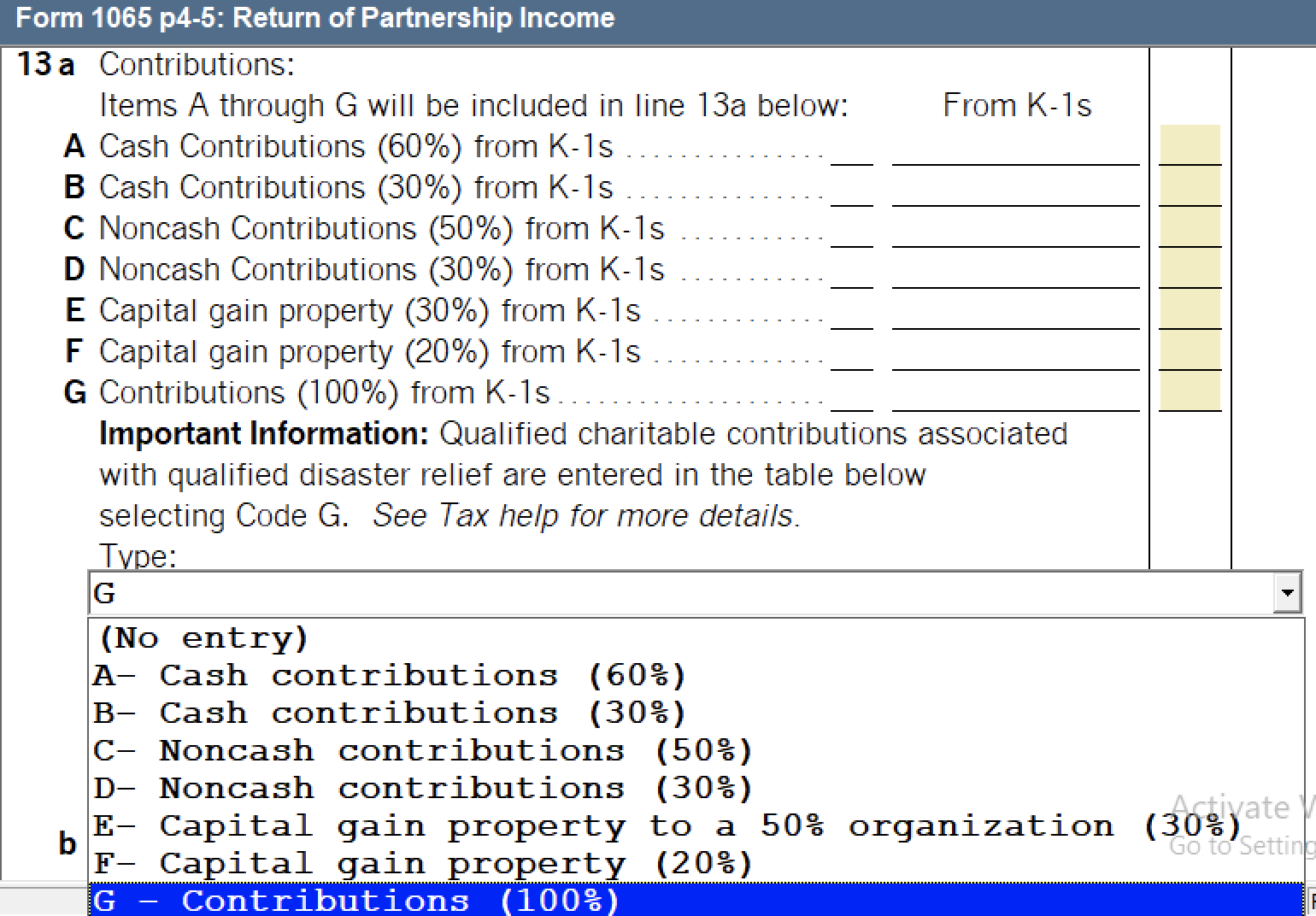

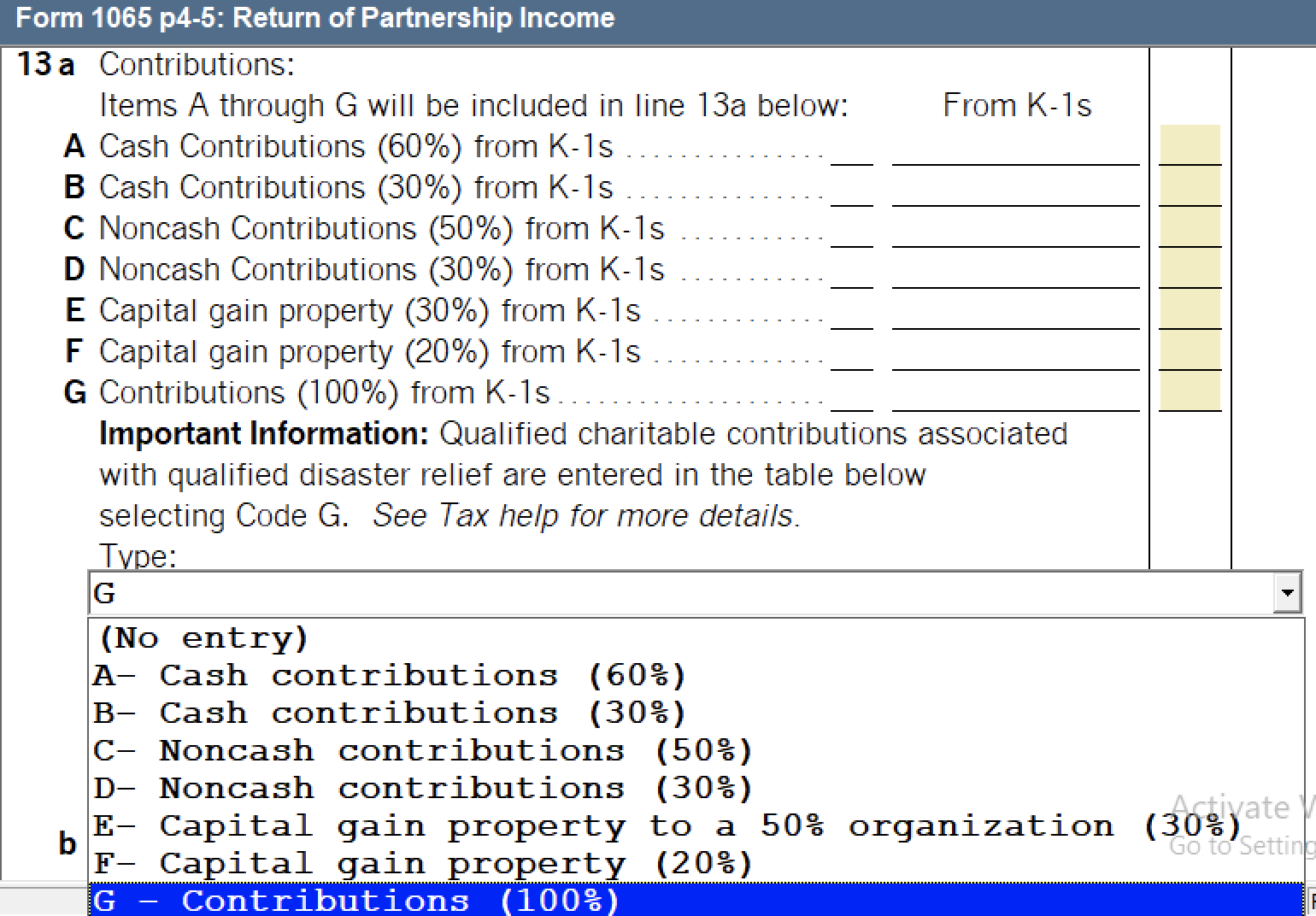

From the Tax Help for Form 1065, page 4, Line 13 A through G:

"Line 13a, Contributions

Charitable contributions, is an expanding table, limited to 30 entries. For each charitable contribution:

- Enter the appropriate code and amount.

- Specify by code if the contribution is subject to the 100%, 60%, 50%, 30%, or 20% AGI limit.

Note: If the partnership made noncash contributions in excess of $500, you must also complete Form 8283, Noncash Charitable Contributions, and attach it to this return.

Refer to Form 8283 if the deduction for any item or group of similar items of contributed property exceeds $5,000, even if the amount allocated to any partner doesn't exceed $5,000.

Entries on lines A through G, Contributions from K-1's, will transfer to the line 13a expanding table with the appropriate information. Notice that the amount column for these lines is under the heading "From K-1s". Each amount in this column will calculate to the sum of amounts (based on the associated code) entered on the lines of the expanding table associated with line 13 of each "Worksheet to Enter Partner's Share of Income, Deductions, Credits, etc." (menu name is "K-1 Partner"). For example, all amounts with a code of A (Cash contributions (50%)) will be totaled and entered in the "From K-1s" amount column for line 13a-A."

Contributions from the partnership are entered in the table below line 13G: