- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Good morning, I am new this year. I am having problems trying to find where I input the look back information. I have a client coming in later who asked about it and I want to be prepared.

Thanks for the help!!

Best Answer Click here

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Are you talking about putting in last years information so you can show it on the "two year comparison"?

You can enter that right on that form taking the information from the prior return.

To enter more detailed information would require using the prior years program and re-entering all of the detailed information to create a complete copy of the prior return.

If you are talking about important information that carries from one year to the next, there is a carryover schedule you can open up and enter the carryover items from the prior return.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

I read that there is a "jump to link" that would take me where I can compare 2019 to 2021. Was this misleading? I found it online from intuit.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

@SWD2012 Sorry, I didnt mean to bang on you. I wasnt sure what that meant.

That could be a "basic" term I am unfamiliar with. In professional there is a history report that we can view......

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

From what I can gather, it means to compare from 2019 to see if that year's earned income would be better for the tax payer. The IRS allowed this same thing last year. Where I worked last year had it already programed in. Im on my own this year, and need all the help I can get

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

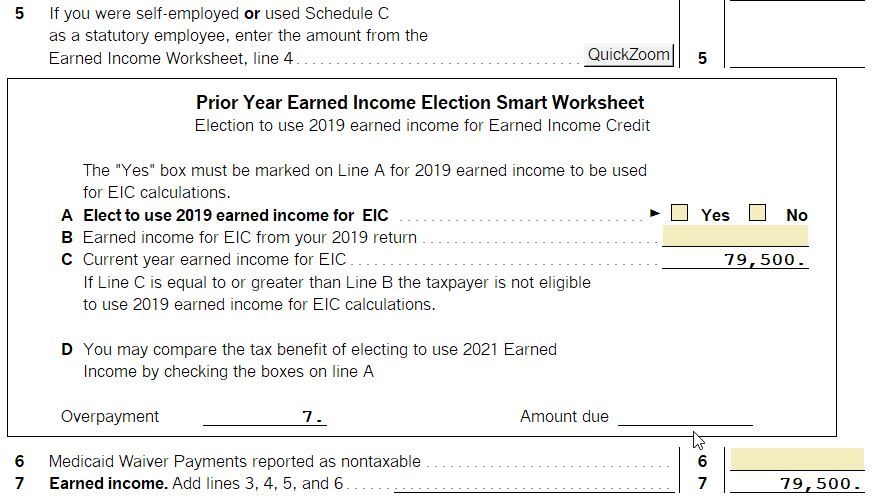

I suspect they mean the "lookback" to 2019 Earned Income for purposes of the Earned Income Credit.

It is on the "EIC Worksheet" (you can go to the "Find Form" button, type "EIC", then click the "EIC Worksheet"). Scroll down to the worksheet between lines 5 and 6.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

It hit me when you started to explain it.

If you found it great, but yes, within the EIC form there should be a question that asks if you want to use 2019's income for the EITC. This of course assumes income in 21 is less than 19. You may use that year again in 2021.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

That makes sense!! Thanks I'll check that out.