Intuit Help

Intuit

12-05-2019

05:36 PM

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Help Articles

This article will show you how to enter W-2 wages and withholdings on multi-state returns in Intuit ProConnect.

Follow these steps to enter W-2 wages and withholdings on multi-state returns:

- Go to the Input Return tab.

- Select Income from the left menu > them Wages, Salaries, Tips (W-2).

- Enter the employer information.

- Scroll to the Wages section.

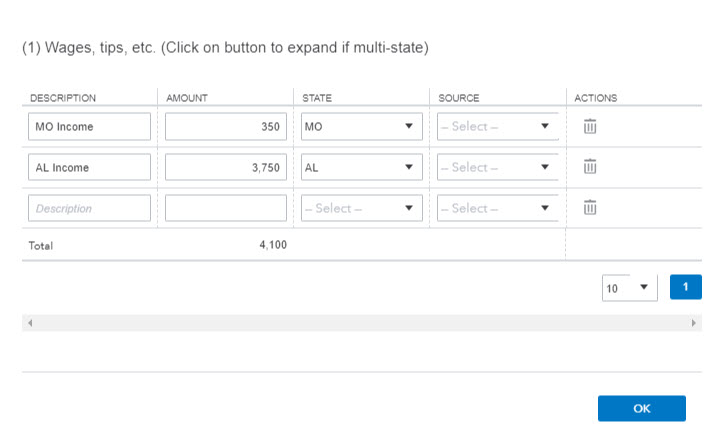

- Select the field (1) Wages, tips, etc. (Click on button to expand if multi-state).

- Select the + button to open the detail screen.

- Enter the income for each state.

- If the total multi-state wage amounts do not equal the federal wages, select S in the Source column to send an amount only to that state's return, without affecting the federal return or any other states.

- To report state withholding, scroll to the State and Local section, and select the field (17) State income tax withheld.

Related topics

Labels