- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

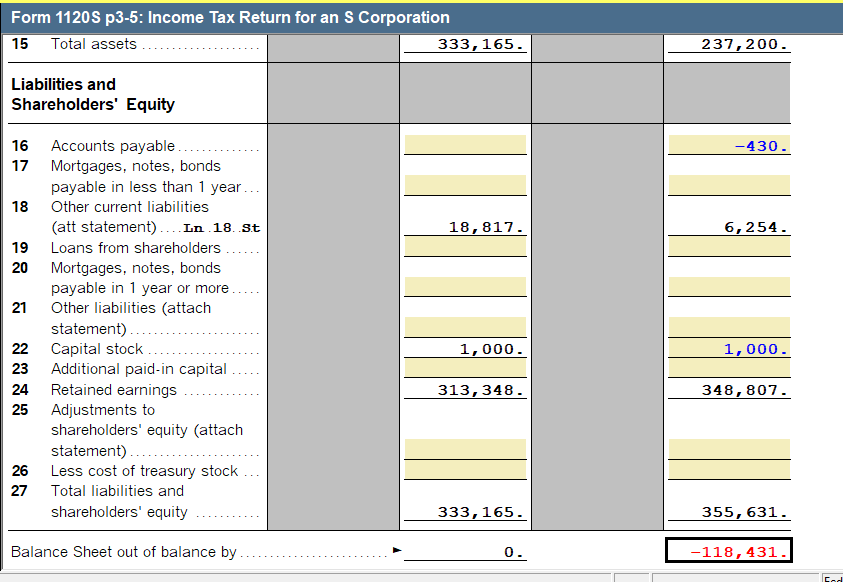

Can any one help me understand why my Sch L is not balanced on 1120S ? the prior year entries are correct? and everything is correct on current year as per books, but there is difference of 118 431? I mean all entries are correct, where would this unbalance source be coming from? I highly suspect it's changes to retained earnings, that's the only account that can be adjusted. Is it okay to make the line 25 adjustment to balance for the same amout? I don't know how else to fix this because all entries are correct. Thank you for any direction.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Withdrawals?

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Did you have PTI distributions to shareholders, that you haven't put on the appropriate part of the tax worksheet? Pages 3-5 Section Items Affecting Shareholder Basis>Shareholder Distributions and Dividends Smart Worksheet "A"

On the M-1 wkst...do you have line F checked yes?

If you have a year end trial balance...that is what s/b entered into the Schedule L.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Common causes:

Not having a trial balance and trying to wing it

Data entry error when there is a trial balance

Ex-AllStar

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Distributions posted as Expense is a common error.

"Level Up" is a gaming function, not a real life function.