- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Where do you enter US bond Interest that is included in the amount of dividend income reported on a 1099DIV. I tried enter on US Bonds (Nontaxable to State) but it adds the amount to interest income on schedule B, when the total dividend amount is already being reported in the dividend section of schedule B. This way I get the reduction on the Wisconsin individual return, but my federal income is overstated by the US bond interest. I don't see any line for reporting US Bond interest on the WI modifications

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

I just tried this - Here is my input

This created $1,800 = Div 1600 + CG 200 on the 1040

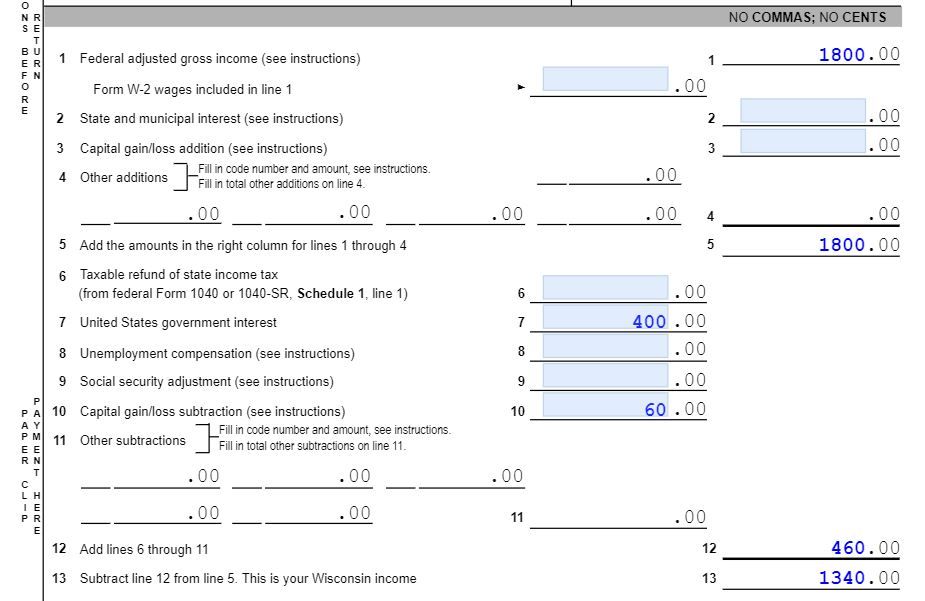

Here is what the WI return looked like

Line 7 subtracts out the US dividend, giving a net of 1,400 = Div 1200 + CG 200 (AND line 10 gives another deduction on CG dividend)

Here's wishing you many Happy Returns