To manually enter the carryover amounts on returns transferred prior to 02/24/2022:

This method is recommended if your working on complex returns or have the return mostly completed for 2021:

- Open the Individual return in ProSeries 2021.

- Press F6 to bring up Open Forms.

- Type 8915E to highlight the Form 8915E-T for taxpayer or Form 8915E-S for spouse.

- Click OK to open the Qualified 2020 Disaster Retirement Plan Distributions and Repayments Worksheet.

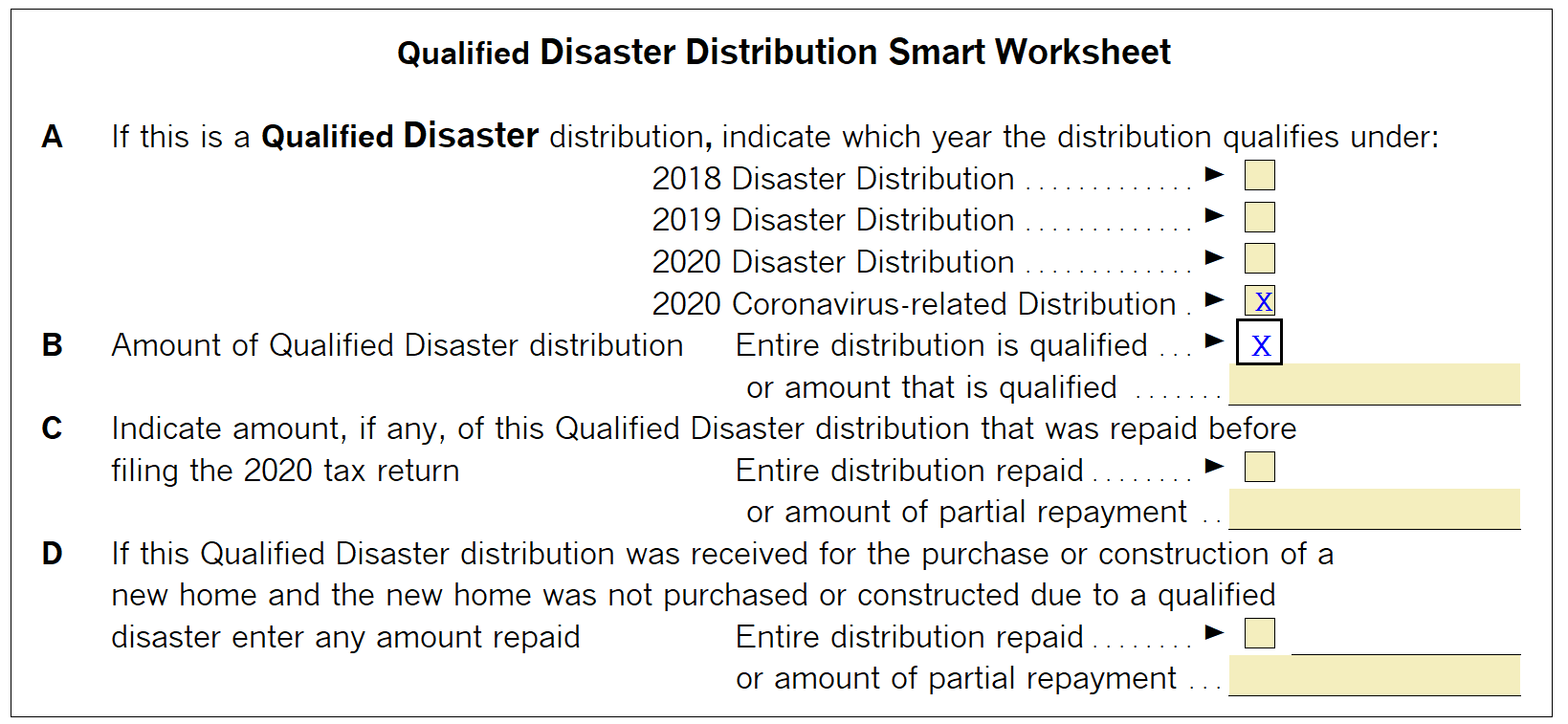

- On the 2020 Form 8915-E Distributions Smart Worksheet:

- Enter Line A if there were disaster distributions other than coronavirus distributions.

