- Topics

- Training

- Community

- Product Help

- Industry Discussions

- User Groups

- Discover

- Resources

- Intuit Accountants Community

- :

- Lacerte Tax

- :

- Lacerte Tax Discussions

- :

- Exporting K-1 SE medical Insurance and CA PTE in 2022 module

Exporting K-1 SE medical Insurance and CA PTE in 2022 module

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Printer Friendly Page

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

August 18, 2023

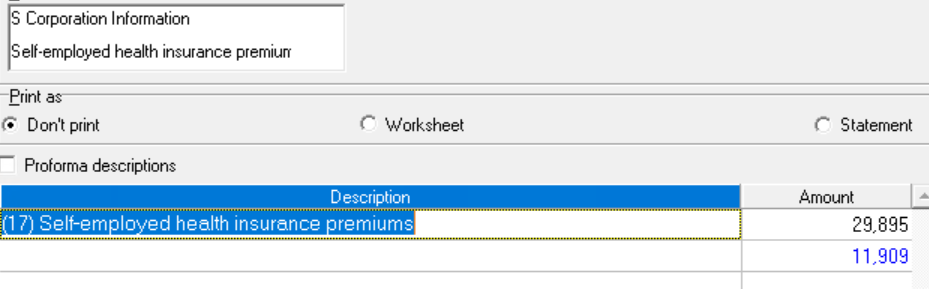

There are ghost amounts that carry over to the 1040 from the S Corp K-1 Transfer. One is shown in the image. Even though it appears in blue I did not input the 11,909. I can't prove it but I have a strong feeling based on the second issue described below

This is the second case. Entries in the supporting detail for Screen 48, Code 104 will come over to the 1040 in the K-1 Transfer process. I verified this transfer error and I deleted the improper detail from the 1040.

Tax preparers please be aware.

@IntuitGabi Would you try to forward my comment to the software people? These are serious flaws.

Solved! Go to Solution.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

@Strongsilence-CPA With a situation like this one, it would be best reviewed by contacting our support experts to be able to troubleshoot the issue in order to determine the source in order to be ale to report the behavior to our tax developers.

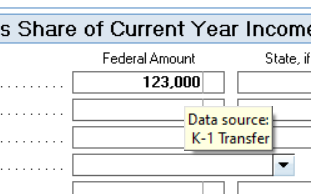

Also, you should be able to tell if an amount came from a K-1 transfer by hovering over the amounts with your mouse. If it was transferred, it will show this:

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

@Strongsilence-CPA With a situation like this one, it would be best reviewed by contacting our support experts to be able to troubleshoot the issue in order to determine the source in order to be ale to report the behavior to our tax developers.

Also, you should be able to tell if an amount came from a K-1 transfer by hovering over the amounts with your mouse. If it was transferred, it will show this:

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Thank you.