for a disabled spouse. Lacerte, which is way more pricier than Pro Series does not and provides no effective way to give the feedback to get it resolved.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

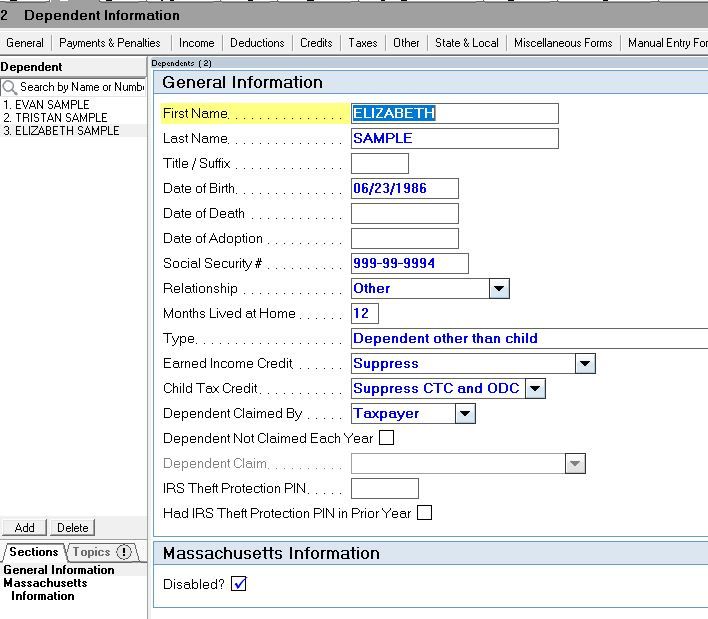

I just tried this in a dummy return. Here's a screenshot of my data entry on screen 2. This matches the spouse info on Screen 1. I have it calculating the $310 credit for her. Maybe tweaking one of the inputs is what's needed.

I do see a critical diagnostic, but 1) you might be able to suppress that in efile, or 2) duplicate the return and efile fed separate from Mass, or 3) just print it and paper file it.

Get a client onboard to try the troubleshooting of suppressing the critical diagnostic. Let us know if that works. Good luck!

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Thanks, Karl. I appreciate you took the time to investigate a solution. Although setting up the spouse as a dependent works for getting the credit to calculate, it also throws the MA tax liability off by claiming a $1,000 dependent exemption deduction on the MA return. Hopefully, Lacerte will either fix this, provide a workaround (other than paper filing and whiteout) or at least communicate that it is a known issue that they are addressing.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

I'm sorry that didn't work. I tried a few other ways and couldn't find a workaround.

Keep in mind that this is a peer user forum, so Lacerte/Support/Tech team is not reading this. If you want an enhancement request, post in the "Tax Idea Exchange" section.

Link that post here to this thread in a reply comment. I'll go upvote it, and I'm sure others will also. Crowdsource more votes from your peers that use Lacerte. Make a post in the FB group "Lacerte Rescuers!"

I would also ask your local peers in MA that use Lacerte (maybe your state society of CPAs/EAs) how they handle this. You can't be the first one experiencing this, and I wouldn't imagine all of them just abandoned Lacerte, or Lacerte would have (likely) fixed this by now. But also, I realize there's a further subset of MA tax pros who have a client where at least one taxpayer is disabled, and that's probably rather small.

As I'm sure you know with Support, it all depends on the agent you get. Be very polite, but focused on what you want/need if you decide to try and call again. "I'm calling to report a glitch in the Massachusetts programming. Can we set up a Glance session so I can demo this for you?" If you can get them to see that there's no way to get a split between page 1 and page 4 on MA Schedule 1 as far as dependents from Screen 2, you might have success.

Being practical, even if you get a promised fix, this won't happen before 4/15. Plan to extend these returns.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Hi I happen to be an Lacerte email support agent and this issue was reported on yesterday through our email support channel. I apologize for the issues you have experienced trying to convey this over the phone. I am currently in the process of submitting it to get an input added in the software. I will come back to this thread and post the solution for you once it is completed. For future reference you can also always submit directly to our email support for issues like this by going to Tools-->Communications--->Service Requests in the software and when possible include a client file so we can see exactly what you are looking for. Have a great day!

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

You are very welcome!

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Karl, Thanks again for taking the time to look into this issue and for your suggestions on how to move forward in getting it resolved. A representative from Lacerte just posted that they will be forwarding it to the appropriate party to have the issue looked at and resolved. I feel relieved now that I know it is being looked into. I hope the rest of your tax season goes well. Eric

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

I just discovered the same issue this week for one of my clients. I spent over 3 hours on two different phone calls that I found to be EXTREMELY frustrating. The level of help that I received was HORRIBLE. The agent new nothing and kept on having to put me on hold to talk to someone which they do all the time now and you have to hold each time 5 to 10 minutes. I was told to make the taxpayer a dependent from the "Tax Expert" SERISOULY!!!!

The issue with Lacerte is they now outsource the support instead of in house. The people that they outsourced it too are HORRIBLE with little knowledge of tax law and limited knowledge of the tax program.

They also use to have a number to the office of the President which you could reach out too and the situation would get escalated to someone that was higher up. They have now closed that office. If you call customer service, there is no one that you can talk to.

Obviously Lacerte has little care or concern for the tax professional that pay a lot of $$$ to use their program.

Year ago, I looked into Ultra Tax which was and is a fraction of the price, and their REP Access is about half of Lacerte. I regret not making the change...now I'm close to retirement and wouldn't make sense.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Pro Connect also does not allow it. I put the spouse in as a dependent with a fake social security number then efiled the Mass return with the credit on it. Then I went back to the federal and removed the dependent then efiled the federal return. I think it worked but I forgot that is what I did. Sucks having to do that. Intuit needs help!!!!!!!!!!!

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Hi Carmine,

I thought about that approach but making the spouse a dependent resulted in a $1,000 dependent exemption deduction in addition to the $310 Child and Family tax credit. This resulted in a refund that was $50 higher than it should have been ($1,000 x 5%). I have given up hope that Lacerte will address this before the filing due date despite being given notice of the issue and ample time to make the fix. I imagine that I will put the affected clients on extension until Lacerte finally gets around to making the fix (hopefully sooner than later). Good luck with the rest of your filing season.

Eric

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

I agree this is very frustrating and, in my opinion, Lacerte has done a poor job in setting up an efficient system for practitioners to report program glitches that Lacerte needs to timely address for us to file complete and accurate returns for our clients. I feel Lacerte has left us hanging with no idea if this issue is even being addressed and, if so, when. So I am left with either putting the affected clients on extension or filing the returns and having to amend later neither of which I want to do. Good luck with the rest of your filing season.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Hi Kallana,

Do you know (or is there a way to find out) where Lacerte stands in fixing this issue?

Thanks, Eric

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

The last update was a couple of weeks ago and it said by 04/18....seriously...the day after tax season ends grrrrrrrrr.

One of my CPA friends gave me the address to the president's office though haven 't tries to see if it actually works.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

I think "grrrrrrr" sums up the situation pretty well. I saw the "4/18" post you mentioned and had a similar reaction "seriously, the day after tax season ends".

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Hi, I apologize for the delayed response. We do not anticipate this being resolved before deadline, but is in the process of being fixed. Our recommendation would be to either extend or paper file.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Thank you for following up. I feel glad to know that the issue is being addressed and that there will eventually be a fix. I have opted to file the affected returns without the credit and then will amend them when the issue has been resolved.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

I think I may have cheated the governor out of $50. Let them catch it.