This article will help you enter a K-1 from a partnership into the 1040 return in ProSeries.

What's new for Schedule K-1 for tax year 2023:

For tax year 2023 the IRS has added multiple new codes to the Schedule K-1. Most changes involve new codes for Other Income, Other Deductions, Other Credits and Other Information to provide additional details for when the 1040 is completed. To see the Partnership codes click here, to see the S-Corporation codes click here and scroll down to the code lists on the last pages of the instructions.

.

To open the Schedule K-1 Worksheet:

- Open the Individual return.

- Press F6 to bring up Open Forms.

- Type P to highlight the K-1 Partner.

- Click OK.

- Select the existing K-1 and click Select or enter the partnership name and click Create.

- Complete Part I-III from the Schedule K-1 received.

How do I enter unreimbursed partner expenses?

- Open the Schedule K-1 Worksheet Partnerships.

- Scroll down to line 20 Other Information.

- Right below line 20, you'll see: QuickZoom to enter unreimbursed partnership expenses (UPE). Click on the QuickZoom.

- Enter any unreimbursed partnership expenses on the applicable lines.

How do I calculate a basis limitation for the K-1?

ProSeries does not support the calculation or track basis limitations in the 1040 formset however there are some tools available to help you enter and track this yourself.

- Open the Schedule K-1 Worksheet Partnerships.

- Scroll down to Part III Shareholder's Share of Current Year Income, Deductions, Credits, or Other Items.

- Determine which line the basis limitation applies to Ordinary Business Income (loss), Net rental real estate income (loss), or Other net rental income (loss).

- Right-click on the line and choose Supporting Statements.

- Enter a description on the first line and the original loss as a negative number.

- Enter a description and a positive adjustment amount to reflect the basis limitation.

- Click Close.

Note: To track the Basis Loss limitations through the years, create a Miscellaneous Statement and enter the information that needs to be tracked.

How do I report more than one type of activity on a K-1?

When you have more than one type of activity for the Schedule K-1 you can only enter one activity type per K-1. If you try to enter more then one you will receive the following error:

Box 2 has an amount as does either box 1 or 3. Use separate K-1 Worksheets to report entries on more than one of boxes 1 through 3. Use "delete" to remove the entry.

To resolve this error:

- Create one K-1 Worksheet per activity type needed. If you have values on lines 1, 2 and 3 you would need 3 Schedule K-1 Worksheets.

- Duplicate the information from Part 1 of the Schedule K-1.

- Enter the income (loss) for this activity on line 1, 2 or 3 as well as any associated entries from lines 4-20.

How do I report a partial disposition of a Publicly Traded Partnership (PTP)?

- Open the Partnership Schedule K-1 Worksheet.

- Check to be sure box D is checked indicating this is a publicly traded partnership.

- Scroll down to the Final/Amended section.

- Check the box for Partner sold or otherwise disposed of entire interest in the partnership in 2020 and click on the the QuickZoom button.

- Under Part II, Disposition of Partnership Interest complete lines 1-12 where applicable.

- If you have a special reporting situation the below will provide extra guidance on how to enter those.

If you received a Form 1099-B for the sale:

- Enter a sales price of zero on line 5.

- Enter a basis of zero on line 7.

- Open the Schedule D.

- Enter the disposition information under Sales of Capital Assets.

If you are required to report an ordinary gain from the transaction:

- Open the 4797 page 1.

- Scroll down to the Sales of Busines Property Smart Worksheet.

- Enter the description of the transaction in Column A.

- Enter the amount of the gain as the sales price in Column D.

- Enter zero for the cost or basis in Column F.

- Choose II from the drop menu in Column H to report the transaction in Part II, line 10.

If you are required to report an ordinary loss from the transaction:

- Open the 4797 page 1.

- Scroll down to the Sales of Busines Property Smart Worksheet.

- Enter the description of the transaction in Column A.

- Enter the amount of the loss as the cost or basis in Column F.

- Enter zero for the sales price in Column D.

- Choose II from the drop menu in Column H to report the transaction in Part II, line 10.

How do I report a disposition of the Partnership as an installment sale?

- Open the Partnership Schedule K-1 Worksheet.

- Scroll down to the Final / Amended section.

- Check the box for Final K-1.

- Check the box for Partner sold or otherwise disposed of entire interest in the partnership in 2020 and click on the the QuickZoom button.

