- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

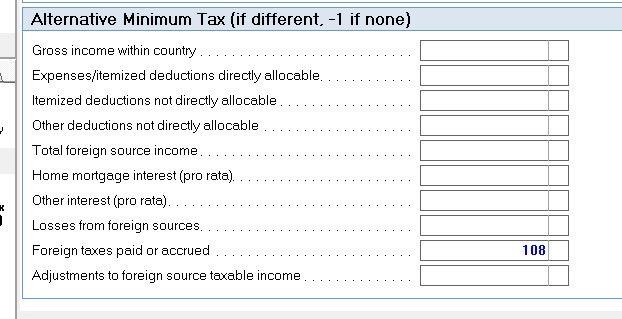

K-1 AMT foreign taxes. Where is the input? I don't see a Line 12 code for amt foreign taxes in screen 20.3. When I use the section in the snip attached (from 35.1), the amt foreign taxes are presented on the 1116 - that is great - but also with the regular foreign taxes paid. The client isn't in amt and the only reason I'm doing this is avoid a question from the client.

client.

Best Answer Click here

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

On a 1040, the AMT vs regular tax difference for FTC has to do with the limitations calculated on the 1116. The gross foreign taxes paid is identical for both, so no special input is required.

I wish there were an input field for foreign-source qualified dividends on the K-1 entry screen. I end up doing a side calculation to be sure I get the right presentation and output.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

On a 1040, the AMT vs regular tax difference for FTC has to do with the limitations calculated on the 1116. The gross foreign taxes paid is identical for both, so no special input is required.

I wish there were an input field for foreign-source qualified dividends on the K-1 entry screen. I end up doing a side calculation to be sure I get the right presentation and output.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Also, if this is from one of those "fund of funds" K-1, the K-1 presentation is strictly garbage in, garbage out. The same thing that gives you 988 loss spread across 3 different boxes, or 15 non-identical entries for various flavors of depletion so you get to guess which ones need to be added and which ones are already included in another total.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

"On a 1040, the AMT vs regular tax difference for FTC has to do with the limitations calculated on the 1116. The gross foreign taxes paid is identical for both, so no special input is required."

That doesn't sound right. Per 6251 instructions:

Line 8—Alternative Minimum Tax Foreign Tax Credit (AMTFTC)

The AMTFTC is a credit that you can claim against the AMT. You will figure the AMTFTC using the same limitation rules that apply to the foreign tax credit for regular tax purposes, but with AMT amounts. However, you may be able to simplify your AMTFTC calculation by electing to use some of the same amounts you used to figure your foreign tax credit.

So you are right! thank you, Phoebe!

What is the purpose of the passthrough entity, a trust in my case, listing the AMT FTC in a footnote?

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Screen 35.1 has a field for Qualified Div Adjustment.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Might be relevant to a C-corp? I don't have any entities that do a Form 1118, so that's something I've never tried to cram into my brain.

Alternatively, someone asked for the information once, and it's easier to footnote it forever after.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Regarding the qualified dividend adjustment, that's for the adjustment amount, not the QDiv amount. When you enter the QDivs in the FTC section of the Dividend screen, Lacerte calculates the adjustment automatically.

Most of my clients are either "qualifies for the adjustment exception" or "54.05% is the right adjusted amount," but it's sure nice when I can see what number Lacerte comes up with and compare it to my spreadsheet, rather than relying on my spreadsheet to catch an edge case.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

That is what I've used as a workaround. It was a lot tidier before the IRS wanted all the countries broken out separately. With a lot of investment accounts, a lot of K-1s, and a lot of countries, it just takes a long time to get the presentation right.