Before you start:

- This article references default installation paths and uses YY to reference the tax year in 20YY format. C: will always indicate the local drive and X: will always indicate the network drive.

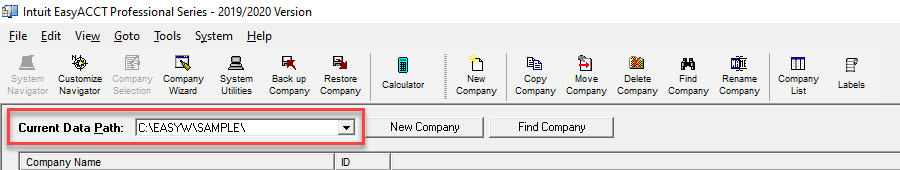

Installing EasyACCT and Information Return Systems on your Rightworks Hosted Desktop:

- Sign in to your Rightworks My Account portal.

- Select the Users tab.

- Select the user that needs to install the application.

- Under the Available Applications section, select Install App next to EasyACCT Professional Series or Information Return System.

- Repeat the steps for any other users.