Welcome back! Ask questions, get answers, and join our large community of tax professionals.

- Topics

- Training

- Community

- Product Help

- Industry Discussions

- User Groups

- Discover

- Resources

- Intuit Accountants Community

- :

- Discover

- :

- Events

- :

- Webinar: Pass-Through Entities in ProConnect Tax

Webinar: Pass-Through Entities in ProConnect Tax

Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

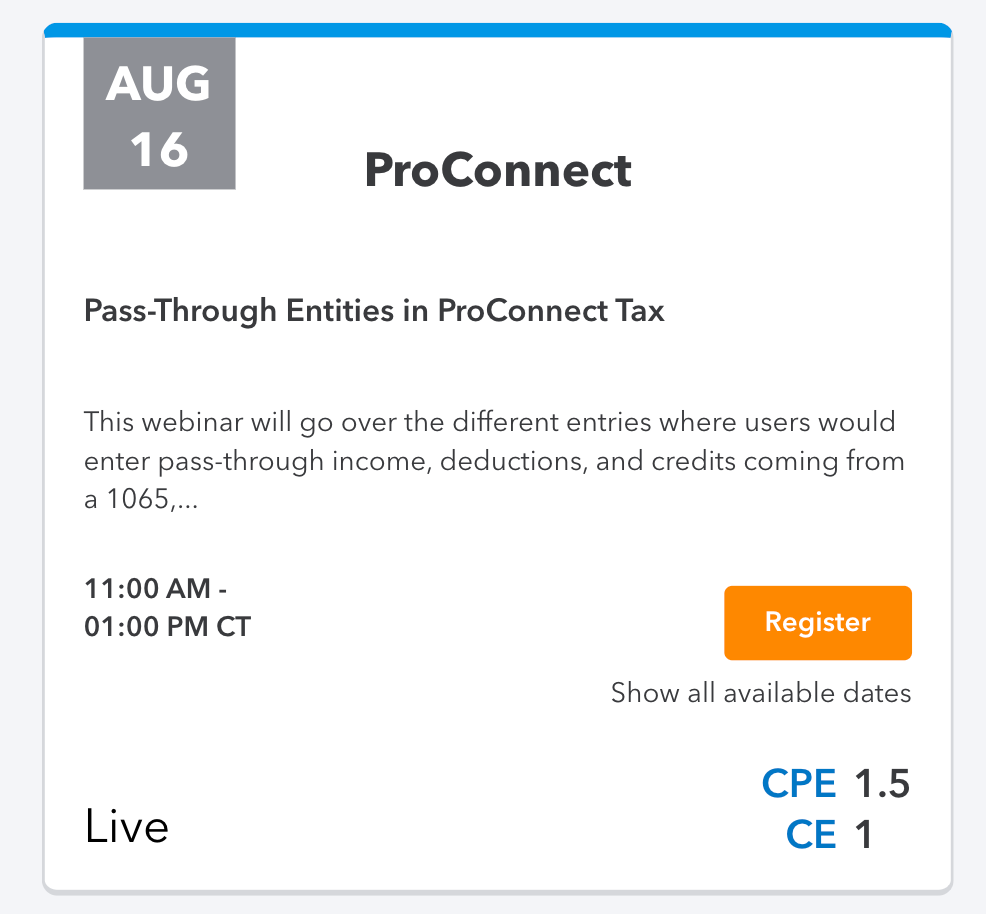

Webinar: Pass-Through Entities in ProConnect Tax

Options

- Subscribe

- Mark as read

- Mark as new

Our speaker for this event is Susan Tinel!

Susan Tinel, EA, heads up April 15 Taxes, Inc., a full-service, cloud-based firm offering services in tax, accounting and entity filings. Based in San Diego, Calif. – and armed with her Blackberry – she works with more than 150 clients across the country, in Canada and the United Kingdom, 75 percent of which are small businesses. Susan is a QuickBooks ProAdvisor® and certified in QuickBooks® Online Advanced; she also uses Intuit® ProConnect™ Tax Online, Intuit Link, QuickBooks Online Accountant and Intuit Online Payroll.

