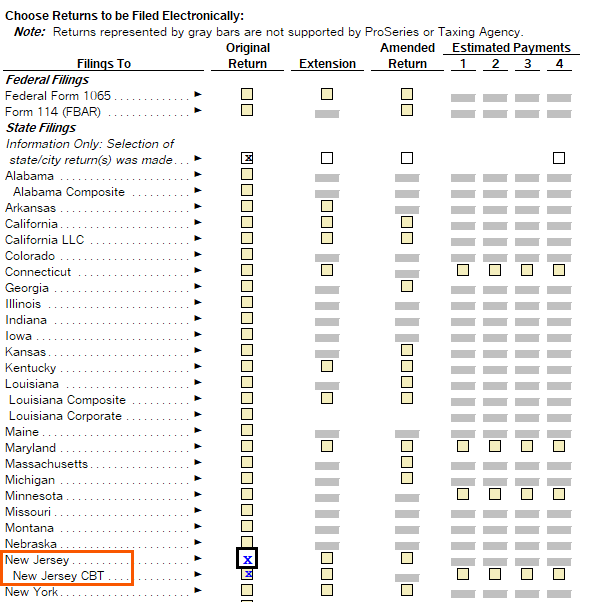

- Open the tax return to the Partnership Information Worksheet.

- Scroll down to Part VI - Electronic Filing Information.

- Locate the New Jersey CBT line.

- Here you can check the boxes to mark the return, extension, or Quarterly Estimated Tax Payments for e-file.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Help Articles

Before you start:

- Data entry and calculations for the NJ-CBT-1065 are done within the NJ Partnership Formset, the New Jersey CBT Return is simply for e-file data to be transmitted to the state taxing authority.

- If you make changes to the New Jersey Partnership return be sure to open and save the NJ-CBT formset again.

- Electronic Funds Withdrawal is available for the return and/or the extension. Use Part V on the NJ CBT-1065 Information Worksheet.

How do I mark the NJ CBT1065 return, extension, or estimated payments for e-file?

How do I access and review the NJ-CBT-1065?

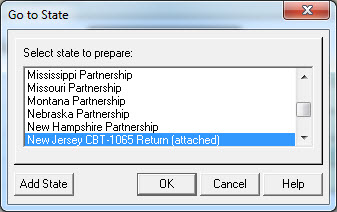

Accessing the New Jersey CBT is similar to accessing a city formset.

- Open the Federal Return.

- From the File menu, select Go to State/City.

- Select the New Jersey Partnership and click OK.

- Once you're in the New Jersey Partnership return from the File menu select Go to State/City.

- Select the New Jersey CBT-1065 Return and click OK.

How do I e-file the NJ-CBT-1065 return, extension or estimated payments?

Before attempting to e-file the return be sure to open the New Jersey CBT-1065 Return and review the form as well as set up Electronic Funds Withdrawal as needed.

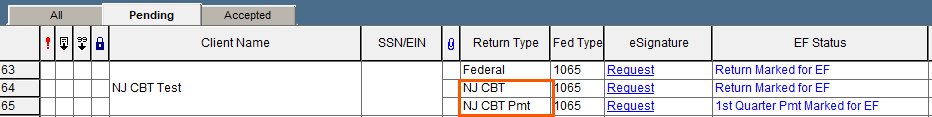

- Close the tax return.

- Open the EF Center HomeBase view.

- Find the client and look for the line that shows NJ CBT as the return type (or NJ CBT Pmt for estimated tax payments).

- Highlight the line that you need to e-file.

- From the E-File menu, choose Electronic Filing, then Convert/Transmit Returns/Extensions/Payments...

- Choose the Convert and Transmit selected returns/extensions/payments and click OK.

