Request eSignatures with just a few clicks and keep track of requests every step of the way. Since it’s fully integrated within your tax workflow, you can do it all electronically right from within your Intuit tax software.

- ProductsProducts

- Professional tax softwareProfessional tax software

- Intuit Lacerte TaxTap into highly powerful tools designed for complex returns and multiple preparers.

- Intuit ProConnect TaxGain added flexibility delivered fully on the cloud with nothing to download.

- Intuit ProSeries TaxGet simple forms-based screens and one-click access to calculation details.

- See all tax software

- Workflow add-onsWorkflow add-ons

- Intuit Tax AdvisorCreate automatic tax plans for clients using tax return data mined from your ProConnect Tax or Lacerte software.

- Hosting for Lacerte and ProSeriesPut your Lacerte or ProSeries software on the cloud for built-in security, automatic backups and less IT stress.

- eSignatureGet any document signed securely from any online device, all done with quick clicks inside your tax software.

- Protection PlusProtect your clients from audits, tax notices and identity theft with $1 Million Tax Audit Defense™.

- Pay-by-RefundGive your clients the option of no upfront, out-of-pocket costs and give yourself an easy way to get paid with refund transfers.

- Intuit Select Pro StaffingBuild capacity, grow your business and increase productivity when you work with tax experts vetted by Intuit.

- See all workflow add-ons

- Accounting solutionsAccounting solutions

- QuickBooks Online AccountantAccess all your QuickBooks clients, resources, and tools under one login from anywhere.

- QuickBooks Accountant DesktopGet all the power of QuickBooks in a one-time purchase accounting software installed on your office computer

- EasyACCTGain a proven solution for write-up, A/P, A/R, payroll, bank reconciliation, asset depreciation, and financial reporting.

- Training & EducationTraining & Education

- Learning, news, and insightsLearning, news, and insights

- Events and virtual conferencesEvents and virtual conferences

- SupportSupport

- Online forum

- Contact us

- Looking for QuickBooks help?Looking for QuickBooks help?

- For Sales: 844-877-9422

- Sign in

INTUIT ESIGNATURE: ELECTRONIC TAX SIGNING SOFTWARE

Never chase client signatures again

Easily request, send, and collect digital signatures in one easy-to-use streamlined workflow.

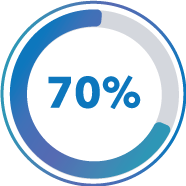

Nearly 70% of eSignatures are completed in one day*

Quick, easy, convenient. eSignature is the modern, digital way to request tax document signatures.

Using eSignature is simple.

Here's how it works:

Why should you choose eSignature for your firm?

Clients can securely review and sign just about any document digitally, from anywhere, at any time, on any device—usually in less than 24 hours*. Plus, you can send up to 130 documents (or 25 MB) in one envelope, so it’s more efficient for both you and your clients.

- Any individual or business forms*

- IRS Forms 8878 and 8879

- Engagement letters and firm agreements

- Estimates and invoices

- Request for transcript (Form 4506-T)

- LLC formation documents

- Confidentiality agreements (NDAs)

- Power of attorney agreements

- Asset purchase agreements

- Reference documentation

- Payment requests (Lacerte only)

*The ability to add eSignature fields to all forms and documents, including business forms, has been enabled and is designed to be used at the preparer's discretion. Per the current IRS Guidelines, electronic signatures are only accepted for the Individual Modules. Please review IRS Publication 4163 and PMTA-2018-08 for more detail.

With eSignature’s enhanced global security standards, your clients will have peace of mind knowing their information is always secure. Send requests with the knowledge-based authentication (K.B.A) process, as required by the IRS for Forms 8878 and 8879.

See eSignature demo videos for:

Simple, transparent pricing for every firm.

Choose from pay-as-you-go, bundles, or unlimited eSignature options.

*Terms, conditions, pricing, subscriptions, packages, features, service and support options are subject to change at any time without notice.

