This article will show you how to enter W-2 wages and withholdings on multi-state returns in ProConnect Tax.

These steps will also help solve Diagnostic ref. 20043, which reads as:

"Input has been made in the input field '(16) State wages, if different'. This input field should only be used when taxable state wages differ from the amount reported on the federal return due to law differences. For example, when a state does not allow wages to be decreased by 401(K) contributions. To allocate amounts earned from state sources only on a part-year or non-resident state tax return, check the 'Multi-state' box in client information, then input the state source amount in the input field '(1) Wages, tips, etc.' To report an amount on the non-resident state return, but not the federal return, enter 'State' in the source column. This diagnostic will not impact your ability to e-file the return."

Follow these steps to enter W-2 wages and withholdings on multi-state returns:

- Go to the Input Return tab.

- Select Income from the left menu > them Wages, Salaries, Tips (W-2).

- Enter the employer information.

- Scroll to the Wages section.

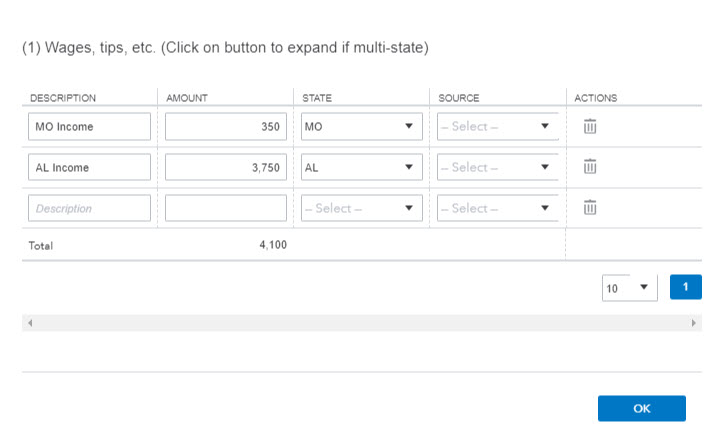

- Select the field (1) Wages, tips, etc. (Click on button to expand if multi-state).

- Select the + button to open the detail screen.

- Enter the income for each state.

- If the total multi-state wage amounts do not equal the federal wages, select S in the Source column to send an amount only to that state's return, without affecting the federal return or any other states.

- To report state withholding, scroll to the State and Local section, and select the field (17) State income tax withheld.

Allocating income to one or more states when the state amount exceeds the federal amount

- Go to the Input Return tab.

- Select Income from the left menu > then Wages, Salaries, Tips (W-2).

- Select the field (1) Wages, tips, etc. (Click on button to expand if multi-state).

- Select the + button to open the detail screen.

- Enter a Description (if applicable).

- Note: The description does not transfer to the return.

- Enter the amount of income for each state, that does not exceed the Federal total income.

- Scroll down to the State and Local section.

- In Box 16 State Wages if Different, enter any amount of state wages that exceeds total Federal wages.

Using the "State wages, if different" field for a multi-state W-2

You should only use the (16) Stage wages, if different field on Screen 10, Wages, Salaries, Tips for multi-state W-2s if the amount of wages for the resident state is more or less than the federal amount. Otherwise, Diagnostic ref. 20043 may generate.

For example, you may need to use this field if the home state doesn't recognize pretax deductions to taxable wages, so the state taxable wages are greater than the federal wages that do recognize pretax deductions. For this case, an entry in (16) Stage wages, if different will usually cause an adjustment on the state return.