Other common questions on the NJ CBT-1065

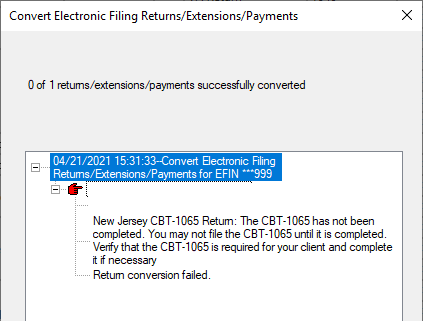

How to resolve EF transmission log error - "The NJ CBT-1065 has not been completed"

New Jersey CBT-1065 fails to transmit, and the EF transmission log generate the following error:

"The CBT-1065 has not been completed. You may not file the CBT-1065 until it is completed. Verify that the CBT-1065 is required for your client and complete it if necessary. Return conversion failed."

How do I resolve this error?

To resolve this error, do the following:

- Make sure NJ CBT is checked on the Federal Information Worksheet - Part VI.

- Make sure NJ CBT-1065 is required to be e-filed.

- For example, is there distributable income for each partner? If income/loss is equal to zero CBT-1065 may not need to be filed to New Jersey.

- Make sure there's at least one nonresident partner. NJ-CBT-1065 is used to calculate a tax for nonresident partners and won't calculate when all resident partners of New Jersey.

- Reference government instructions on NJ-CBT-1065 for additional information, or contact the New Jersey Department of Revenue for further guidance.

Additional information

New Jersey NJ-CBT-1065 is found in New Jersey's module, and CBT-1065 is located in a separate module for the state. To fully activate CBT-1065, click on Go To State from within New Jersey Partnership, and then click on New Jersey CBT-1065 from the Go To State screen.

The experience of opening CBT-1065 is similar to opening a New York and New York City return in which you click Go To State twice to access NYC.

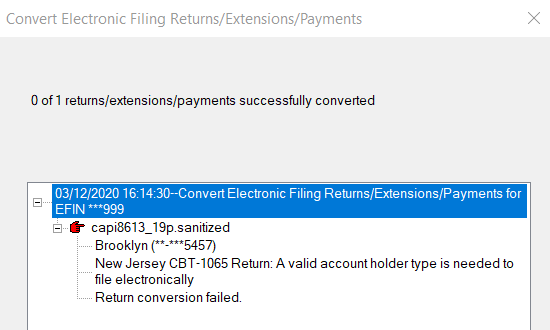

How to resolve e-file error: "NJ CBT-1065: A valid account holder type is needed to file electronica...

When trying to e-file, New Jersey Form CBT-1065 fails return conversion. The following error generates in the program:

"New Jersey CBT-1065 Return: A valid account holder type is needed to file electronically. Return conversion failed."

How do I resolve this error?

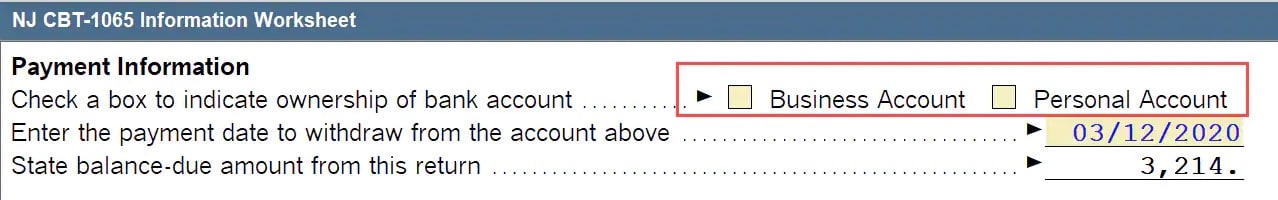

The error occurs when the checkbox to indicate ownership of bank account isn't selected.

Follow these steps to resolve the error:

- Open the client return.

- From the File menu, select Go to State/City.

- Select the New Jersey Partnership and click OK.

- Once you're in the New Jersey Partnership return, go the File menu and select Go to State/City.

- Select the New Jersey CBT-1065 Return and click OK.

- Scroll down to Part V.

- Locate the Payment Information section.

- For Check a box to indicate ownership of bank account, mark the applicable checkbox:

- Business Account

- Personal Account

- Save the return.

- Run Final Review.

- Try to e-file the NJ CBT-1065 again.