- Check box B to indicate there were 2020 coronavirus related distributions.

- If the qualified distribution was from a retirement plan (Other than an IRA) complete Part II:

- Enter any repayments already made on the Part II Repayments Smart Worksheet above line 12.

- Fill out lines 12, 14 and 15 from the 2020 Form 8915-E.

- If the qualified distribution was from a Traditional, SEP, SIMPLE, or Roth IRA complete Part III:

- Enter any repayments already made on the Part III Repayments Smart Worksheet above line 26.

- Fill out lines 26, 28 and 29 from the 2020 Form 8915-E.

- The 8915-F will now generate automatically based on the entries on this 8915-E worksheet.

To re-transfer a return:

This method is only recommended if you have not done much work on the 2021 return. This does involve deleting the 2021 return:

- Go to the Form 1040: Individual HomeBase view in ProSeries Professional 2021 or the 1040 tab in ProSeries Basic 2021.

- Highlight the return and press Delete.

- On the Confirm File Delete pop up review the file name on the confirmation screen and select Yes.

- From the File menu select Transfer then Transfer Clients.

- Select this return.

- Click on the Transfer button.

- Open the Individual return in ProSeries 2021.

- Press F6 to bring up Open Forms.

- Type 8915E to highlight the Form 8915E-T for taxpayer or Form 8915E-S for spouse.

- Click OK to open the Qualified 2020 Disaster Retirement Plan Distributions and Repayments Worksheet.

- Review the amounts that transferred from the prior year. The Form 8915-F will generate based on these amounts and be automatically calculated and e-filed with the return.

Identifying tax year 2020 returns that have a carryover for Form 8915-F:

With the 3/17/22 release of ProSeries Professional 2020 there is now a Client Analyzer Query available that will help you locate clients that may need the 8915-F in tax year 2021, 2022 and 2023. To use the query:

- If you have not already done so update ProSeries Professional 2020 by going to the Update menu and selecting Update Installed Products.

- When prompted, select Install Now.

- When ProSeries opens under HomeBase View: select Client Analyzer Queries.

- On step 1) Select Return Type, select 1040 Individual.

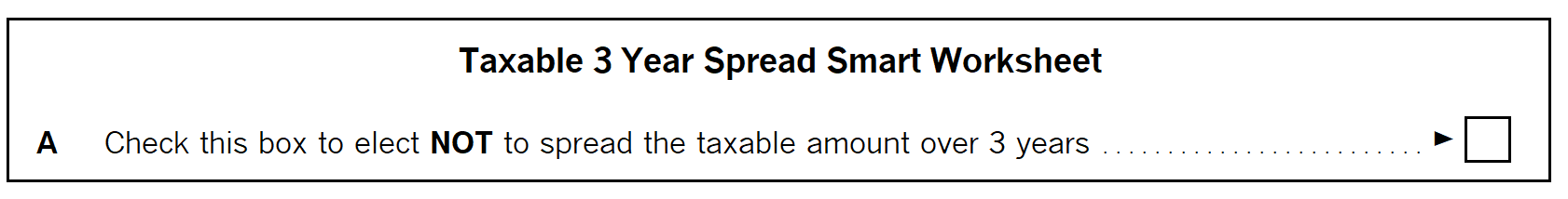

- On step 2) Select Query, select Qualified Disaster Distribution spread over 3 years.

- Click Go.

- If you have any password protected returns enter the client level password or the primary password. Click Cancel to exclude the password protected return from the query.

- ProSeries will query the clients and show you the results at the end. Click Close to view the returns containing the distribution.

- You can print the list by going to the HomeBase menu and selecting Print HomeBase.

- You can export the list to a spreadsheet by going to the HomeBase menu and selecting Export View.