Follow Susan on Twitter @April15Taxes.

Register today by clicking on this link!

Description:

This webinar will go over the different entries where users would enter pass-through income, deductions, and credits coming from a 1065, 1120-S or 1041.

This session will provide attendees with an understanding and confidence in preparing Partnership, S Corporation, and 1041 returns. The topics explored will examine basic income, deductions, and credits as well as how to enter and allocate information pertaining to partners and shareholders. Discussion around mandatory input, input required to generate relevant supporting forms or schedules as well as the electronic filing process will be central to this session.

LEARNING OBJECTIVES:

This webinar will go over the different entries where users would enter pass-through income, deductions, and credits coming from a 1065, 1120-S or 1041.

This session will provide attendees with an understanding and confidence in preparing Partnership, S Corporation, and 1041 returns. The topics explored will examine basic income, deductions, and credits as well as how to enter and allocate information pertaining to partners and shareholders. Discussion around mandatory input, input required to generate relevant supporting forms or schedules as well as the electronic filing process will be central to this session.

LEARNING OBJECTIVES:

By completing this webinar, you will be able to:

Input Partnership and Partner information

Locate input for Partnership Income, Deductions, and Credits

Recognize Direct and Automatic Input on the 1065 Balance Sheet, M-1, M-2 and M-3

Understand Partner Percentage and Change in Ownership

Utilize Special Allocation

Enter S Corporation and Officer Information

Find Input for S Corporation Income, Deductions, and Credits

Recognize Direct and Automatic Input on the 1120-S Balance Sheet, M-1, M-2

and M-3

Complete S Corporate Shareholder Information

Enter Basic Input and Beneficiary Distributions for a Fiduciary (Form 1041)

Produce Grantor Trusts and Split-Interest Trusts (1041)

WHO SHOULD ATTEND?

Tax Professionals who would like to learn how ProConnect Tax handles the pass-through income from the Partnership, S Corporate and Fiduciary tax modules.

Course Level: Intermediate

Course Length: 120 Minutes

Prerequisites: Preparing a Simple 1040 in ProConnect Tax

Delivery Method: Group-Live Internet

Field of Study: Taxes - Technical

Recommended CPE: 2

Recommended CE: 2

IRS Course Category: Federal Tax Law Topics/Federal Tax Related Matters

Online: NESGF-T-00094-19-O

In Person: NESGF-T-00094-19-I

Input Partnership and Partner information

Locate input for Partnership Income, Deductions, and Credits

Recognize Direct and Automatic Input on the 1065 Balance Sheet, M-1, M-2 and M-3

Understand Partner Percentage and Change in Ownership

Utilize Special Allocation

Enter S Corporation and Officer Information

Find Input for S Corporation Income, Deductions, and Credits

Recognize Direct and Automatic Input on the 1120-S Balance Sheet, M-1, M-2

and M-3

Complete S Corporate Shareholder Information

Enter Basic Input and Beneficiary Distributions for a Fiduciary (Form 1041)

Produce Grantor Trusts and Split-Interest Trusts (1041)

WHO SHOULD ATTEND?

Tax Professionals who would like to learn how ProConnect Tax handles the pass-through income from the Partnership, S Corporate and Fiduciary tax modules.

Course Level: Intermediate

Course Length: 120 Minutes

Prerequisites: Preparing a Simple 1040 in ProConnect Tax

Delivery Method: Group-Live Internet

Field of Study: Taxes - Technical

Recommended CPE: 2

Recommended CE: 2

IRS Course Category: Federal Tax Law Topics/Federal Tax Related Matters

Online: NESGF-T-00094-19-O

In Person: NESGF-T-00094-19-I

Event has ended

You can no longer attend this event.

Start:

Tue, Aug 16, 2022 11:00 AM CDT

End:

Tue, Aug 16, 2022 01:00 PM CDT

0 Comments