BobKamman

Level 15

02-16-2023

11:14 AM

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

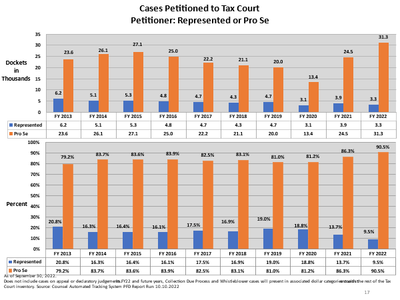

Of course, many of these are Collection Due Process cases (and many of those, are stalling tactics). The Tax Court has petition forms for "small tax" cases, but petitioners can draft their own; most should not run more than three or four pages. Most cases are assigned to an Appeals Officer (the more they insist on "Independent" being included in their name, the more it looks like they're not, but at least you get a GS-12 instead of a GS-4 at the Service Center). Most cases settle before trial.