- Topics

- Training

- Community

- Product Help

- Industry Discussions

- User Groups

- Discover

- Resources

- Intuit Accountants Community

- :

- Intuit Tax Advisor

- :

- Intuit Tax Advisor Discussions

- :

- How to review potential strategies and savings

How to review potential strategies and savings

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Printer Friendly Page

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

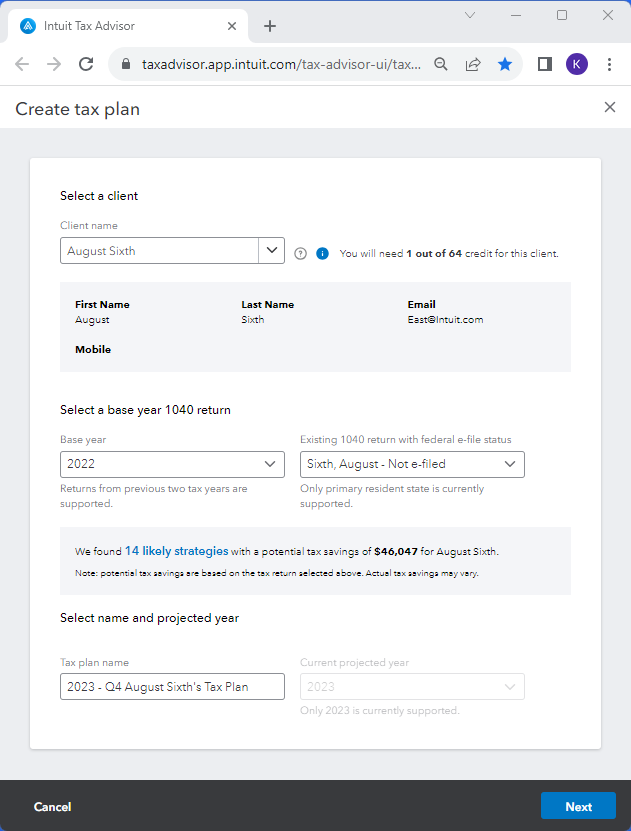

Intuit Tax Advisor is designed to create custom tax plans in minutes. Show your clients valuable savings by using tax strategies automatically generated from your ProConnect Tax or Lacerte returns.

When creating a plan, the program will identify if there are any potential savings before using a credit. The potential savings may help determine if the client is a good fit for a tax plan.

Before using a credit you can review potential savings before creating a plan. Here's how:

- Select "Create tax plan"

- Think of business owners, clients with one state, or individuals that have multiple streams of income.

- To find a client, search client's "First Name". Select their name & existing 1040 return.

- In the second grey box, Review # of likely strategies (see screenshot below)

- Review $ amount of potential savings (see screenshot below)

- Press Next to use 1 credit for 1 client; credits are used per client, not per plan

How many potential clients did you identify and what are you looking for when identifying advisory clients? Start a conversation by selecting Reply on this thread below.

After selecting Create tax plan, you'll be able to select a client and review # likely strategies and $ potential savings in the second grey box pictured above.

No credits will be used until you select Next at the bottom of the screen.

Did you discover a tax plan for your client? Share your feedback by selecting Reply on this thread below.

_________________________________________________________________

Try out Tax Advisor: get 3 free client credits