Advise your bookkeeping clients with the power of QuickBooks Online Accountant then seamlessly bring their information into ProConnect Tax, the #1 online professional tax software. With a new streamlined workflow all in one place on the cloud, you'll save more time to manage your practice and deliver more for your clients.

Join us January 10–11 for the 2024 Tax Season and Advisory Readiness free virtual conference.

Online software for trial balance work

I rely on integrated Intuit solutions to have my clients' books and taxes in one seamless workflow

Go from bookkeeping to tax preparation in one place with Intuit ProConnect Tax and QuickBooks Online Accountant.

Access the full version free, and pay only when you print or file.

Get a fully digital, books-to-tax workflow with the #1 professional tax software on the cloud*

+

ProConnect Tax includes everything you expect from a leading professional tax software

5,700+ forms for 1040, 1041, 1065, 1120, 1120S, 709 and 990 tax returns.

Over 20,000 automated calculations to help tackle the most complex tax scenarios.

More than 21,000 critical diagnostics and suggestions to prevent e-file rejections and missed deductions.

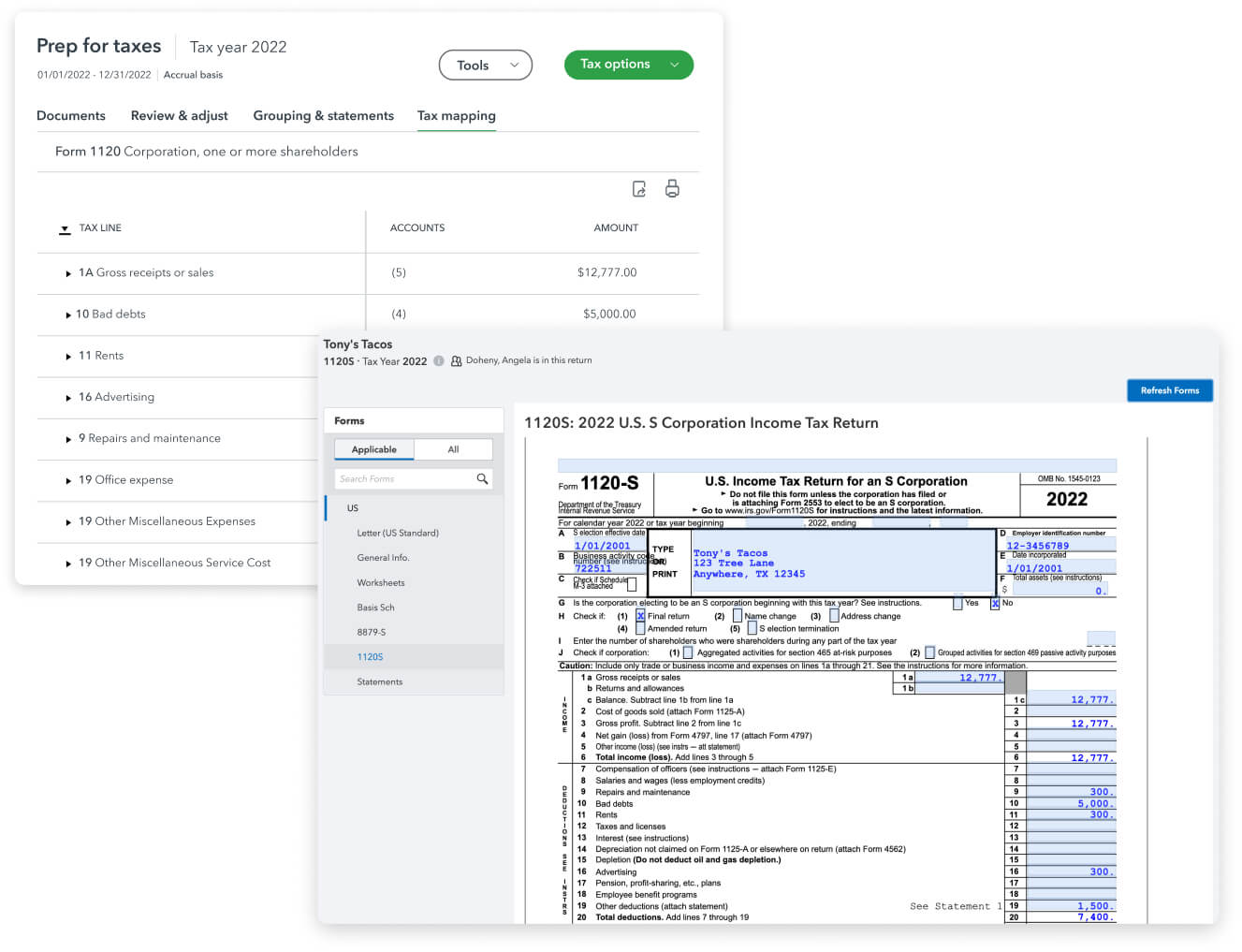

Use Prep for Taxes to easily review, adjust, and transfer client data in less time, with less work

- Expand and collapse expense categories and accounts to show only as much as you need to see while you make adjustments, add notes, or attach files.

- Quickly identify accounts that haven’t been mapped to tax lines and update tax lines more efficiently with predictive text entry.

- Select different tax forms, edit tax lines, and view your complete audit log from the same screen.

- View, modify, and approve any changes made to your clients’ books before exporting your pre-filled form to tax returns in ProConnect.

Enjoy the best of both worlds, all in one place

See how Intuit delivers full-circle for your clients by offering you everything needed to support their personal and business lives.

- Manage your accounting and tax clients from the same dashboard.

- Make client information changes in QuickBooks Online Accountant and have those changes reflect on the ProConnect software automatically.

- Get quick access with one single sign-on (SSO) experience.

- Take your client's balance sheet and profit and loss statements and apply them to your year-end tax work with the Prep for Taxes feature.

- Account mapping shows you exactly where accounts match, and will let you know where the software wasn’t able to make a match.

- See which forms you can map with Prep for Taxes >

Reconcile accounts quickly and accurately while moving data into returns

The more you buy, the more you save

Original price $97.95 per return

300-499

returns$27.71*

per return

200-299

returns$33.71*

per return

100-199

returns$40.46*

per return

50-99

returns$55.46*

per return

10-49

returns$65.96*

per return

1-9

returns$73.46*

per return

Original price $117.95 per return

300-499

returns$30.71*

per return

200-299

returns$37.46*

per return

100-199

returns$44.21*

per return

50-99

returns$68.96*

per return

10-49

returns$78.71*

per return

1-9

returns$88.46*

per return

Add eSignature to your order with options as low as $2.49 per eSignature.