- eSignature claim:

Based on a survey of Intuit Accountants Tax Pros who used used eSignature to complete client TY2022 returns. Survey compiled 10/2023-01/2024. eSignature sold separately.

- Any individual or business forms:

The ability to add eSignature fields to all forms and documents, including business forms, has been enabled and is designed to be used at the preparer’s discretion. Per the current IRS Guidelines, electronic signatures are accepted for the Individual and Business Modules. Please review IRS Publication 4163 for more detail.

The IRS accepts electronic signatures on forms 8878 and 8879. eSignatures can be used for a wide range of online documents apart from IRS forms such as engagement letters, contracts, invoices, NDAs, and bank documents. Please keep updated and compliant on what forms you can and cannot use in connection with the preparation of federal tax returns with the IRS. Most states also accept electronic signatures on forms 8878 and 8879 or their equivalent.

- KBA:

Knowledge based authentication, also known as KBA, is an identity verification measure that requires end users to establish their identities through the use of specific security questions. The e-signature option is only available to taxpayers e-filing their tax returns through an Electronic Return Originator (ERO), who uses software that provides identity verification and e-signature functionality. To meet e-signature requirements, the ERO must be able to record the taxpayer’s name, social security number, address and date of birth electronically for identity verification purposes. As part of identity verification, the software may create what is known as a “soft inquiry” in the credit reporting industry. A soft inquiry is not a credit check, although it is conducted by a credit reporting company that uses information from the taxpayer’s credit report to generate knowledge-based authentication questions. Typically, the knowledge-based authentication questions address the taxpayer’s personal and financial history. These are usually multiple-choice questions such as the name of their mortgage lender, type of car financed, a former address or phone number. The taxpayer is expected to answer the questions correctly. Taxpayers who cannot complete the identity verification check cannot use e-signature. Ordinarily, knowledge based authentication is not mandatory for envelopes which do not contain Form 8878/8879 or their state equivalents.

Offer of a 20% discount on 100+ eSignatures for tax year 2024. Product must be purchased by 5 PM CT on August 29, 2024. Offer valid only for new to eSignature customers (offer not available for current eSignature customers). The purchase of 2024 eSignatures is applicable for usage in tax year 2024 Lacerte/ProSeries/ProConnect Tax product only, unused eSignature envelopes may be used through December 31, 2027. Validity does not apply to usage in other product years. Terms, conditions, pricing, features, service and support options are subject to change without notice. For more information, please visit https://proconnect.intuit.com/esignature/.

Offer of Unlimited eSignature for tax year 2024 for $1,549 (14% off). Product must be purchased by 5 PM CT on August 29, 2024. Offers valid only for new eSignature Unlimited customers. The purchase of 2024 eSignatures is applicable for usage in tax year 2024 Lacerte/ProSeries/ProConnect Tax product only, unused eSignature envelopes may be used through December 31, 2025. Validity does not apply to usage in other product years. Terms, conditions, pricing, features, service and support options are subject to change without notice. For more information, please visit https://proconnect.intuit.com/esignature/.

Offer of Unlimited eSignature for tax year 2024 for $1,439 (20% off). Product must be purchased by 5 PM CT on March 31, 2024. Offers valid only for new eSignature Unlimited customers. The purchase of 2024 eSignatures is applicable for usage in tax year 2024 Lacerte/ProSeries/ProConnect Tax product only, unused eSignature envelopes may be used through December 31, 2025. Validity does not apply to usage in other product years. Terms, conditions, pricing, features, service and support options are subject to change without notice. For more information, please visit https://proconnect.intuit.com/esignature/.

Call Sales: 844-877-9422

© 2024 Intuit Inc. All rights reserved.

Intuit, QuickBooks, QB, TurboTax, ProConnect, Credit Karma, and Mailchimp are registered trademarks of Intuit Inc. Terms and conditions, features, support, pricing, and service options subject to change without notice.

By accessing and using this page you agree to the Terms and Conditions.