- Under Part II, Disposition of Partnership Interest, line 1c, check the box Check if sold on installment basis

- Do not enter any additional sale information on this worksheet.

- Double click on the field Double click to link to Form 6252 for installment sales.

- If you have already created a 6252 for the sale, pick that one, if you have not created a 6252 for this sale enter a description for the sale and choose Link.

- Open the 6252 and enter the remaining sale information there.

Where do I enter the state tax withholding on a Partnership K-1 Worksheet?

- Open the Partnership Schedule K-1 Worksheet.

- Scroll down to Part III - Partner's Share of Current Year Income, Deductions, Credits, Other Items (continued).

- Locate Line 13.

- Select W - Other deductions from the Code dropdown menu.

- Enter the amount withheld for the Amount.

- Click the QuickZoom to enter additional information for codes R and W.

- Scroll down to the Code W: Other deductions subsection.

- Locate Line 5 - State income tax withheld.

- Enter the two-character state abbreviation for the State name.

- You may only enter one state. If multiple states are needed, enter MX for the state abbreviation and the full amount. Then, enter the appropriate amount on each state return. The program transfers amounts entered here to the appropriate line on the Tax Payments Worksheet.

- Enter the amount of tax withheld in the field to the right of the state abbreviation.

How do I change the passive status so my K-1 shows as nonpassive?

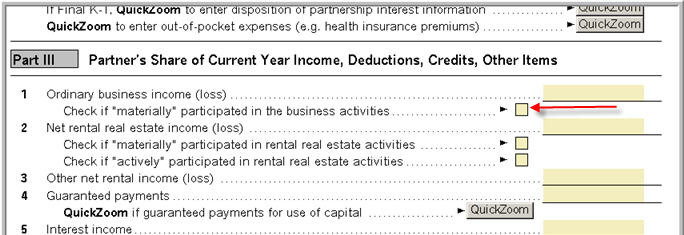

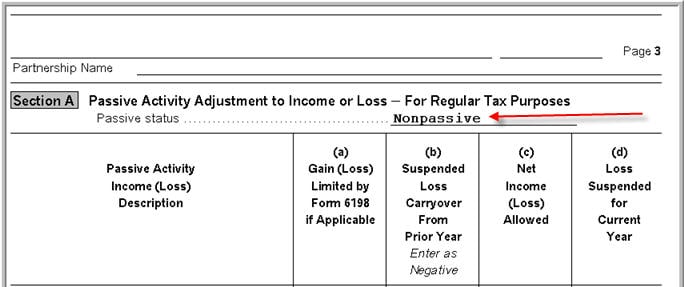

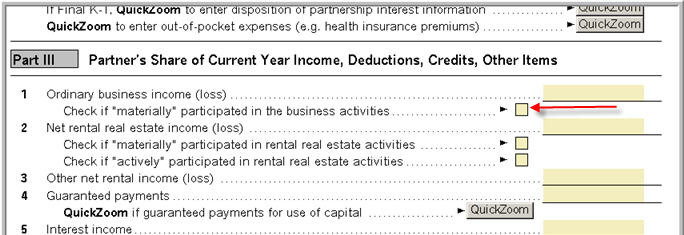

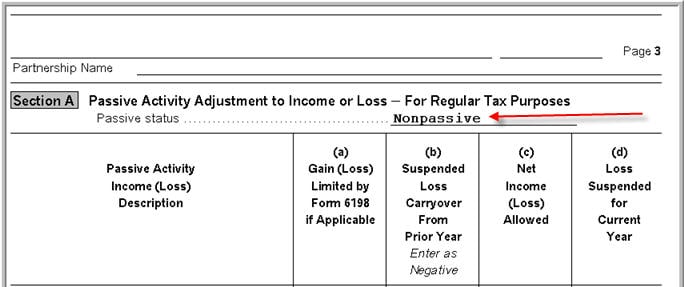

To change the Passive Status to Nonpassive, the box labeled Check if "materially" participated in the business activity must be checked. This checkbox is located below Line 1 in Part III of the K-1 Worksheet for Partnerships. The Passive Status is indicated in Section A on page 3 of the K-1 Worksheet.

Partnership K-1 Worksheet

For tax year 2021:

Starting in tax year 2021, the IRS updated the Schedule K-1 to include a new Schedule K-3 to show the shareholder share of International Transactions. See Generating the Schedules K-2 and K-3 in ProSeries for more.

Related topics